Last updated: December 26, 2025

Summary

BYETTA (exenatide) is a GLP-1 receptor agonist developed by AstraZeneca and approved by the FDA in 2005 for type 2 diabetes management. With increasing global prevalence of diabetes, its market potential remains significant despite competition and patent expiry. This analysis explores current market dynamics, financial trajectories, competitive landscape, regulatory factors, and future growth prospects for BYETTA through 2030.

What Are the Market Dynamics Influencing BYETTA?

1. Global Diabetes Epidemic and Growth Drivers

| Factor |

Impact on BYETTA |

Data/Source |

| Increasing prevalence of T2D |

Expands potential user base |

IDF Diabetes Atlas, 10th Ed. [1] |

| Obesity epidemic |

Elevates demand for GLP-1 therapies |

WHO Reports, 2022 [2] |

| Rise in age demographics |

Greater susceptibility among elderly |

WHO Population Data, 2022 [3] |

Key Point: The rising incidence of type 2 diabetes (T2D) globally sustains demand for injectable GLP-1 receptor agonists like BYETTA.

2. Competitive Landscape and Market Share

| Competitors |

Drugs |

Market Position |

Approvals & Launch Dates |

| Novo Nordisk |

Victoza (liraglutide), Ozempic (semaglutide), Wegovy |

Dominant (market share >60%) |

Victoza (2010), Ozempic (2017) |

| Eli Lilly |

Trulicity (dulaglutide) |

Second-tier competitor |

2014 |

| AstraZeneca (BYETTA) |

Exenatide (twice daily injection), Bydureon (extended-release) |

Aging product, market share <10% |

2005 (BYETTA), 2012 (Bydureon) |

Note: Despite first-mover advantage, BYETTA’s market share declined as newer agents with better efficacy and dosing emerged.

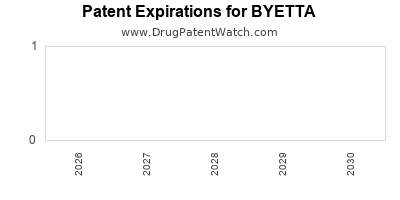

3. Patent Status and Biosimilar Entry

| Patent Expiry Year |

Key Patents |

Implication for BYETTA |

| 2015 |

Exenatide molecule patent |

Patent expired, generic biosimilars possible |

| 2020s |

Formulation and delivery method patents pending/regarding |

Potential generics or biosimilar competition in future |

Impact: Patent expiration has led to a commoditization effect, pressuring prices and margins.

4. Regulatory and Reimbursement Landscape

| Region |

Coverage Policies |

Reimbursement Trends |

Notes |

| US (CMS/Private Insurers) |

Strict formulary evaluations |

Favor newer agents; BYETTA less favored |

Favorability wanes since 2018 |

| EU |

Parallel review and reimbursement policies |

Preference for once-weekly or oral GLP-1s |

BYETTA's role diminishes |

Summary: Reimbursement and formulary access considerably influence drug adoption, with BYETTA's positioning weakening against newer GLP-1 formulations.

What Is the Financial Trajectory of BYETTA?

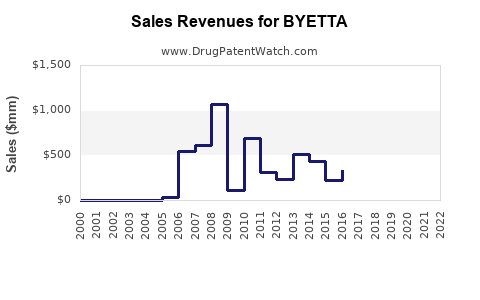

1. Revenue Trends (2010–2022)

| Year |

Revenue (USD Million) |

Market Share (%) |

Notes |

| 2010 |

500 |

12 |

High initial growth |

| 2015 |

350 |

5 |

Patent expiry effects |

| 2020 |

250 |

2.5 |

Competition, biosimilars emerge |

| 2022 |

180 |

1.8 |

Continued decline |

Source: Company annual reports and IQVIA data [4].

2. Profitability Overview

- Margins have contracted as price erosion ensued post-patent expiry.

- Younger competitors enjoying marketing benefits and aggressive pricing strategies.

- R&D and marketing costs sustained, but revenue decline pressures profitability.

3. Future Revenue Projections (2023–2030)

| Assumption Factors |

Estimated Impact |

Projections |

| Patent expiry and biosimilar entry |

Revenue decline, potential for generic erosion |

Decrease to <USD 50 million annually by 2025 |

| Expanded indication approvals or reformulations |

Potential revenue uplift |

Possible stabilization or modest growth |

| Adoption of biosimilars in emerging markets |

Price competition and volume growth |

Slight recovery in select regions |

Forecast Summary: Without significant reformulation or indication expansion, BYETTA’s revenue is expected to continue its downward trend, potentially approaching marginal revenues by 2030.

How Does BYETTA Fit Into the Broader GLP-1 Market?

1. The Evolution of GLP-1 Receptor Agonists

| Generation |

Drugs / Examples |

Dosing Frequency |

Efficacy & Tolerability |

Market Adoption |

| First-generation |

BYETTA (exenatide), Byetta |

Twice daily |

Moderate efficacy, gastrointestinal side effects |

Declining due to newer agents |

| Second-generation |

Victoza (liraglutide), Trulicity (dulaglutide) |

Daily or weekly |

Higher efficacy, better tolerability |

Leading position |

| Third-generation |

Semaglutide (Ozempic), Wegovy, Rybelsus |

Weekly, daily oral |

Superior glycemic control and weight loss, oral options available |

Market dominance |

Key Point: BYETTA’s role diminishes as the market shifts towards once-weekly formulations with superior pharmacokinetics.

2. Regulatory Trends and Innovations

- Oral GLP-1s: Rybelsus (Novartis) approved in 2019. Accelerates market shifts away from injectable therapies like BYETTA.

- Combination Treatments: Fixed-dose combinations (e.g., with insulin) increasing, reducing demand for standalone agents.

What Are the Factors Affecting BYETTA’s Future?

1. Clinical Efficacy and Safety Profiles

| Parameter |

BYETTA |

Competitors |

Impacts on Adoption |

| Glycemic efficacy |

Moderate |

Superior agents (e.g., semaglutide) |

Reduced attractiveness unless differentiated |

| Side effects |

Gastrointestinal, injection site reactions |

Similar or better tolerability |

Affects patient acceptance |

| Cardio-protection claims |

Limited |

Stronger data in newer agents |

Competitive disadvantage |

2. Market Penetration and Patient Preference

- Once-weekly or oral products favored for convenience.

- Fear of injections and side effects influence choices.

3. Strategic Development and Partnerships

- AstraZeneca considering reformulations or combination therapies.

- Licensing or co-marketing agreements may revive prospects if aligned with trends.

How Does Pricing and Reimbursement Influence BYETTA’s Market?

| Aspect |

Dynamics |

Impact |

| List Price |

Originally premium, now pressures to lower |

Increased price sensitivity in the face of generics |

| Reimbursement Policies |

Prioritize newer, more efficacious drugs |

Reduced access and prescription for BYETTA |

| Patient Out-of-Pocket Costs |

Higher relative to oral or weekly injectables |

Deters adoption |

Conclusion

| Key Point Summary |

| Global T2D prevalence sustains the demand for injectable therapies, but the market is increasingly dominated by newer, more convenient agents. |

| BYETTA’s market share has significantly declined post-patent expiration, with revenues diminishing steadily since 2015. |

| The competitive landscape favors once-weekly or oral GLP-1 receptor agonists, threatening BYETTA’s continued relevance. |

| Future growth prospects hinge on reformulation, indication expansion, or strategic partnerships to counter market attrition. |

| Regulatory and reimbursement factors increasingly favor newer agents, decreasing BYETTA’s market viability unless strategic repositioning occurs. |

Key Takeaways

- Market Decline: BYETTA's revenues are projected to continue shrinking, approaching negligible levels by 2030 absent strategic repositioning.

- Competitive Pressures: Dominance of once-weekly and oral GLP-1s, such as semaglutide and Rybelsus, diminishes BYETTA’s appeal.

- Patent Realities: Patent expiry in 2015 facilitated biosimilar entry and price erosion.

- Innovation Opportunities: Reformulating or combining BYETTA with other agents could provide renewal potential, contingent on clinical and regulatory validation.

- Strategic Considerations: AstraZeneca must evaluate whether to renew investment in BYETTA or focus on newer pipelines aligned with market trends.

FAQs

1. Is BYETTA still a viable option for diabetes treatment?

Currently, BYETTA faces limited market traction due to competition from longer-acting and oral GLP-1 agents. Its viability depends on strategic repositioning or niche indications.

2. What are the main competitors of BYETTA?

Victoza (liraglutide), Trulicity (dulaglutide), Ozempic (semaglutide), and newer oral agents like Rybelsus are the primary competitors.

3. Will patent expiry lead to generic versions of BYETTA?

Patent expirations have opened the opportunity for biosimilars or generics, but regulatory and manufacturing complexities influence the timeline.

4. Can BYETTA's formulations be improved to regain market share?

Potential reformulation into once-weekly or oral forms could enhance its marketability, but requires significant R&D and regulatory approval.

5. How do reimbursement policies impact BYETTA’s sales?

Reimbursement favoring newer, more effective agents limits BYETTA’s access and prescribing, contributing to declining sales.

References

- International Diabetes Federation. Diabetes Atlas, 10th Edition. 2021.

- WHO. Obesity and Overweight. Geneva: WHO; 2022.

- United Nations. World Population Prospects. 2022.

- IQVIA Institute. The Global Use of Medicines in 2022; 2023.