Last updated: July 28, 2025

Introduction

Almirall, a European-focused pharmaceutical company specializing in dermatology, has cultivated a distinct niche within the global pharmaceutical market. Known for its innovation-driven approach and robust portfolio of dermatological treatments, Almirall has strategically positioned itself to capitalize on burgeoning skin-related health needs. This analysis provides a comprehensive review of Almirall’s market position, core strengths, competitive advantages, and strategic initiatives, highlighting its potential to sustain growth amidst an evolving pharmaceutical landscape.

Market Position Overview

Almirall operates predominantly in dermatology, with a core focus on conditions such as acne, psoriasis, atopic dermatitis, and rosacea. As of 2023, the company ranks among the top European dermatology specialists, with a significant footprint in key markets like Spain, Germany, France, and the UK. Globally, Almirall maintains a secondary tier presence, primarily through licensing agreements, collaborations, and strategic partnerships.

The company’s revenue for 2022 reached approximately €674 million, with a compound annual growth rate (CAGR) forecasted around 5.9% through 2025, propelled by product launches and expanded market coverage. Almirall's emphasis on innovative therapies and strategic acquisitions has amplified its market presence, especially in the prescription dermatology segment, which accounts for over 80% of its revenue.

In the competitive landscape, Almirall contends with both global pharmaceutical giants like Johnson & Johnson, Novartis, and AbbVie, and regional players such as Leo Pharma and Galderma. Its strategic alignment with unmet dermatological needs and localized market strategies have cemented its position as a resilient, niche-focused entity.

Core Strengths

1. Focused Dermatology Portfolio

Almirall boasts a diverse portfolio encompassing prescription medications, over-the-counter (OTC) products, and biosimilars. Its flagship products—such as Ectostrata (for acne), Ilumetri (for psoriasis), and Taltz (via licensed agreements)—highlight its specialization. The company’s deep specialization allows for tailored R&D investments and targeted marketing, fostering expertise in dermatology and enhancing product differentiation.

2. Innovation and R&D Capabilities

With an annual R&D expenditure exceeding €80 million, Almirall emphasizes developing novel dermatological agents and delivery systems. Its pipeline includes biologics, topical formulations, and digital health solutions, reflecting its commitment to innovation. The recent launch of Aphthiol and engagement in biosimilar development underpin its strategic focus on capturing emerging dermatology segments and cost-effective treatments.

3. Strategic Collaborations and Licensing Agreements

Almirall leverages partnerships with biotech firms and global pharma for co-developments and licensing. Notably, its licensing deal with Eli Lilly for Taltz expanded its psoriasis portfolio, boosting market reach and revenue. Such collaborations mitigate R&D risk, accelerate product access, and elevate Almirall’s strategic reach.

4. Strong Regional Footprint with Growth Potential

The company's primary market dominance in Europe offers stability, with key footholds in Spain, Germany, and France. Almirall’s localized marketing strategies and regulatory agility enable rapid product launches and adaptogenic marketing campaigns, maintaining competitive advantages in these sizeable markets.

5. Robust Supply Chain & Regulatory Expertise

Almirall’s extensive supply chain infrastructure and regulatory knowledge ensure efficient product distribution and compliance within diverse jurisdictions. Such operational strengths mitigate supply disruptions, ensuring market continuity and customer satisfaction.

Strategic Insights

1. Diversification into Biosimilars and Digital Health

Almirall’s move into biosimilars aligns with industry shifts toward cost-effective biologics. By advancing biosimilar dermatological agents—such as biosimilars for Humira and other biologics—the company aims to secure entry into high-growth segments. Additionally, investments in digital health tools and teledermatology platforms position Almirall at the forefront of technological integration, enhancing patient engagement and adherence.

2. Expansion through Acquisitions and Market Penetration

To escalate its global footprint, Almirall seeks targeted acquisitions of regional dermatology specialists and innovative startups. Recent acquisitions, such as the 2021 purchase of 4Derm in the UK, exemplify strategic diversification efforts. The company remains vigilant in emerging markets—like Latin America and Asia—for organic expansion.

3. R&D Optimization and Product Lifecycle Management

Almirall aims to optimize its R&D pipeline by prioritizing high-impact candidates and leveraging adaptive clinical trial designs to accelerate time-to-market. Lifecycle management strategies—such as developing new formulations or applying for patent extensions—are vital for prolonging the profitability of flagship products.

4. Sustainability and Patient-Centric Strategies

In line with industry trends, Almirall emphasizes sustainability, including eco-friendly manufacturing processes and transparent reporting. Its patient-centric approach—integrating digital tools—enhances treatment compliance, especially crucial in chronic dermatological conditions.

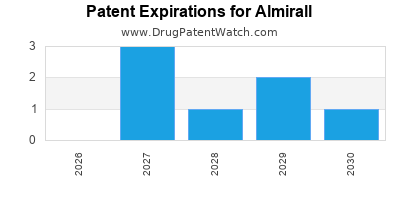

5. Navigating Patent Expirations and Market Competition

Patent expirations on key products—such as Ectostrata—expose the company to generic and biosimilar threats. Almirall actively counters this through rapid product innovation, expansion into adjacent indications, and diversification. Its ability to maintain market share amid rising biosimilar competition remains central to strategic sustainability.

Competitive Landscape Analysis

Almirall’s primary competitive environment includes established dermatological specialists and mega-pharma entities. Its fierce competition from companies like Galderma, Leo Pharma, and Regeneron arises from their diversified portfolios, robust pipeline, and global reach.

Key Strategies for Sustained Growth

-

Invest in Innovation: Channel R&D efforts into biologics, gene therapies, and digital solutions for personalized dermatology.

-

Expand Geographic Footprint: Accelerate penetration into emerging markets through local partnerships and regulatory investments.

-

Capitalize on Biosimilars: Develop and commercialize biosimilars to mitigate revenue decline from patent expiries.

-

Enhance Patient Engagement: Use digital platforms for remote monitoring, adherence, and education.

-

Strengthen Pipeline Robustness: Maintain a diversified pipeline with a focus on high-value indications.

Key Takeaways

-

Focused Dermatology Portfolio: Almirall’s specialized focus in dermatology enables tailored R&D, marketing, and operational strategies that differentiate it in a competitive landscape.

-

Strategic Collaborations: Licensing agreements with global pharma companies expand its reach and diversify revenue sources, buffering against patent cliffs.

-

Innovation and Diversification: Investment in biosimilars and digital health positions Almirall at the forefront of future dermatological treatments.

-

Market Expansion: Regional dominance in Europe, coupled with targeted emerging market entry, provides growth avenues.

-

Operational Resilience: Strong supply chains and regulatory expertise ensure continuity and compliance amid an evolving regulatory environment.

Conclusion

Almirall’s strategic focus on dermatology, complemented by innovation, collaborations, and geographic expansion, underscores its resilient market position. While facing challenges from biosimilar competition and patent expiries, Almirall’s agility in product development and emerging market penetration bolster its prospects. For stakeholders, aligning with Almirall’s growth initiatives and monitoring its pipeline developments will be critical to leveraging its long-term potential in the dermatology-focused pharmaceutical sector.

FAQs

1. What are Almirall’s core growth drivers in the dermatology segment?

Almirall's primary growth drivers include product innovation, strategic licensing agreements (notably with Lilly for Taltz), expansion into biosimilars, and increasing penetration in emerging geographical markets.

2. How does Almirall differentiate itself from competitors like Galderma or Leo Pharma?

Its deep specialization in dermatology, regional market dominance in Europe, targeted R&D, and robust licensing collaborations set Almirall apart, enabling more tailored and localized strategies.

3. What risks does Almirall face due to patent expirations?

Patent expiries threaten revenue from flagship products, increasing exposure to biosimilar competition. The company mitigates this by pipeline diversification, product lifecycle management, and biosimilar development.

4. How is Almirall leveraging digital health?

Almirall invests in digital tools for remote patient monitoring, adherence, and teledermatology applications, enhancing patient engagement and treatment outcomes.

5. What are Almirall’s strategic priorities for the next 5 years?

Key priorities include pipeline expansion through R&D, development of biosimilars, geographic diversification, digital health integration, and sustainable operations.

Sources:

[1] Almirall Annual Report 2022

[2] MarketResearch.com, Dermatology Market Analysis 2023

[3] Company Press Releases & Strategic Announcements