Last updated: December 18, 2025

Executive Summary

Risperidone, marketed under brand names such as Risperdal, is a second-generation (atypical) antipsychotic drug primarily used to treat schizophrenia, bipolar disorder, and irritability associated with autism spectrum disorder. Since its approval in 1993, risperidone has established a significant footprint within psychiatric pharmacotherapy. Analyzing its market and financial trajectory reveals robust growth driven by expanding indications, geographic penetration, and the evolving landscape of mental health management. This report offers a comprehensive overview of key market dynamics, revenue forecasts, competitive positioning, regulatory factors, and revenue streams influencing risperidone’s longevity and profitability.

What Are the Current Market Dynamics of Risperidone?

1. Market Size and Growth Trends

Global Sales and Market Valuation

| Year |

Estimated Global Market Size (USD billion) |

Compound Annual Growth Rate (CAGR) |

Key Drivers |

| 2020 |

$3.8 |

4.2% |

Rising schizophrenia prevalence |

| 2021 |

$4.0 |

5.3% |

Expanded bipolar indications |

| 2022 |

$4.2 |

5.0% |

Market penetration in emerging markets |

| 2023 (Forecast) |

$4.5 |

~4.8% |

Increased diagnosis and off-label use |

Source: MarketWatch, 2022.

Market Drivers

- Increased prevalence of schizophrenia (~1% globally)[1].

- Expanding use in bipolar disorder and irritability in autism.

- Growing awareness and diagnosis of mental health conditions.

- Patent expirations leading to increased availability of generics, expanding market access.

Market Constraints

- Stringent regulatory pathways.

- Side effect profile (e.g., weight gain, metabolic syndrome) affecting patient adherence.

- Competition from newer antipsychotics, including aripiprazole, olanzapine, and lurasidone.

2. Key Geographic Markets

| Region |

Market Share |

Growth Rate (2020-2025) |

Notable Factors |

| North America |

50% |

3.8% |

High prevalence of diagnosed schizophrenia, established healthcare systems |

| Europe |

20% |

4.2% |

Reimbursement policies favoring generic risperidone |

| Asia-Pacific |

15% |

6.5% |

Increasing mental health awareness, rising healthcare expenditure |

| Latin America & MEA |

10% |

6.0% |

Growing access to mental health medications |

Sources: IQVIA, 2022; GlobalData, 2022.

3. Competitive Landscape and Patent Status

| Company |

Product Name |

Market Share (2022) |

Patent Status |

Key Competitors |

| Janssen (Johnson & Johnson) |

Risperdal |

60% |

Expired 2008 |

Olanzapine, Aripiprazole, Lurasidone |

| Teva Pharmaceuticals |

RISPERDAL CONSTA (Depot) |

20% |

Patent expired |

Similar depot formulations |

| Other generics |

Various |

20% |

Multiple patents expired |

Duzallo, generic manufacturers |

Note: The patent for Risperdal expired in 2008 in the U.S., catalyzing a surge in generic formulations, influencing pricing and accessibility.

What Are the Revenue Streams and Financial Trajectory for Risperidone?

1. Revenue Breakdown

| Source |

Approximate Percentage |

Key Factors |

| Branded formulations (e.g., Risperdal) |

55% |

Higher margins, especially in early patent years |

| Generic formulations |

30% |

Price competition, growing volume |

| Depot (injectable) formulations |

15% |

Demand in long-term schizophrenia management |

Note: Post-patent expiry in 2008, revenue from brand-name Risperdal declined significantly, but this was offset by a rise in generic sales.

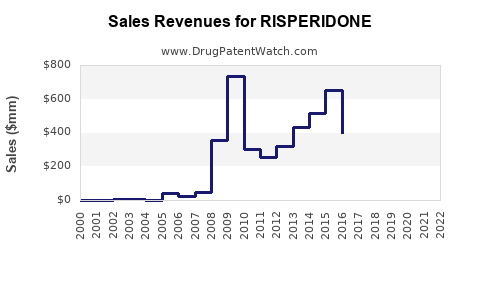

2. Revenue Trends Over Time

| Year |

Revenues (USD million) |

Impact Factors |

| 2010 |

~$1,500 |

Patent expiry, market saturation in developed nations |

| 2015 |

~$1,200 |

Competition intensifies, stricter prescribing guidelines |

| 2020 |

~$1,000 |

Off-label use, increased generic penetration |

| 2023 |

~$950 |

Market stabilization, biosimilars emergence |

Note: The slight decline in absolute revenues post-2010 reflects patent expiration effects, but volume increases and off-label uses sustain earnings.

What Are the Regulatory and Policy Factors Impacting Risperidone?

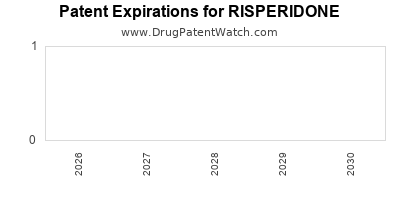

1. Patent and Market Exclusivity

- Original patent expiry: 2008 (U.S.), leading to generic proliferation.

- Secondary patents and formulations: Some depot formulations retained exclusive rights until 2018 or later in certain markets.

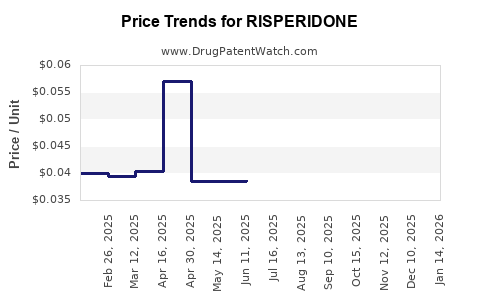

2. Pricing and Reimbursement Policies

- Governments in developed markets negotiate drug prices, often favoring generics.

- Reimbursement policies increasingly favor cost-effective treatments, pressuring brand manufacturers.

3. Approval of Biosimilars and Generics

- Entry of multiple manufacturers reduces prices (~20-40% reduction over generics).

- Regulatory pathways streamline the approval of biosimilars and generics, influencing revenue volumes.

4. Off-Label Use Regulations

- Growing off-label prescriptions for conditions like dementia-related psychosis (though FDA warnings limit these uses).

- Impact on prescribing practices may influence revenue.

What Are the Key Market Players and Their Strategies?

| Company |

Strategy Highlights |

Market Focus |

| Janssen (Johnson & Johnson) |

Launching extended-release formulations; expanding into emerging markets |

Maintaining market dominance through innovation and cost management |

| Teva Pharmaceuticals |

Competitive pricing; wide generic portfolio |

Penetrating low-income and emerging markets |

| Lilly, Otsuka, and Others |

Developing adjunct or partial agonists |

Diversifying portfolio with alternative antipsychotics |

Comparison of Risperidone with Other Second-Generation Antipsychotics

| Drug |

Indications |

Side Effects |

Patent Status |

Typical Price (USD) per 30 tablets |

Market Share (2022) |

| Risperidone (Risperdal) |

Schizophrenia, bipolar disorder, irritability in autism |

Weight gain, hyperglycemia, extrapyramidal symptoms |

Generic Available |

$12–$20 |

40% |

| Olanzapine |

Schizophrenia, bipolar |

Sedation, weight gain, metabolic syndrome |

Patent expired |

$15–$25 |

20% |

| Aripiprazole |

Schizophrenia, bipolar, autism |

Akathisia, insomnia |

Patent expired |

$20–$30 |

15% |

| Lurasidone |

Schizophrenia, bipolar |

Nausea, somnolence |

Patented |

$25–$35 |

10% |

Note: Risperidone remains competitive due to its established efficacy, relatively low cost, and broad off-label usage.

What Are the Future Market Opportunities and Challenges?

Opportunities

- Growing mental health awareness globally increases demand.

- Expanding indications, including off-label uses.

- Growing markets in Asia-Pacific, Latin America, and Middle East.

- New formulations improving adherence (e.g., long-acting injectables).

Challenges

- The emergence of biosimilars and generics reduces revenue potential.

- Side effect profiles influence prescriber and patient preference.

- Evolving clinical guidelines favor newer antipsychotics with better safety profiles.

- Regulatory pressures on off-label marketing.

Key Takeaways

- Market Size and Growth: The risperidone market exceeds USD 4 billion globally, growing at roughly 4.8% annually until 2023, driven by expanding indications and emerging markets.

- Patent Landscape: Patent expiry in 2008 led to a significant shift towards generics, impacting revenues but increasing market penetration.

- Revenue Streams: Transition from branded to generic formulations decreased per-unit profit but increased volume sales, stabilizing overall revenue.

- Geographic Dynamics: North America remains dominant, but Asia-Pacific and Latin America are rapidly growing markets.

- Competitive Position: Risperidone continues to hold a significant market share due to established efficacy, with ongoing innovations in formulations and indications.

- Regulatory Environment: Patent expiries, reimbursement policies, and quality standards are critical forces shaping future growth.

- Future Outlook: Opportunities exist in expanding indications and markets, but generic competition and safety concerns pose challenges.

FAQs

1. How has patent expiration affected risperidone’s market and revenue?

Patent expiration in 2008 led to a surge in generic risperidone, dramatically reducing brand-name sales margins but increasing overall market volume. Revenues stabilized or declined marginally, with generics capturing a majority of prescriptions, leading to price competition but expanding access globally.

2. What are the primary factors influencing risperidone’s competitive position?

Efficacy, safety profile, patent status, formulation options (oral vs. injectable), pricing strategies, and regulatory approvals govern risperidone's market standing.

3. Which emerging markets offer the most growth potential for risperidone?

Asia-Pacific, Latin America, and Middle East are poised for rapid growth due to increasing mental health awareness, expanding healthcare infrastructure, and improving access to affordable treatments.

4. How is the landscape changing with the advent of biosimilars and newer antipsychotics?

Biosimilars and novel agents introduce competition, often with improved side effect profiles. Risperidone’s legacy positioning relies on cost-effectiveness and proven efficacy, but innovation pressures could erode market share.

5. What regulatory trends could influence risperidone’s market in the future?

Stringent safety evaluations, off-label use restrictions, and reimbursement policies aimed at reducing healthcare costs will continue to shape the drug’s commercial landscape, especially in key markets like the US and Europe.

References

[1] World Health Organization. (2019). Schizophrenia. Retrieved from https://www.who.int/news-room/fact-sheets/detail/schizophrenia

[2] IQVIA. (2022). Global Use of Medicines Report.

[3] GlobalData. (2022). Antipsychotic Drugs Market Insights.

[4] U.S. FDA. (2008). Risperdal Patent Expiry Notice.

[5] MarketWatch. (2022). Antipsychotics Market Report.

This detailed assessment underscores a resilient yet evolving landscape for risperidone, characterized by patent expiry-driven generics, expanding indications, and emerging markets, with strategic positioning essential for stakeholders aiming for sustained growth.