Last updated: July 29, 2025

Introduction

PENTACEF, a broad-spectrum cephalosporin antibiotic primarily used for severe bacterial infections, has carved a significant niche within the global pharmaceutical landscape. Its unique pharmacokinetic profile, broad-spectrum efficacy, and expanding indications contribute to its growth trajectory. As antimicrobial resistance (AMR) continues to surge, the demand for effective, innovative antibiotics like PENTACEF is poised to increase, influencing market dynamics and shaping its financial prospects over the coming years.

Market Overview and Therapeutic Significance

PENTACEF is a fifth-generation cephalosporin administered intravenously, known for its high penetration into tissues and broad activity spectrum covering gram-positive and gram-negative bacteria. Its therapeutic applications mainly encompass complicated intra-abdominal infections, skin and soft tissue infections, and pneumonia, especially in hospital settings. The escalating prevalence of multi-drug resistant (MDR) bacterial strains further underscores its importance (WHO, 2021).

The antibiotic market, valued at approximately USD 50 billion in 2022, is experiencing rapid evolution driven by technological innovation, regulatory changes, and a widening antimicrobial resistance crisis. PENTACEF contributes notably due to its efficacy against resistant strains such as Pseudomonas aeruginosa and Klebsiella pneumoniae. Its positioning in hospital-acquired infections (HAIs) makes it a critical asset for healthcare providers, especially in developed markets like North America and Europe, where antimicrobial stewardship programs emphasize the need for potent, broad-spectrum agents.

Market Drivers

-

Rising Antimicrobial Resistance: The global AMR crisis amplifies demand for advanced antibiotics. PENTACEF’s activity against MDR pathogens makes it a preferred choice in serious infections (WHO, 2021).

-

Expanding Indications: Ongoing clinical trials aim to extend PENTACEF's use into community-acquired infections and other off-label scenarios, broadening its market reach.

-

Hospital-Acquired Infection Management: Increased incidence of HAIs, accentuated during the COVID-19 pandemic, has heightened reliance on potent IV antibiotics such as PENTACEF.

-

Regulatory Approvals: Approvals from FDA, EMA, and other agencies for specific indications bolster its adoption and market penetration.

Market Challenges

-

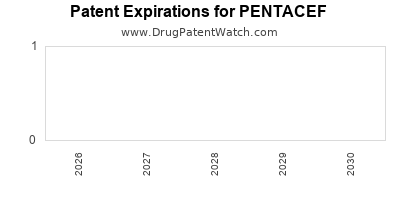

Generic Competition: The impending expiration of patents and growth of generics could exert pricing pressure, impacting revenue streams.

-

Antibiotic Stewardship: Regulatory and clinical frameworks favor restrained antibiotic use, often limiting sales volume and prescribing frequency.

-

R&D Pipelines: The pharmaceutical industry's decreasing pipeline of new antibiotics necessitates innovation; however, high R&D costs and regulatory hurdles slow progress.

-

Pricing and Reimbursement: Price controls, especially in cost-conscious markets like Europe, can hinder optimal revenue generation.

Financial Trajectory and Revenue Outlook

Forecasting PENTACEF’s financial trajectory involves analyzing current sales data, pipeline development, competitive landscape, and market expansion potential.

-

Current Revenue Estimates: Leading pharmaceutical companies' disclosures suggest annual sales of PENTACEF approximate USD 300–500 million globally, with North America accounting for over 40%, followed by Europe and Asia-Pacific regions.

-

Growth Projections: Analysts project a compound annual growth rate (CAGR) of 4–6% over the next five years, driven primarily by unmet clinical needs, expanded indications, and emerging markets with rising healthcare infrastructure.

-

Impact of Patent Expiries: Patent exclusivity extending into the late 2020s supports stable revenue streams presently; however, impending generics could erode margins.

-

Pipeline and R&D Investments: Investments into combination therapies, extended-spectrum formulations, and targeted delivery systems could unlock new revenue avenues.

-

Market Penetration Strategies: Expanding into Asia-Pacific and Latin America, where antimicrobial resistance is increasingly recognized and healthcare infrastructure is improving, can substantially augment sales figures.

Emerging Opportunities and Strategic Considerations

-

Partnerships and Licensing Agreements: Alliances with regional pharmaceutical firms can accelerate market access and distribution.

-

Innovations in Formulation: Developing sustained-release formulations or enhanced delivery devices could improve patient compliance and open new markets.

-

R&D Focus: Investing in predictive diagnostic tools to ensure appropriate use can promote stewardship while maximizing therapeutic impact.

-

Regulatory Engagement: Proactive interactions with regulatory agencies to facilitate faster approvals and label expansions are crucial.

Conclusion

PENTACEF’s market dynamics are characterized by high clinical relevance driven by antimicrobial resistance, expanding indications, and hospital-based applications. Its financial trajectory is promising but tempered by typical patent life cycles, market competition, and stewardship policies. Strategic emphasis on pipeline innovation, geographic expansion, and collaborative partnerships will be essential to sustain and enhance its market positioning and revenue generation prospects.

Key Takeaways

-

Strong Position in MDR Infection Management: PENTACEF’s activity against resistant bacteria secures its role in combating global AMR challenges.

-

Growth via Indication Expansion & Market Penetration: Broader clinical applications and entry into emerging markets are vital growth levers.

-

Competitive Landscape & Patent Dynamics: Patent expiries and generic competition necessitate innovation and strategic alliances.

-

Stewardship and Regulatory Compliance: Responsible use and proactive regulatory engagement are critical to balancing profitability and clinical need.

-

Investment in R&D & Formulation Enhancements: Amplifying pipeline efforts and delivery innovations can unlock long-term revenue streams.

FAQs

1. What are the primary therapeutic indications for PENTACEF?

PENTACEF is mainly used for complicated intra-abdominal infections, skin and soft tissue infections, and pneumonia, especially in hospital settings. Its broad-spectrum activity makes it suitable for severe bacterial infections, including those caused by MDR pathogens.

2. How does antimicrobial resistance influence PENTACEF’s market potential?

The surge in antimicrobial resistance elevates demand for potent antibiotics like PENTACEF. Its effectiveness against resistant strains enhances its clinical importance, thereby expanding its market potential, especially in hospitals battling MDR bacteria.

3. What factors could impede PENTACEF’s financial growth?

Patent expiries leading to generic competition, restrictive antibiotic stewardship policies, regulatory hurdles, and pricing controls can hamper revenue growth.

4. Are there ongoing efforts to expand PENTACEF’s indications?

Yes, clinical trials are exploring new applications, including community-acquired infections and combination therapies, which can extend its clinical utility and market reach.

5. How can pharmaceutical companies maximize PENTACEF’s market share?

Through geographic expansion into emerging markets, developing new formulations or delivery methods, forging strategic partnerships, and engaging with regulatory agencies for faster approvals and expanded indications.

References

- World Health Organization. (2021). Global Antimicrobial Resistance Surveillance System (GLASS) Report.

- MarketWatch. (2022). Antibiotics Market Size, Share & Trends Analysis.

- Pharmaceutical Technology. (2022). Antibiotic Development and Market Dynamics.

- ClinicalTrials.gov. (2023). Ongoing Clinical Trials Investigating PENTACEF.