Last updated: November 24, 2025

Introduction

GlaxoSmithKline (GSK), a leading global pharmaceutical and healthcare firm, holds a significant position in the industry’s competitive landscape. With a diverse portfolio spanning vaccines, pharmaceutical medicines, and consumer health products, GSK’s strategic maneuvers are crucial to understanding its market dynamics. This analysis evaluates GSK's current market position, core strengths, and strategic initiatives aimed at maintaining its competitive edge amid evolving industry challenges.

Market Position

Global Footprint and Revenue Streams

GSK ranks among the world's top pharmaceutical companies, consistently positioning within the top five by revenue. In 2022, the company's revenue reached approximately £34 billion, reflecting robust operational performance (GSK Annual Report 2022)[1]. Its market presence extends across leading regions—North America, Europe, Asia, and emerging markets—highlighting a balanced geographic footprint.

Pipeline and Innovation

GSK maintains substantial R&D investments (~£3 billion annually)[2], fueling an active pipeline with over 50 candidates spanning vaccines, oncology, respiratory diseases, and immunology. Recent collaboratives, such as the partnership with Vir Biotechnology for COVID-19 therapeutics, demonstrate commitment to innovation, reinforcing its strategic focus on high-value, differentiated assets.

Product Portfolio and Market Segments

- Vaccines: The core revenue driver, with GSK holding approximately 30% market share globally[3], supported by a strong portfolio including Shingrix (herpes zoster), Cervarix (HPV), and the COVID-19 vaccine.

- Pharmaceuticals: Focused on respiratory (e.g., Advair), HIV (e.g., Tivicay), and oncology products, GSK faces fierce competition from players like Pfizer and Merck.

- Consumer Healthcare (CH): Sold to GSK Consumer Healthcare division prior to the 2019 spin-off, GSK strategically divested its consumer segment to focus on pharmaceuticals and vaccines, emphasizing high-margin prescription medicines.

Competitive Position

GSK's strategic focus on vaccines and specialty medicines places it in a premium niche, differentiating it from rivals primarily targeting mass-market generics or broad-spectrum drugs. Its collaborations and pipeline investments bolster its position against competitors such as Pfizer, Roche, and Sanofi.

Strengths

1. Robust Vaccine Portfolio and Leadership

GSK’s global vaccine market share and leading positions, especially with the Shingrix vaccine, underpin its revenue resilience. The company’s vaccine R&D pipeline aims to expand into areas like influenza, RSV, and COVID-19, ensuring long-term growth opportunities.

2. Focused R&D Strategy and Innovative Pipeline

GSK allocates significant resources to R&D, emphasizing disease areas with high unmet medical needs. Its strategic partnerships with biotech firms and academic institutions enhance its pipeline and accelerate delivery of novel therapeutics.

3. Strategic Divestments and Focused Business Model

The $3.3 billion sale of its consumer healthcare division to Pfizer in 2019 allowed GSK to streamline operations and allocate resources more effectively toward pharmaceuticals. This strategic refocusing has improved profitability and operational agility.

4. Strong Global Presence and Market Access

GSK’s established distribution networks across emerging markets, coupled with partnerships in developing nations, enhance market penetration. Its legacy of localized manufacturing and regulatory expertise facilitates entry into high-growth markets.

5. Commitment to Sustainability and Digital Innovation

GSK's sustainability initiatives, including commitments to reduce carbon footprint and improve access to medicines, bolster its corporate reputation. Its investments in digital health solutions for clinical trials and patient engagement provide operational efficiencies and data-driven insights.

Strategic Insights

1. Emphasizing Vaccines and Specialty Medicines to Sustain Growth

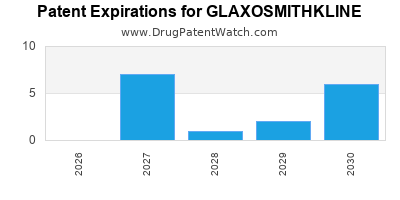

GSK’s strategic emphasis on vaccines and specialty medicines positions it favorably amid patent cliff challenges faced by traditional pharma. Recent advancements in mRNA vaccine development and biotherapeutics expansion are critical to this strategy.

2. Leveraging Collaborations and Partnerships

Collaborations like those with Vir Biotechnology exemplify GSK’s strategy to co-develop innovative therapeutics, reducing R&D risks and accelerating time-to-market for novel products.

3. Digital Transformation and Data Analytics

Integrating digital health strategies, such as real-world evidence generation and AI-driven R&D, enables GSK to optimize clinical trials, tailor therapies, and enhance patient outcomes—thus maintaining a technological edge.

4. Focused Market Entry and Expansion in Emerging Economies

GSK’s targeted investments in high-growth regions, supported by local manufacturing and partnerships, aim to capture increased healthcare spending and population health improvements.

5. Navigating Regulatory and Competitive Challenges

GSK’s geographic and portfolio diversification buffers against regulatory hurdles in specific markets. However, the company must stay agile amid increasing scrutiny over vaccine safety, pricing pressures, and patent disputes.

Competitive Landscape and Key Rivalry Dynamics

Major competitors include Pfizer, Merck & Co., Sanofi, and Roche. Pfizer’s recent victory with its COVID-19 vaccine and R&D investments pose significant competition. Merck’s expanding oncology portfolio also threatens GSK’s oncology ambitions. Sanofi remains a formidable rival in vaccines, challenging GSK’s market share.

GSK’s competitive strategy emphasizes product differentiation through innovation, continued pipeline development, and strategic partnerships. its focus on high-margin specialty therapeutics and vaccines positions it favorably relative to rivals heavily reliant on generics.

Conclusion

GlaxoSmithKline’s strategic repositioning toward vaccines and specialty medicines has strengthened its market standing, especially in endemic disease areas and emerging markets. Its substantial R&D investments, collaborative strategies, and operational focus underpin its resilience and growth trajectory. As the pharmaceutical landscape becomes increasingly competitive and regulated, GSK’s agility and innovation capacity will be vital for maintaining its leadership and expanding its global footprint.

Key Takeaways

- GSK’s leadership in vaccines and focus on specialty medicines serve as key differentiators in a competitive landscape.

- Strategic divestments have allowed GSK to concentrate on high-margin, high-growth sectors, improving profitability.

- Continuous pipeline development, enhanced by collaborations, sustains innovation and addresses unmet medical needs.

- Geographic diversification, especially in emerging markets, underpins sales growth and market share expansion.

- Digital transformation initiatives increase operational efficiencies, accelerate R&D, and improve patient engagement.

FAQs

1. How does GSK differentiate itself from competitors like Pfizer and Sanofi?

GSK’s primary differentiation lies in its leadership in vaccines and a strategic focus on specialty medicines such as immunology and oncology, supported by a robust pipeline and innovation-driven collaborations.

2. What are GSK’s key growth areas for the next five years?

Vaccine development, particularly for respiratory and emerging infectious diseases, along with innovative therapeutics in oncology and immunology, are central to GSK’s growth strategy.

3. How does GSK’s divestment of consumer health impact its market focus?

By divesting its consumer healthcare division, GSK sharper its focus on pharmaceuticals and vaccines, enabling targeted R&D investments and strategic alignment with high-margin, high-growth sectors.

4. What role do global collaborations and partnerships play in GSK’s strategy?

Collaborations enhance GSK’s R&D capabilities, facilitate faster product development, mitigate risk, and expand its geographic reach into high-growth markets.

5. How is GSK preparing for future industry challenges?

GSK invests heavily in R&D, digital health, and strategic partnerships, while emphasizing sustainability and market agility to navigate regulatory changes, pricing pressures, and competitive threats.

Sources:

[1] GSK Annual Report 2022.

[2] GSK R&D Investment Data, 2022.

[3] IQVIA Data on Vaccine Market Share, 2022.