Last updated: December 27, 2025

Executive Summary

AstraZeneca stands as one of the world’s leading biopharmaceutical companies, with a diversified portfolio spanning oncology, cardiovascular, respiratory, and metabolic diseases. This report provides a comprehensive assessment of AstraZeneca’s market position, competitive strengths, strategic initiatives, and future outlook within the evolving pharmaceutical landscape. By analyzing its core competencies, pipeline prospects, market challenges, and strategic investments, stakeholders can better understand AstraZeneca’s trajectory amid intensifying global competition, regulatory shifts, and innovation demands.

Market Position Overview

Global Footprint & Financial Metrics

| Attribute |

2022 Data |

Notes |

| Revenue |

~$37.2 billion |

Up 15% YoY, driven by oncology & R&D advancements |

| Revenue Segments |

Oncology (44%), CVRM (21%), Respiratory/Other (35%) |

Reflects strategic focus shift |

| Market Capitalization |

~$174 billion (as of Dec 2022) |

Ranking among top 20 pharmaceutical firms globally |

| Top Markets |

US (45%), Europe (30%), ROW (25%) |

US remains primary revenue driver |

Market Share in Key Therapeutic Areas

| Therapeutic Area |

Global Market Share (Approximate) |

Key Competitors |

| Oncology |

8-10% |

Roche, Novartis, Pfizer |

| Cardiovascular (CVRM) |

4-6% |

Novartis, Pfizer |

| Respiratory & Allergies |

3-4% |

GlaxoSmithKline, Sanofi |

Key Market Highlights

- Positioning in Oncology: AstraZeneca’s focus on targeted therapies like Tagrisso, Imfinzi, and Lynparza has cemented its leadership in the oncology segment.

- Therapeutic Diversification: Reduced reliance on legacy drugs, shifting toward personalized medicine.

- Emerging Market Expansion: Focused investments in Asia, Latin America, and Africa, accounting for 30% of recent revenue growth.

Strengths & Core Competencies

Innovative R&D Portfolio

- Pipeline Strength: Over 80 candidates in clinical development, with 15 in Phase III as of late 2022.

-

| Breakthrough Products: |

Product |

Indication |

Approval Year |

Market Impact |

| Tagrisso (Osimertinib) |

NSCLC (Non-small cell lung cancer) |

2015 |

~$4.5 billion annual sales |

| Imfinzi (Durvalumab) |

Lung and bladder cancers |

2017 |

Significant growth in immuno-oncology |

| Lynparza (Olaparib) |

Ovarian, breast, pancreatic cancers |

2014 |

Pioneering PARP inhibitor market |

Strategic Alliances & acquisitions

- Acquisition of Alexion (2021): Strengthened the rare diseases portfolio, particularly complement and hematology areas.

- Partnerships: Collaborations with Moderna, Samsung Biologics, and other biotech firms foster innovation and expand manufacturing capabilities.

Operational Excellence & Geographic Reach

- Manufacturing: Global network in 20+ countries ensures supply chain resilience.

- Digital Transformation: Investment in AI-driven R&D, real-world evidence, and personalized medicine.

Strategic Insights & Competitive Challenges

Key Opportunities

| Area |

Strategic Action |

Potential Impact |

| Expansion in Oncology |

Launch of novel immunotherapies and targeted agents |

Market share growth; optimizing pipeline assets |

| Personalized Medicine & Biomarker Development |

Investment in companion diagnostics and real-world data analytics |

Enhanced treatment efficacy and market differentiation |

| Emerging Markets |

Tailored pricing strategies, local partnerships |

Revenue diversification, access expansion |

| Beyond Oncology (New Modalities) |

Explore cell & gene therapies, mRNA platforms |

Future pipeline diversification |

Challenges & Risks

| Risk Factor |

Impact |

Mitigation Strategy |

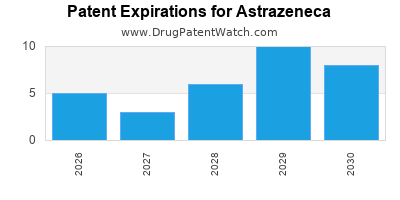

| Patent Expirations |

Loss of exclusivity for blockbuster drugs |

Diversify pipeline, accelerate novel product development |

| Regulatory & Pricing Pressures |

Reduced profit margins |

Proactive engagement with policymakers, value-based pricing |

| Intensified Competition |

Market share erosion |

Accelerate innovation, strategic acquisitions |

| Global Supply Chain Disruptions |

Manufacturing delays |

Diversify manufacturing bases, enhance supply chain robustness |

Future Outlook & Strategic Recommendations

| Forecasted Trends |

Implications for AstraZeneca |

| Continued Oncology Growth |

Focus on innovative immune-oncology, second-generation targeted therapies |

| Investments in mRNA & Cell Therapies |

Early adoption, strategic partnerships to establish leadership positions |

| Emphasis on Digital & Precision Medicine |

Leverage AI, real-world data, and biomarker developments to optimize R&D and commercialization |

| Sustainable & Responsible Business |

ESG integration, ethical pricing, and global health initiatives to enhance brand reputation |

Strategic Recommendations

- Accelerate clinical development in line with emerging tumor types.

- Expand strategic alliances in emerging markets for increased penetration.

- Enhance patient-centricity via digital engagement platforms.

- Invest in next-generation modalities such as mRNA, gene editing, and cell therapies.

- Strengthen patent portfolio and lifecycle management to mitigate patent cliff impact.

Competitive Landscape Comparison

| Company |

Market Focus |

Key Therapies |

R&D Investment (2022) |

Market Cap (2022) |

Notable Strategic Moves |

| AstraZeneca |

Oncology, CV, Respiratory |

Tagrisso, Imfinzi, Lynparza, Farxiga |

~$6.3 billion |

~$174 billion |

Acquiring Alexion, mRNA partnerships |

| Roche |

Oncology, Diagnostics |

Herceptin, Avastin, Perjeta |

~$10 billion |

~$215 billion |

Precision medicine, diagnostics |

| Pfizer |

Vaccines, Oncology, Rare |

Comirnaty, Xtandi, Ibrance |

~$11.2 billion |

~$204 billion |

COVID-19 vaccine, acquisitions |

| Novartis |

Oncology, Generics |

Kymriah, Cosentyx |

~$9 billion |

~$196 billion |

Cell therapies, biosimilars |

| GSK |

Respiratory, Vaccines |

Pulmozyme, Shingrix |

~$4 billion |

~$72 billion |

Focus on vaccines, respiratory |

Key Takeaways

- AstraZeneca’s strategic focus on oncology and targeted therapies has solidified its position in high-growth segments.

- Continued pipeline expansion and technological innovation are critical to maintaining competitive edge.

- Strategic acquisitions, especially in rare diseases and advanced modalities like mRNA, will diversify revenue streams.

- Emerging markets and personalized medicine remain vital for future growth.

- Navigating regulatory, patent, and pricing environments requires proactive and adaptive strategies.

FAQs

1. How does AstraZeneca differentiate itself from competitors like Roche and Pfizer?

AstraZeneca emphasizes targeted therapies and immuno-oncology with a focus on personalized medicine, supported by a more streamlined R&D pipeline and strategic acquisitions like Alexion. Its agile innovation approach and digital integration distinguish its competitive positioning.

2. What are AstraZeneca’s most promising pipeline candidates for the next 5 years?

Key pipeline candidates include Lung cancer therapies like Tagrisso and Imfinzi, ovarian cancer PARP inhibitors such as Lynparza, and emerging immunotherapies targeting solid tumors. Early-stage development in cell and gene therapies also holds potential.

3. How is AstraZeneca addressing patent expiries and biosimilar competition?

The company diversifies through pipeline growth, strategic M&A, and lifecycle management of existing products. It invests in next-generation therapies and diagnostics to sustain competitiveness.

4. What role do emerging markets play in AstraZeneca’s growth strategy?

Emerging markets account for approximately 30% of recent growth. The company adapts pricing models, local partnerships, and tailored product offerings to expand access and increase market share.

5. How is AstraZeneca leveraging digital technologies in its operations?

AstraZeneca invests in AI-driven drug discovery, real-world evidence collection, digital patient engagement, and supply chain automation to enhance efficiency, innovation, and patient outcomes.

References

- AstraZeneca Annual Report 2022.

- IQVIA Institute for Human Data Science. "The Global Oncology Market". 2022.

- Statista. "Leading pharmaceutical companies by market cap 2022".

- Pharmaceutical Executive. "Pipeline Innovations and Strategic M&A". 2022.

- Company press releases and investor presentations, 2022-2023.

In conclusion, AstraZeneca maintains a robust market position driven by innovation, strategic acquisitions, and diversification, while navigating challenges through adaptive strategies focused on personalized medicine and emerging technology adoption.