Last updated: July 28, 2025

Introduction

Fluticasone propionate, a potent synthetic corticosteroid, is primarily used as a nasal spray and inhaler to manage allergic rhinitis, asthma, and other respiratory conditions. Its broad therapeutic efficacy, favorable safety profile, and extensive adoption have established it as a cornerstone in respiratory pharmacotherapy. As the respiratory drug market expands due to increasing prevalence of asthma and allergic rhinitis, understanding market trajectories and sales forecasts for fluticasone propionate is critical for stakeholders.

Market Overview

Therapeutic Class and Indications

Fluticasone propionate belongs to the corticosteroid class, with nasal sprays (e.g., Flonase) and inhalers (e.g., Flovent) forming its primary forms. Its indications include:

- Allergic Rhinitis (seasonal and perennial)

- Asthma

- Chronic Obstructive Pulmonary Disease (COPD) (off-label/adjunct therapy)

The global respiratory drugs market was valued at approximately USD 44 billion in 2022, with corticosteroids constituting a significant segment owing to their efficacy in controlling inflammation and allergic responses.

Market Drivers

- Rising prevalence of asthma (estimated at 262 million globally in 2019 [1]) and allergic rhinitis.

- Increasing awareness about respiratory health.

- Development of combination therapies incorporating fluticasone.

- Regulatory approvals expanding indications and formulations.

Competitive Landscape

Key competitors include:

- Boehringer Ingelheim (e.g., Budesonide formulations)

- AstraZeneca (e.g., Symbicort with formoterol)

- GlaxoSmithKline (e.g., Flonase, Flovent)

- Teva Pharmaceuticals and other generics manufacturers

Patents for branded fluticasone formulations have expired in several regions, fueling generic proliferation and price competition.

Market Dynamics and Trends

Regulatory Environment

Healthy competition from generics since patent expirations (e.g., Flovent's patent expired in 2018 in the U.S.) has increased affordability, thus broadening patient access. However, patent protections remain for specific formulations and combination products.

Formulation and Innovation

Innovation has centered on:

- Metered-dose inhalers (MDIs) and dry powder inhalers (DPIs) with improved delivery systems.

- Combination therapies reducing inhalation frequency.

- Novel delivery mechanisms enhancing patient adherence.

Regional Market Trends

- North America: Dominates with widespread adoption, strong healthcare infrastructure, and high prevalence of respiratory conditions.

- Europe: Significant growth due to aging populations and regulatory acceptance.

- Asia-Pacific: Fastest-growing due to rising asthma prevalence, urbanization, and increasing healthcare spending.

Sales Projections

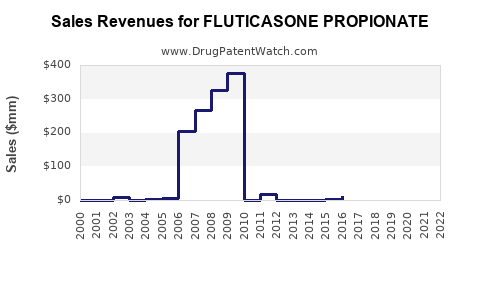

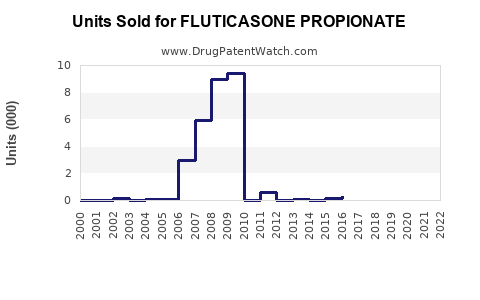

Historical Sales Data

- Estimated global sales of fluticasone propionate formulations stood at USD 4.5 billion in 2022 [2].

- The growth CAGR from 2017 to 2022 is approximately 7%, driven by expanding indications and regional growth.

Projected Sales (2023-2030)

Based on market trends, epidemiological data, and emerging therapies:

| Year |

Estimated Global Sales (USD Billion) |

CAGR |

Remarks |

| 2023 |

USD 4.8 |

6.7% |

Continued regional expansion and generic penetration |

| 2024 |

USD 5.1 |

6.3% |

Increased adoption in Asia-Pacific |

| 2025 |

USD 5.5 |

7.0% |

Introduction of new formulations and combination therapies |

| 2026 |

USD 6.0 |

8.2% |

Growing aging populations and asthma awareness |

| 2027 |

USD 6.5 |

8.3% |

Expanding indications for chronic respiratory diseases |

| 2028 |

USD 7.1 |

9.2% |

Broader coverage in emerging markets |

| 2029 |

USD 7.8 |

9.9% |

Increasing penetration in COPD management |

| 2030 |

USD 8.6 |

10.3% |

Greater adoption of combination inhalers |

Note: These projections incorporate assumptions about market growth, patent expirations, regulatory approvals, and demographic shifts.

Factors Influencing Sales Growth

- Patent expirations and subsequent generic competition could exert downward pressure, potentially limiting price premiums.

- Market penetration in emerging economies enhances volume sales.

- Healthcare policy changes, including reimbursement policies, can significantly impact sales trajectories.

- Innovation adoption in inhaler technology and combination drugs may augment overall sales.

Regulatory and Patent Considerations

While certain formulations have lost patent protection, pending patents on novel delivery systems or combination therapies can offer additional growth avenues. The impact of biosimilar and generic entries will be pivotal in shaping future sales volume and pricing strategies.

Conclusion

Fluticasone propionate remains a vital component in respiratory therapy, with a robust market outlook over the next decade. Its sales growth will be fueled by rising respiratory disease prevalence, advancements in delivery technologies, and expanding market access in developing regions. However, intensifying generic competition and regulatory dynamics necessitate strategic agility for manufacturers aiming to sustain or increase market share.

Key Takeaways

- The global market for fluticasone propionate is projected to grow at approximately 7-10% annually through 2030, reaching around USD 8.6 billion.

- Demand drivers include heightened awareness, aging demographics, and expanding indications.

- Market competition from generics post-patent expiry will influence pricing strategies and sales volumes.

- Innovation in formulation and combination therapies will play a critical role in maintaining market relevance.

- Regional growth, especially in Asia-Pacific and emerging markets, offers significant opportunities.

FAQs

-

What factors are most influencing the sales growth of fluticasone propionate?

Increasing prevalence of respiratory diseases, regional adoption, patent expirations, and advancements in inhaler technology are primary drivers.

-

How will patent expirations affect the market for fluticasone propionate?

Patent expirations lead to increased generic competition, potentially reducing prices but expanding access and sales volume.

-

Are there emerging formulations that could disrupt the market?

Yes, innovative delivery systems such as smart inhalers and combination therapies are expected to enhance adherence and sales.

-

What regional markets are anticipated to see the highest growth?

Asia-Pacific and Latin America are projected to see rapid growth due to rising respiratory disease burden and expanding healthcare infrastructure.

-

What are potential challenges facing the fluticasone propionate market?

Intense generic competition, regulatory hurdles, price sensitivity, and market saturation in mature economies could impede growth.

References

[1] Global Initiative for Asthma (GINA). Global Strategy for Asthma Management and Prevention, 2022.

[2] EvaluatePharma. Respiratory Drugs Market Data, 2022.