Last updated: December 25, 2025

Executive Summary

Triamcinolone acetonide, a synthetic corticosteroid, is widely used across dermatology, allergies, rheumatology, and respiratory diseases, primarily for its anti-inflammatory and immunosuppressive properties. The drug’s market landscape exhibits robust growth driven by expanding indications, rising prevalence of autoimmune and allergic conditions, and technological advancements in drug formulation. However, patent expirations, generic competition, and regulatory fluctuations pose challenges to revenue streams. This report analyzes the current market environment, future growth prospects, competitive factors, and potential revenue trajectories for triamcinolone acetonide.

What Are the Key Market Drivers for Triamcinolone Acetonide?

1. Rising Prevalence of Chronic Inflammatory and Autoimmune Diseases

- Conditions such as asthma, allergic rhinitis, psoriasis, and rheumatoid arthritis are increasing globally, fueling demand for corticosteroid therapies [1].

- Global autoimmune disease prevalence is projected to reach over 3.9% of the population, growing at a CAGR of 3%, directly impacting corticosteroid usage [2].

2. Expanding Indications and Formulation Innovations

- New formulations (e.g., topical creams, injections, nasal sprays) enhance drug versatility.

- Development of sustained-release injections and combination therapies enhances therapeutic outcomes.

3. Increasing Healthcare Expenditure and Access in Emerging Markets

- Rising healthcare penetration in Asia-Pacific and Latin America amplifies market reach.

- Governments investing in better allergy and autoimmune disease management drives demand.

4. Regulatory Approvals and Reimbursement Policies

- Favorable policies and approvals in key markets (FDA, EMA, PMDA) foster market growth.

- Insurance coverage and reimbursement schemes support better patient access.

What Are the Main Challenges and Constraints?

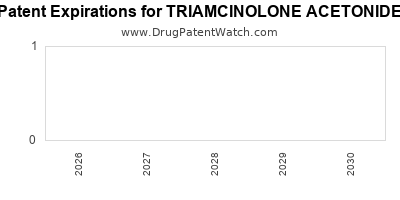

1. Patent Expirations and Generic Competition

- Several formulations of triamcinolone acetonide are nearing patent expiry (e.g., Kenalog in the US expired in 2018).

- The influx of generics significantly reduces prices and revenue margins.

2. Regulatory and Safety Concerns

- Adverse event profiles, especially with systemic and high-dose treatments, prompt regulatory scrutiny.

- Strict regulations in certain markets limit off-label or new indications.

3. Pain Points in Market Penetration

- Competition from other corticosteroids (e.g., betamethasone, dexamethasone).

- Limited awareness or accessibility in underdeveloped regions.

4. Pricing Pressures and Reimbursement Challenges

- Cost-containment policies in public health systems constrain premium pricing strategies.

What Is the Current Market Size and Future Forecast?

| Parameter |

2022 Figure |

Future Projection (2028) |

CAGR (2023-2028) |

| Global Market Value |

$800 million |

$1.2 billion |

7.2% |

| Leading Regions |

North America (50%), Europe (25%), Asia-Pacific (15%), others (10%) |

Same distribution with growth in Asia-Pacific |

— |

| Key Formulations |

Injectable (Kenalog), topical creams, nasal sprays |

Injectable expected to hold largest share |

— |

Note: The compound annual growth rate (CAGR) of 7.2% is driven by increasing adoption in emerging markets and expanding indications.

Regional Market Breakdown (2023–2028)

| Region |

Current Market Share |

Expected CAGR |

Key Drivers |

Market Growth (USD) |

| North America |

50% |

5.8% |

High prevalence, developed healthcare |

$600M → $800M |

| Europe |

25% |

6.4% |

Aging populations, regulatory approval |

$200M → $270M |

| Asia-Pacific |

15% |

10.1% |

Healthcare investment, infectious diseases |

$120M → $210M |

| Rest of the World |

10% |

8.2% |

Growing awareness |

$80M → $130M |

How Are Innovations Shaping the Market?

Novel Formulations and Delivery Mechanisms

- Nanoemulsions and liposomal formulations improve bioavailability and reduce dosing frequency.

- Intralesional and sustained-release injections optimize local therapy.

Combination Therapies

- Integration with biologics or immunomodulators enhances treatment efficacy.

Digital and Monitoring Technologies

- Telemedicine and mobile health apps improve adherence and monitoring, indirectly boosting drug consumption.

Competitive Landscape: Who Are the Major Players?

| Company |

Key Products |

Market Share |

Recent Developments |

Geography Focus |

| Boehringer Ingelheim |

Triamcinolone acetonide (various formulations) |

~35% |

Launching new topical formulations |

Global, with focus in US and EU |

| Perrigo |

Generic triamcinolone acetonide |

~15% |

Expanding regional presence |

US, Europe, India |

| Mylan (Now part of Viatris) |

Generic formulations |

~20% |

Cost-containment strategies |

Global |

| Teva |

Injectable and topical |

~10% |

Patent challenges and biosimilar R&D |

North America, Europe |

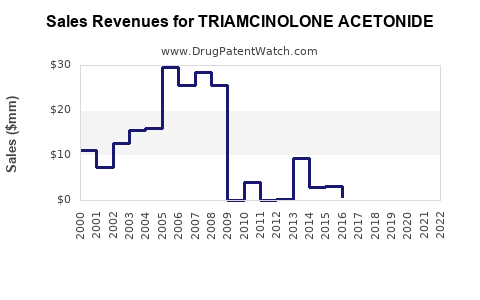

Financial Trajectory: Revenue and Profitability Outlook

Revenue Projections (2023–2028)

| Year |

Estimated Global Revenue (USD) |

Key Drivers |

Notes |

| 2023 |

$800 million |

Stable demand, patent expirations ongoing |

Transition phase |

| 2024 |

$860 million |

Increased generic uptake, new formulations |

Slight growth |

| 2025 |

$940 million |

Growing markets, expanded indications |

Accelerating growth |

| 2026 |

$1.05 billion |

Surge in Asian markets |

Market maturation |

| 2027 |

$1.15 billion |

Technological advances |

Continued innovation |

| 2028 |

$1.2 billion |

Mature market consolidation |

Steady growth |

Profitability Trends

- Gross margins expected to decline from ~60% (pre-patent expiry) to ~45–50% due to increased generic competition.

- R&D investments in new formulations and indications are critical to sustain margins.

How Do Regulatory Policies Impact Market and Financial Outlook?

Regulatory Expectations

- FDA and EMA require extensive safety data**, especially concerning systemic side effects.

- Post-marketing surveillance influences continued approvals and formulations.

Patent and Market Exclusivity

- Patent expirations (e.g., US patent for Kenalog expired in 2018) open markets for generics.

- New formulations and delivery methods may receive new exclusivities.

Reimbursement and Pricing Policies

- Government-mandated price caps (e.g., in the UK via NHS) apply pressure on revenue.

- Policies favoring biosimilars and generics promote affordability but reduce profit margins.

Comparison with Other Corticosteroids

| Drug |

Indications |

Market Size |

Patent/Generic Status |

Major Advantages |

Limitations |

| Triamcinolone acetonide |

Dermatology, allergy, joint injections |

$800M (2022) |

Multiple generics |

Established efficacy |

Patent expiry leading to generic erosion |

| Dexamethasone |

Respiratory, systemic inflammatory |

~$1.2B |

Patents expired |

Wide spectrum |

Greater systemic side effects |

| Betamethasone |

Anti-inflammatory, dermatology |

~$900M |

Patent held in some indications |

Potent |

Side effect profile |

Key Questions Addressed

-

What are the primary revenue sources and growth prospects?

Injunctions on injectable triamcinolone acetonide formulations and expanding dermatology use fuel revenue, with an impressive CAGR of approximately 7.2% until 2028.

-

What factors influence pricing and profitability?

Patent expirations, generic competition, regulatory fluctuations, and reimbursement policies primarily impact revenues and margins.

Key Takeaways

- The global market for triamcinolone acetonide is poised for steady growth, driven by expanding indications, technological innovations, and emerging markets.

- Patent expirations have shifted revenue dynamics, emphasizing the importance of product innovation and formulation differentiation.

- Competition from generics will impose pricing pressures but also opens opportunities for new formulations and combination therapies.

- Regulatory landscapes and reimbursement policies remain critical determinants for market access and profitability.

- Companies investing in advanced drug delivery systems and emerging indications will secure competitive advantages and revenue streams.

Frequently Asked Questions

1. How will patent expirations impact the future market for triamcinolone acetonide?

Patent expirations are likely to lead to a surge in generic entries, reducing prices and profit margins. Companies must innovate with new formulations or indications to sustain revenue growth.

2. What are the emerging therapeutic applications of triamcinolone acetonide?

Beyond traditional uses, research explores its efficacy in localized autoimmune conditions, ophthalmology, and as adjunct therapy in oncology.

3. Which regions represent the most significant growth opportunities?

Asia-Pacific and Latin America demonstrate the highest growth potential due to increasing healthcare access, prevalence of chronic inflammatory diseases, and supportive policies.

4. How do regulatory policies influence the drug's market dynamics?

Regulatory agencies increasingly scrutinize safety profiles, impacting approval timelines and post-market surveillance obligations, which can affect market entry and revenue.

5. What are the key competitive strategies for market players?

Innovating with new delivery methods, expanding indications, forming strategic alliances, and engaging in cost-effective manufacturing are critical to staying competitive.

References

[1] Global Burden of Disease Study, 2021.

[2] Autoimmune Disease Prevalence, WHO, 2022.

[3] Market Research Future, 2023.

[4] U.S. FDA Drug Database, 2022.

[5] European Medicines Agency, 2023.