Last updated: September 8, 2025

Introduction

Aripiprazole, marketed globally under brand names such as Abilify, is an atypical antipsychotic primarily prescribed for schizophrenia, bipolar disorder, and major depressive disorder. Since its initial approval in 2002 by the U.S. Food and Drug Administration (FDA), aripiprazole has experienced significant market penetration, driven by patent protections, expansive therapeutic indications, and strategic marketing. This analysis explores the evolving market environment, competitive landscape, regulatory factors, and financial projections that shape aripiprazole's trajectory over the coming decade.

Market Overview and Growth Drivers

Established Therapeutic Market

Aripiprazole targets chronic psychiatric conditions, affecting an estimated 50 million people globally[^1]. The growing prevalence of schizophrenia and bipolar disorder, compounded by increased awareness and diagnosis, sustains steady demand. Moreover, expanding indications, such as irritability associated with autism spectrum disorder and Tourette’s syndrome, bolster market size.

Patent Expiry and Generic Competition

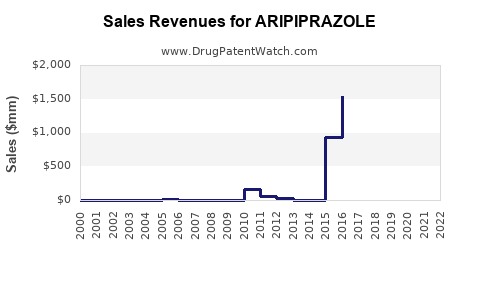

Patents protecting Abilify in key markets, including the U.S. and Europe, expired around 2015–2018. Generic versions rapidly entered the marketplace, leading to a precipitous decline in branded drug revenue. According to IQVIA, generic aripiprazole accounted for over 80% of prescriptions in the U.S. by 2019[^2]. This transition significantly eroded profit margins for original manufacturers and prompted a strategic pivot toward biosimilars and novel formulations.

Biosimilar and Combination Therapies

The emergence of biosimilars and innovative combination products aims to recapture some of the revenue lost to generics. Notably, pharmacovigilance and patent litigation influence the pace and scope of biosimilar market entry, with regulatory pathways varying globally. For example, the approval of Bretsar (a biosimilar aripiprazole fusion protein) in certain regions indicates ongoing efforts to expand accessible options[^3].

Market Expansion in Emerging Economies

Emerging markets like China, India, and Brazil present robust growth prospects owing to rising healthcare infrastructure, increasing mental health awareness, and affordability initiatives. Valuable partnerships and licensing agreements are facilitating market penetration in these regions. However, price sensitivity and regulatory barriers pose persistent challenges.

Competitive Landscape

Major Pharmaceutical Players

The primary market participants include:

- Otsuka Pharmaceutical (original developer of Abilify)

- Bristol-Myers Squibb (initial marketing and distribution partner)

- Teva Pharmaceuticals, Sandoz, and Mylan (top generic producers)

- Formulation Innovators: Companies focusing on longer-acting injectables such as Aristada (Alkermes) and Austedo (Otsuka) demonstrate diversification strategies.

Off-Label Use and Market Diversification

Off-label utilization of aripiprazole for agitation, tics, and other psychiatric conditions provides additional revenue streams, influencing market dynamics. However, off-label prescribing raises regulatory and reimbursement considerations, impacting market predictability.

R&D and Pipeline Developments

R&D investments focus on:

- New formulations: Long-acting injectable variants improve adherence.

- Digital health integration: Apps for symptom monitoring support personalized therapy.

- Novel analogs: Compounds with better tolerability profiles aim to replace or supplement existing therapies.

Regulatory Environment and Market Access

Regulatory hurdles include approval processes for biosimilars, controlled substance scheduling, and post-marketing surveillance. In the U.S., aripiprazole's classification as a Schedule IV controlled substance necessitates compliance with stringent regulations, impacting distribution strategies.

Market access and reimbursement policies are vital to financial performance. In the U.S., insurance coverage, formulary placements, and prior authorization influence prescription volumes. In Europe, pricing regulations and national health service decisions similarly shape revenue streams[^4].

Financial Projections and Future Trends

Revenue Trends

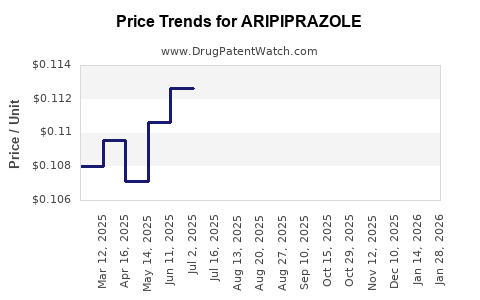

Following patent expiration, branded sales declined from approximately $7 billion globally in 2014 to less than $2 billion by 2019[^2]. However, current projections suggest stabilized revenues through:

- Launch of new formulations (e.g., Aristada Long-Acting Injectables)

- Expansion into orphan indications

- Patent litigation victories protecting core formulations

Market Valuation and Forecast

Industry analysts project the global aripiprazole market to grow modestly at a CAGR of 2-3% from 2023 to 2030, influenced heavily by biosimilar adoption and emerging markets. The neuropsychiatric therapeutics segment overall is expected to expand, driven by demographic shifts and rising mental health awareness[^5].

Risks and Opportunities

Risks:

- Patent expirations accelerating generic erosion

- Regulatory hurdles for biosimilars

- Pricing pressures in cost-sensitive markets

- Competition from novel drug classes (e.g., dopamine partial agonists)

Opportunities:

- Development of next-generation formulations with improved compliance

- Digital therapeutics integration enhancing patient outcomes

- Strategic alliances expanding geographic reach

Conclusion

Aripiprazole’s market dynamics are marked by the legacy of patent expiry, fierce generic competition, and ongoing innovations. While initial revenues have declined post-patent, strategic positioning through extended-release formulations, biosimilars, and expanding indications sustains its financial significance. The drug’s trajectory remains cautiously optimistic, contingent on regulatory environments, competitive responses, and global mental health trends.

Key Takeaways

- The expiration of patents caused a sharp decline in branded aripiprazole revenues, yet newer formulations and indications provide growth avenues.

- Biosimilar competition and generics dominate current sales, requiring strategic adaptation from original manufacturers.

- Expansion into emerging markets offers substantial growth but demands tailored pricing and regulatory strategies.

- Investment in R&D for long-acting injectables and digital health integrations remains critical to maintaining market relevance.

- The neuropsychiatric drug segment's growth prospects align with broader societal shifts toward mental health awareness and treatment adherence.

FAQs

-

What factors contributed to the decline in aripiprazole’s branded sales?

Patent expirations and the subsequent influx of generic versions drastically reduced revenue, compressing profit margins for original manufacturers.

-

How are biosimilars impacting the aripiprazole market?

Biosimilars offer more cost-effective options, challenging branded formulations, especially in price-sensitive markets, influencing overall revenue streams.

-

What are the key regulatory considerations for aripiprazole’s future?

Regulatory approval of biosimilars varies globally, with strict compliance needed for marketing. Additionally, controlled substance scheduling influences distribution and prescribing practices.

-

Which emerging markets show the most promise for aripiprazole?

China, India, and Brazil present significant opportunities due to growing healthcare infrastructure, increased mental health awareness, and government initiatives.

-

What innovations could restore growth to aripiprazole's revenue?

Development of longer-acting injectables, combination therapies, and digital health monitoring tools are promising innovations to enhance adherence and outcomes.

Sources:

[1] WHO. World Mental Health Reports, 2022.

[2] IQVIA. 2019 Global Pharma Trends Report.

[3] European Medicines Agency. Biosimilar Aripiprazole Approval Notice, 2021.

[4] OECD. Drug Pricing and Reimbursement Policies, 2022.

[5] MarketsandMarkets. Neuropsychiatric Drugs Market Size & Trends, 2023.