Last updated: November 18, 2025

Introduction

Apixaban, marketed primarily under the brand name Eliquis, is an oral anticoagulant introduced by Bristol-Myers Squibb and Pfizer. As a direct Factor Xa inhibitor, it plays a vital role in preventing and treating thromboembolic disorders. Since its FDA approval in 2012, Apixaban has experienced significant market penetration, driven by evolving clinical guidelines, competitive landscape shifts, and pharmacoeconomic factors. This analysis details its current market dynamics and forecasts its financial trajectory, providing critical insights for stakeholders.

Pharmacological Profile and Clinical Positioning

Apixaban’s mechanism of action involves selective inhibition of Factor Xa, reducing thrombin generation, and subsequently thrombus formation. Its differentiated profile—with oral administration, fewer dietary interactions, and lower bleeding risk—has established it as a preferred alternative to warfarin and other anticoagulants (e.g., rivaroxaban, dabigatran). Clinical trials such as ARISTOTLE solidified its efficacy in atrial fibrillation-related stroke prevention, deepening its clinical foothold [1].

Market Size and Growth Drivers

Global Anticoagulant Market Landscape

The global anticoagulant market, estimated at approximately USD 9 billion in 2022, is projected to reach USD 17.5 billion by 2030, growing at a CAGR of about 8% (2023-2030). This expansion is driven by rising prevalence of atrial fibrillation (AF), venous thromboembolism (VTE), and an aging global population. AF alone affects over 37 million individuals worldwide [2].

Key Growth Drivers

- Epidemiological Trends: Increased aging populations elevate the incidence of AF and VTE, creating sustained demand for anticoagulants.

- Clinical Guidelines Revisions: Recommendations favor NOACs (including Apixaban) over warfarin for non-valvular AF and VTE, emphasizing superior safety profiles and convenience [3].

- Regulatory Approvals and Off-Label Uses: Approvals for additional indications such as prophylaxis post-orthopedic surgery have expanded the market.

- Urbanization and Lifestyle Changes: Lifestyle-induced risk factors (obesity, hypertension) intensify thrombotic conditions.

Competitive Environment

The anticoagulant market is fiercely competitive, with key players including Bristol-Myers Squibb/Pfizer (Apixaban), Bayer (rivaroxaban), Boehringer Ingelheim (dabigatran), and generics providers. Rivaroxaban (Xarelto) is its primary competitor, often vying for market share based on efficacy, safety, and formulary preferences.

Market Dynamics Influencing Financial Trajectory

Regulatory and Patent Landscape

Bristol-Myers Squibb and Pfizer hold patent exclusivity for Eliquis until approximately 2026–2028 in key territories. Patent expiries enable generic entrants, pressuring prices and margins. However, patent rights, regulatory exclusivities, and formulations delay generic penetration in highly regulated markets, supporting revenue stability.

Pricing and Reimbursement Policies

Healthcare systems worldwide favor cost-effective therapies. Apixaban’s clinical advantages translate into favorable reimbursement, but pricing pressures persist, especially from generics. In the U.S., Medicare and Medicaid negotiations influence net pricing strategies.

Adoption in Emerging Markets

Growing healthcare infrastructure and increased awareness promote Apixaban’s adoption in emerging economies. Pricing and supply chain logistics are crucial factors influencing market entry and expansion in these regions.

Partnerships and Licensing

Strategic collaborations, licensing agreements, and co-marketing initiatives further accelerate market penetration, particularly in regions with limited local manufacturing.

Financial Trajectory and Future Outlook

Revenue Growth Projections

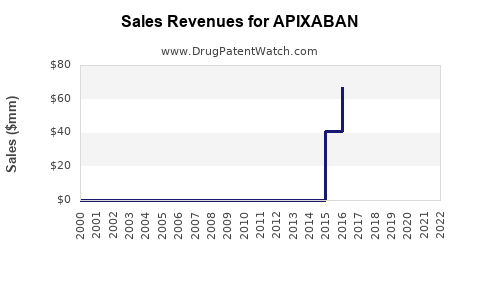

Analyzing historical sales data, Apixaban generated approximately USD 5.4 billion globally in 2022. Market analysts project a compound annual growth rate (CAGR) of around 8–10% through 2030, driven by:

- Increased adoption in new indications such as secondary VTE prevention.

- Rising prevalence of AF and age-related thrombotic conditions.

- Expansion into emerging markets.

Assuming these growth parameters, revenues may reach USD 11–12 billion by 2030, factoring in patent expiries and generic competition.

Impact of Patent Expiry

The patent expiry slated post-2026 could trigger biosimilar and generic entrants, resulting in price erosion of 40–60%. While this may reduce profit margins, volume increases and expanded indications can offset declining per-unit revenues, preserving high overall sales.

Research and Development Opportunities

Novel formulations (e.g., fixed-dose combinations, injectable variants) and additional indications (e.g., deep vein thrombosis, pulmonary embolism in pediatric populations) represent avenues for revenue expansion.

Competitive and Regulatory Risks

The emergence of new anticoagulants, reversal agents (e.g., Andexanet alfa approved for FXa inhibitor reversal), or adverse regulatory decisions could impact market share and revenue streams.

Strategic Recommendations

- Focus on expanding indications and geographic markets, especially in emerging economies.

- Invest in patient adherence programs, leveraging the convenience of oral administration.

- Monitor biosimilar developments and prepare for price competition post-patent expiry.

- Engage proactively with regulatory authorities for timely approvals and label extensions.

- Strengthen reimbursement relationships with healthcare payers.

Key Takeaways

- Market Growth: Apixaban is positioned within a rapidly expanding anticoagulant market driven by demographic shifts and evolving clinical guidelines.

- Revenue Potential: With consistent CAGR projections of about 8–10%, revenues could reach USD 11–12 billion by 2030, despite patent expiries.

- Competitive Edge: Its safety profile and broad clinical validation sustain market dominance, although impending patent expiries necessitate strategic adaptations.

- Emerging Market Opportunities: Growth prospects in emerging economies can boost volume, offsetting price erosion.

- Innovation & Expansion: R&D investments into new formulations and indications can further enhance Apixaban’s financial trajectory.

Conclusion

Apixaban’s market dynamics reflect a combination of strong clinical positioning, demographic-driven demand, and competitive challenges. While patent protection offers lucrative revenues in the near term, market entrants and price pressures necessitate strategic innovations. Stakeholders should prioritize geographic expansion, indication diversification, and cost management to capitalize on the drug’s robust growth trajectory.

FAQs

1. How will patent expiration affect Apixaban’s market share?

Patent expiry post-2026 will open the market to biosimilars and generics, likely causing substantial price reductions and erosion of profit margins. However, increased volume and new indications can mitigate revenue loss.

2. What are the key differentiators of Apixaban compared to rivals like rivaroxaban?

Apixaban’s lower bleeding risk, proven stroke prevention efficacy, and flexible dosing regimens serve as competitive advantages, reinforcing its preference in clinical practice.

3. Which emerging markets show the highest growth potential for Apixaban?

Regions such as Asia-Pacific, Latin America, and Eastern Europe are poised for rapid growth due to expanding healthcare infrastructure and rising disease prevalence.

4. Are there new indications for Apixaban under clinical investigation?

Yes, ongoing research explores its use in conditions like deep vein thrombosis, pulmonary embolism in pediatric populations, and secondary prevention of cardiovascular events.

5. What role do regulatory approvals play in Apixaban’s future financial performance?

Timely approval for new indications or formulations, along with maintenance of exclusivity, directly influences sales growth and market share retention.

Sources:

[1] ARISTOTLE Trial, 2011. New England Journal of Medicine.

[2] World Health Organization, 2021. Global Prevalence of Atrial Fibrillation.

[3] American College of Cardiology Guidelines, 2020.