Last updated: July 27, 2025

Introduction

Risedronate sodium, a bisphosphonate derivative, has been a cornerstone in the management of osteoporosis and other bone-resorptive disorders since its approval. As a potent inhibitor of osteoclast-mediated bone resorption, risedronate has established a significant presence in the pharmaceutical landscape. With evolving demographic trends, regulatory landscapes, and technological innovations, understanding the market dynamics and financial trajectory of risedronate sodium is imperative for stakeholders aiming to capitalize on growth opportunities and mitigate risks.

Pharmaceutical Market Landscape for Risedronate Sodium

Therapeutic Area and Clinical Demand

Risedronate targets osteoporosis—a condition characterized by decreased bone density and increased fracture risk—primarily impacting postmenopausal women, older adults, and certain patient populations with corticosteroid-induced osteoporosis. The global prevalence of osteoporosis is projected to reach 1.2 billion by 2050, spurring sustained demand for effective therapies. Currently, risedronate accounts for a significant share within bisphosphonate therapeutics, with therapies favored for their efficacy and safety profiles.

Regulatory Environment and Approvals

Risedronate received notable regulatory approvals across major markets, including the FDA (1998), EMA (1998), and other national agencies, for indications such as postmenopausal osteoporosis, Paget’s disease of bone, and corticosteroid-induced osteoporosis. Post-approval, regulatory bodies have continued to scrutinize safety profiles, especially concerning rare adverse effects like osteonecrosis of the jaw and atypical femoral fractures, influencing prescribing behaviors and patent strategies.

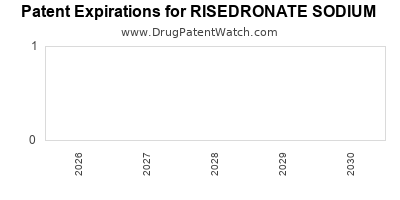

Patent Expiry and Generic Competition

A critical driver impacting market dynamics is the patent expiration of several risedronate formulations, notably initial formulations in the early 2010s. Patent cliffs have led to increasing generic entry, exerting downward pressure on prices and impacting revenue streams for original developers. The proliferation of generics has democratized access, expanding the patient base but compressing profit margins for innovators.

Market Drivers

Growing Demographic Burden

The aging global population remains the dominant catalyst for sustained demand. According to WHO, the population aged 60 and above is projected to double by 2050, amplifying osteoporosis prevalence and related fracture risks, thereby fueling prescription rates of risedronate.

Advancements in Formulation and Delivery

Innovations such as weekly versus daily dosing regimens, intravenous options, and improved bioavailability have enhanced patient adherence and broadened market reach. The development of combination therapies further emphasizes the drug's relevance.

Increased Awareness and Screening

Enhanced osteoporosis screening programs and public health initiatives have increased early diagnosis rates, translating into higher prescription volumes. Furthermore, growing awareness about fracture prevention elevates demand for maintenance therapies like risedronate.

Market Challenges

Safety and Side Effect Profile

Concerns regarding long-term bisphosphonate safety influence prescribing patterns. Regulatory warnings and patient education efforts demand heightened pharmacovigilance, potentially limiting widespread adoption.

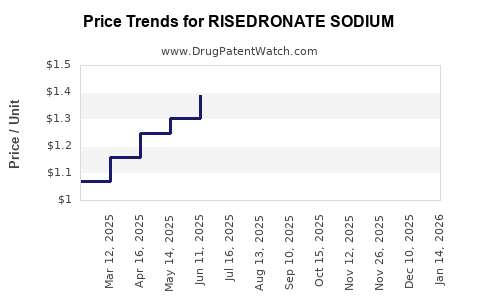

Pricing Pressures and Reimbursement

Universal pressure to curb healthcare costs impacts revenue, especially in markets with stringent reimbursement policies. The advent of generics has intensified price competition, necessitating strategic positioning.

Alternatives and Shift Toward Novel Therapies

The advent of newer therapeutic classes—such as anabolic agents (e.g., teriparatide) and monoclonal antibodies (denosumab)—has diversified treatment options. These alternatives, offering differing mechanisms and dosing advantages, pose competitive threats to risedronate.

Financial Trajectory and Market Forecast

Historical Revenue Trends

Historically, risedronate has achieved peak sales in its initial years post-approval, driven by extensive clinical use. The patent lifecycle’s progression saw a shift towards generic competition, resulting in a decline in brand-specific revenues but an expansion in overall market size due to increased accessibility.

Current Market Valuation

As of 2022, the global bisphosphonate market—dominated by risedronate, alendronate, and ibandronate—was valued at approximately USD 4 billion, with risedronate accounting for an estimated 35–40% of this segment. The segment is expected to grow at a CAGR of 3–5% through 2028, driven mainly by emerging markets and aging populations.

Future Growth Drivers

Emerging markets present significant room for growth, supported by increasing osteoporosis awareness and improving healthcare infrastructure. Additionally, extended indications, such as for Paget’s disease, and combination regimens will bolster sales.

Impact of Biosimilars and Generics

The increasing penetration of biosimilar and generic versions from 2014 onward influences overall market share and revenue potential. While reducing prices, these entrants push incumbent companies toward innovation, biosimilar development, and strategic alliances to sustain profitability.

Investment Trends and Pharma Strategies

Pharmaceutical companies are exploring lifecycle management opportunities through reformulations, new indications, and combination strategies to extend the commercial viability of risedronate. Investment in pharmacovigilance, targeted marketing, and clinical research aims to mitigate safety concerns and differentiate offerings.

Regulatory and Market Outlook

The outlook for risedronate’s market trajectory remains cautiously optimistic. The aging demographic sustains natural demand, while advancements in drug delivery and formulations expand its applicability. Nevertheless, safety concerns, patent expirations, and competitive pressures necessitate strategic innovation. Companies that invest in clinical research, diversify portfolios, and adapt to evolving regulatory landscapes will position favorably for sustained revenue streams.

Key Takeaways

- Demographics Drive Demand: Global aging populations are the primary long-term growth driver, necessitating ongoing access to effective osteoporosis therapies.

- Patent Expiry Amplifies Competition: Generic and biosimilar entries following patent expirations have compressed profit margins but expanded market access and volume.

- Innovation is Critical: Advances in formulations, combination therapies, and indications are essential to maintain market relevance.

- Safety Profile Management: Vigilant pharmacovigilance and transparent communication are vital amid safety concerns affecting prescribing behaviors.

- Emerging Markets Present Opportunities: Rapid healthcare infrastructure development and increased screening facilitate growth prospects in Asia-Pacific, Latin America, and Africa.

FAQs

1. How has patent expiry affected risedronate sodium’s market sales?

Patent expirations led to the entry of generic competitors, significantly reducing prices and revenue for brand-name formulations. However, increased accessibility broadened the patient base, partially offsetting revenue declines.

2. What are the key safety concerns influencing risedronate’s market trajectory?

Risks such as osteonecrosis of the jaw and atypical femoral fractures have prompted regulatory warnings, impacting prescriber confidence and patient adherence.

3. Which emerging therapies threaten risedronate’s market share?

Agents like denosumab (a monoclonal antibody) and anabolic drugs such as teriparatide offer alternative mechanisms, often with simplified dosing, thus challenging bisphosphonate dominance.

4. How are developers extending risedronate’s lifecycle?

Through new formulations (e.g., IV options), expanded indications, combination therapies, and exploring biosimilar development.

5. What growth strategies should pharmaceutical companies consider?

Focusing on emerging markets, investing in clinical research to demonstrate safety, and developing innovative formulations to improve adherence.

References

[1] WHO. Osteoporosis Fact Sheet. World Health Organization, 2021.

[2] MarketLine. Global Osteoporosis Treatment Market Report, 2022.

[3] U.S. Food and Drug Administration. Risedronate Sodium Approvals and Safety Warnings, 1998–2022.

[4] IMS Health. Pharmacovigilance and Safety Concerns in Bisphosphonates, 2021.

[5] Grand View Research. Bisphosphonate Drugs Market Size & Trends, 2022–2028.