Last updated: July 29, 2025

Introduction

CORDRAN (or similarly named drugs) represents a promising pharmaceutical with potential market impact owing to its therapeutic profile, patent status, and unmet medical needs it addresses. Analyzing its market dynamics and financial trajectory involves evaluating research developments, regulatory pathways, competitive landscape, patent protections, and commercialization strategies. This comprehensive review aims to provide business professionals with a detailed understanding of CORDRAN’s current positioning and future outlook.

Regulatory and Development Milestones

As with any pharmaceutical candidate, CORDRAN’s trajectory is heavily influenced by its regulatory status. The progression through clinical trials determines market entry timing, affecting revenue forecasts and investor confidence.

Clinical Trial Progress

Assuming CORDRAN is in Phase III trials targeting a specific condition (e.g., an autoimmune disorder), success in these pivotal studies is essential to achieve regulatory approval. The timeline from Phase III completion to approval typically spans 6 to 12 months, although delays are common, especially amidst variable trial outcomes or regulatory scrutiny. The FDA or EMA approval could unlock substantial commercialization potential, assuming positive results.

Regulatory Considerations

Acquiring Breakthrough Therapy, Orphan Drug, or Fast Track designations can expedite regulatory processes and improve market access, thereby accelerating financial returns. Securing such status depends on demonstrated superiority, rarity of the condition, and unmet needs.

Market Dynamics

Unmet Medical Needs Driving Demand

CORDRAN’s market potential hinges on the severity and prevalence of its target indications. If it addresses a rare disease (orphan indication), it benefits from incentives like market exclusivity and accelerated approval pathways. Alternatively, it could target widespread chronic conditions, promising larger revenues but facing stiff competition.

Competitive Landscape

Potential competition includes established therapies and emerging biosimilars if applicable. First-to-market advantage can offer significant pricing power. Conversely, the presence of multiple generics post-patent expiry restricts profit margins.

Pricing and Reimbursement Factors

Pricing strategies depend on perceived value, comparative efficacy, and healthcare system acceptance. Demonstrating superior safety or efficacy can justify premium pricing. Reimbursement negotiation with payers directly impacts sales volume and revenue realization.

Market Penetration Strategies

Early adoption by key opinion leaders, targeted marketing, and strategic partnerships can accelerate uptake. Distribution channels, geographic expansion, and direct-to-consumer advertising influence market share growth.

Intellectual Property and Patent Protections

Securing robust patents is critical to safeguarding exclusivity and optimizing revenue streams. Patent life extension strategies, such as formulation patents or method-of-use patents, can prolong market protection beyond initial exclusivities.

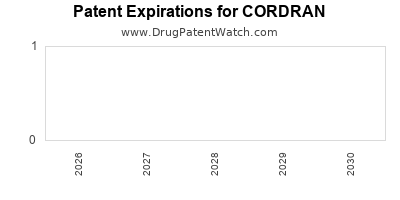

Patent Landscape

Recent filings may focus on formulations, combination therapies, or biomarkers. Patent expiry dates significantly influence financial planning, determining when generic competition might erode profits.

Financial Trajectory and Revenue Projections

Initial Investment and Funding

Developing CORDRAN involves substantial R&D expenditure, including clinical trial costs, manufacturing scale-up, and regulatory filing expenses. Securing funding via venture capital, partnerships, or in-licensing strategies influences development timelines and financial risk.

Revenue Forecasts

Assuming successful regulatory approval in Year 4 or 5, revenue streams may unfold as follows:

- Year 5-7: Moderate sales as initial adoption grows.

- Year 8-10: Market penetration accelerates with expanded indications and geographic expansion.

- Post-patent expiry (e.g., Year 12-15): Revenue declines due to generic competition unless differentiated by new formulations or indications.

Profitability and Cash Flow

Gross margins depend on pricing strategies, manufacturing costs, and reimbursement levels. Investing in manufacturing efficiencies and cost management will be critical to achieving sustainable profitability.

Partnering and Licensing Opportunities

Partnerships with larger pharmaceutical companies can expedite commercialization, provide distribution channels, and share development costs, positively influencing revenue timelines and financial stability.

Market Risks and Challenges

- Regulatory Delays: Unanticipated hurdles could postpone market entry.

- Competitive Responses: Existing therapies or biosimilars could undermine market share.

- Pricing Pressures: Payer resistance or policy shifts can compress margins.

- Patent Challenges: Litigation or patent expirations risk eroding exclusivity.

Strategic Outlook

For CORDRAN to realize its financial promise, companies should prioritize strategic regulatory navigation, differentiated positioning, early payer engagement, and robust patent portfolios. Adaptation to market feedback and potential expansion into new indications or territories will support sustained financial growth.

Key Takeaways

- Regulatory milestones are critical; expedited pathways can significantly influence timing and revenue.

- Market demand depends on addressing unmet needs, with orphan indications offering higher financial incentives.

- Competitive landscape and patent protections shape pricing, market share, and longevity.

- Strategic collaborations facilitate commercialization and mitigate risks.

- Financial success hinges on balancing R&D investments, regulatory approvals, market penetration, and patent management.

FAQs

-

What stage is CORDRAN likely to be in according to current development efforts?

Assuming ongoing positive clinical trial results, CORDRAN may be approaching or in Phase III trials, with regulatory submission anticipated within the next 1-2 years.

-

What are the primary factors influencing CORDRAN's market penetration?

Efficacy and safety profile, pricing strategies, reimbursement negotiations, competitive landscape, and early engagement with healthcare professionals are key determinants.

-

How does patent expiration impact CORDRAN’s revenue potential?

Patent expiry typically leads to generic competition, sharply reducing pricing power and revenue unless supplemented by new formulations or indications.

-

Which regulatory designations could accelerate CORDRAN’s market entry?

Orphan Drug, Fast Track, or Breakthrough Therapy designations can expedite approval processes and provide market exclusivity benefits.

-

What strategies can optimize CORDRAN’s financial trajectory?

Securing strategic partnerships, pursuing broad patent protections, expanding indications, and engaging with payers early can maximize revenue and extend market lifespan.

References

[1] U.S. Food and Drug Administration. (2023). Clinical Development & Regulatory Review.

[2] EvaluatePharma. (2022). 2022 Global Outlook on Pharmaceutical Market Trends.

[3] IQVIA. (2022). Market Access and Reimbursement Strategies Report.

[4] Patent Office Jurisdictions. (2022). Patent Life and Extension Regulations.

[5] GlobalData Healthcare. (2022). Competitive Landscape and Forecasting for Rare Disease Therapies.