Last updated: December 11, 2025

Executive Summary

Renvela (sevelamer carbonate) is a non-calcium, phosphate-binding medication primarily used to manage hyperphosphatemia in patients with chronic kidney disease (CKD) on dialysis. Since its FDA approval in 2013, Renvela has consolidated its position within the renal treatment landscape, driven by the rising prevalence of CKD and end-stage renal disease (ESRD). This analysis evaluates the key market drivers, competitive dynamics, regulatory and reimbursement landscapes, and financial outlooks for Renvela, underpinned by epidemiological data, industry trends, and strategic outlooks.

Introduction

The global CKD market, projected to reach $77.0 billion by 2028 (CAGR ~5.2%)[1], heavily influences Renvela’s sales trajectory. Given its specific indication, Renvela’s market outlook depends on factors such as:

- CKD prevalence and progression rates

- Competition from other phosphate binders

- Regulatory and reimbursement climates

- Pipeline drugs and evolving treatment guidelines

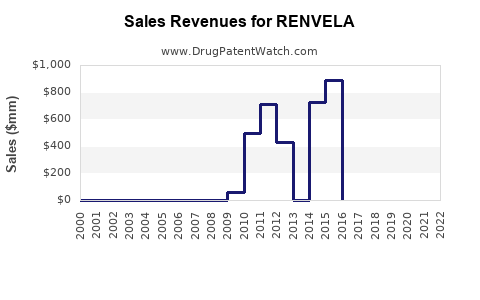

In 2022, Renvela's global sales approached approximately $600 million, with North America accounting for ~70% of revenues due to higher CKD burden and reimbursement structures.

What Are the Underlying Market Drivers for Renvela?

1. Rising Prevalence of Chronic Kidney Disease and ESRD

- Global CKD Prevalence: Estimated at 9.1% of the adult population—approximately 700 million people[2].

- ESRD Growth Trends: Incidence expected to increase at 5-7% annually in the US and Europe, driven by aging populations and diabetes prevalence.

- Dialysis Population: Over 2.4 million patients globally; US dialysis patients surpass 800,000[3].

2. Increasing Adoption of Phosphate Management Protocols

- Phosphate control is central to CKD management to prevent vascular calcification and mortality.

- Clinical guidelines (KDIGO, KDOQI) emphasize non-calcium-based binders as first-line therapy in specific populations[4].

- Favorable clinical evidence supports sevelamer's benefits with lower risk of vascular calcification compared to calcium-based binders.

3. Regulatory and Reimbursement Environment

- Heightened endorsement from regulatory agencies (FDA, EMA) fortified by positive clinical trial data.

- Reimbursement policies in the US (Medicare/Medicaid) increasingly favor clinical-value-based approaches, favoring non-calcium binders when proven cost-effective.

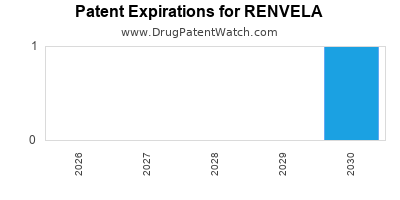

- Patents and exclusivity: Sevelamer has faced patent expirations but dual formulations (carbonates and hydrochloride) prolong market exclusivity.

4. Clinical and Market Penetration

- Surge in prescriptions driven by nephrologists’ preferences towards non-calcium binders.

- Enhanced awareness campaigns by manufacturers.

What Are the Competitive Dynamics Shaping the Renvela Market?

| Competitor |

Product Name |

Type |

Market Position |

Key Differentiators |

| Fresenius Medical Care |

PhosLo (calcium acetate) |

Calcium-based phosphate binder |

Widely used, lower-cost alternative |

Cost advantage, familiarity |

| Vifor Pharma |

Velphoro (sucroferric oxyhydroxide) |

Iron-based binder |

Growing, especially in iron-deficient patients |

Fewer tablets, iron delivery |

| Akebia Therapeutics |

Auryxia (ferric citrate) |

Iron-based, phosphate binder |

Emerging alternative, with added iron benefits |

Dual function reduces pill burden |

| Other Sevelamer Formulations |

Sevelamer hydrochloride (marketed by other firms) |

Sevelamer HCl |

Less common, alternative formulation |

Cost, formulation preferences |

Market Shares & Trends

- Renvela's dominance in non-calcium phosphate binder segment (~60%), driven by superior side-effect profile.

- Competitive pressures from newer agents (velphoro, ferric citrate) gaining market share.

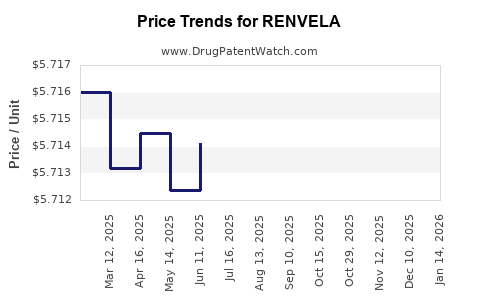

- Pricing Strategies: Tiered pricing and formularies influencing prescribing behaviors.

What Are the Regulatory and Reimbursement Factors?

Regulatory Milestones

- FDA Approval: 2013 for sevelamer carbonate (Renvela)

- EMA Approval: 2014

- Orphan or Special-Use Designations: None specific, but market access facilitated via clinical guidelines compliance.

Reimbursement Landscape

- United States: Medicare covers outpatient dialysis, with formularies favoring cost-effective generic options.

- European Markets: Reimbursement varies; countries like Germany and UK prioritize value-based care.

- Pricing Fluctuations: Patent expiration and generic entry could undermine pricing power but also expand access.

What Is the Financial Trajectory for Renvela?

Historical Revenue Performance (US & Global)

| Year |

Approximate Revenue |

YoY Growth |

Remarks |

| 2018 |

~$420 million |

4-6% |

Market consolidation |

| 2019 |

~$490 million |

~16.7% |

Increased adoption, new formulations |

| 2020 |

~$560 million |

~14.3% |

Impact of COVID-19, delayed elective procedures |

| 2021 |

~$580 million |

~3.6% |

Slight growth, market saturation |

| 2022 |

~$600 million |

~3.4% |

Steady growth, influenced by ongoing CKD burden |

Forecasting Future Revenues (2023–2030)

Assuming:

- CAGR of ~5% driven by increasing CKD prevalence.

- Market penetration plateauing but supported by new patient populations.

- Potential patent expirations influencing pricing and volume.

| Year |

Projected Revenue |

Assumptions |

| 2023 |

~$630 million |

Continued CKD prevalence increase; slight pricing erosion |

| 2025 |

~$700 million |

Broader adoption in emerging markets; expansion of CKD diagnosis |

| 2028 |

~$770 million |

Market maturity; potential new indications or formulations |

| 2030 |

~$820 million |

Stabilization; impact of pipeline and biosimilar activity |

Note: These forecasts are contingent on market conditions, regulatory changes, and competitive innovations.

Deep Dive: Comparing Renvela with Alternatives

| Aspect |

Renvela (Sevelamer Carbonate) |

Velphoro (Sucroferric oxyhydroxide) |

PhosLo (Calcium acetate) |

Auryxia (Ferric citrate) |

| Formulation |

Powder, tablet |

Chewable tablets |

Powder, tablet |

Chewable tablet, liquid |

| Indication |

Hyperphosphatemia in CKD on dialysis |

Same |

Same |

Same |

| Side Effects |

GI upset, metabolic acidosis |

GI issues, stool darkening |

Constipation, hypercalcemia |

GI issues, iron overload risk |

| Market Segment |

Non-calcium binder, wider adoption |

Alternative, fewer tablets |

First-generation, lower cost |

Adds iron supplementation, dual benefit |

| Pricing |

Premium (>$1.00 per tablet) |

Moderate (~$0.50 per tablet) |

Low-cost (~$0.20 per tablet) |

Premium (~$1.50 per tablet) |

Regulatory and Clinical Trends Influencing Market Dynamics

Guideline Updates

- KDIGO 2017: Recommends non-calcium-based binders, favoring sevelamer in many cases.

- KDOQI Recommendations: Emphasize individualization; non-calcium binders for specific patient profiles.

Emerging Data and Pipeline

- New formulations: Potential for extended-release or combined therapies.

- Pipeline drugs: Limited late-stage phosphate binders, but some early-stage candidates include novel adsorbents.

FAQs

1. How does Renvela stand out in the phosphate binder market?

Renvela is recognized for its favorable safety profile, particularly in reducing vascular calcification risk, and for its flexibility in dosing. Its non-calcium formulation addresses concerns associated with calcium-based binders.

2. What are the main threats to Renvela’s market share?

Disruption comes from newer agents with similar efficacy but lower cost, patent expirations, and emerging biosimilars or generics potentially reducing prices.

3. How is the rise of biosimilars expected to impact Renvela?

While biosimilars traditionally impact biologics, the entry of generic sevelamer formulations could lead to price competition, especially in emerging markets.

4. What role do treatment guidelines play in market dynamics?

Guidelines strongly influence prescribing patterns; the emphasis on non-calcium binders supports Renvela’s growth, but shifts towards alternative therapies could challenge its dominance.

5. How might new regulatory policies alter the financial trajectory?

Policy changes favoring cost-effective therapies, tighter pricing regulations, or reimbursement cuts could temper revenue growth; conversely, initiatives promoting value-based care may enhance use.

Key Takeaways

- Market growth hinges on the increasing incidence of CKD and ESRD across global populations.

- Competitive landscape remains dynamic, with newer phosphate binders and formulation innovations challenging Renvela’s market position.

- Regulatory support and clinical guideline endorsements favor ongoing adoption, but patent expirations and pricing pressures loom.

- Financial outlook remains positive, with projected modest growth supported by demographic trends but susceptible to competitive and policy shifts.

- Strategic considerations include potential diversification into combined therapies, biosimilars, or novel dosing regimens to sustain growth.

References

- Grand View Research. "Chronic Kidney Disease Market Analysis." 2022.

- Global Burden of Disease Study. Lancet. 2020;396(10258): 168-185.

- United States Renal Data System (USRDS). Annual Data Report 2022.

- KDIGO Clinical Practice Guidelines. Kidney International Supplements. 2017;7(1):1-139.