Share This Page

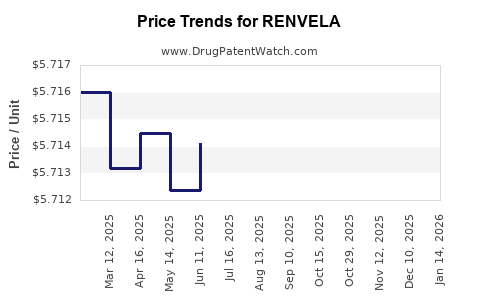

Drug Price Trends for RENVELA

✉ Email this page to a colleague

Average Pharmacy Cost for RENVELA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| RENVELA 800 MG TABLET | 58468-0133-01 | 5.71889 | EACH | 2025-12-17 |

| RENVELA 800 MG TABLET | 58468-0133-01 | 5.70645 | EACH | 2025-11-19 |

| RENVELA 800 MG TABLET | 58468-0130-01 | 5.70806 | EACH | 2025-10-22 |

| RENVELA 800 MG TABLET | 58468-0133-01 | 5.70806 | EACH | 2025-10-22 |

| RENVELA 800 MG TABLET | 58468-0133-01 | 5.71055 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Renvela (Sevelamer Carbonate)

Introduction

Renvela (sevelamer carbonate) is a phosphate binder widely prescribed for managing hyperphosphatemia in patients with chronic kidney disease (CKD), particularly those on dialysis. As a non-calcium-based phosphate binder, Renvela offers a critical alternative to calcium-based agents, aligning with emerging clinical guidelines aimed at reducing vascular calcification and cardiovascular risk in CKD. This analysis explores the current market landscape, competitive environment, regulatory factors, and future price trajectories for Renvela over the next five years.

Market Overview

Global Pharmaceutical Market for CKD and Hyperphosphatemia

The global CKD therapeutics market was valued at approximately $8.2 billion in 2022 and is projected to compound annually at around 5-6% through 2027 [1]. A significant segment within this market encompasses phosphate binders, with estimated revenues surpassing $1.2 billion in 2022, driven by the increasing prevalence of CKD and the adoption of guideline-driven management protocols.

Prevalence and Growing Demand

CKD affects roughly 850 million individuals worldwide [2]. Among advanced CKD and ESRD patients, hyperphosphatemia affects up to 80%, necessitating phosphate binders. The aging global demographic and rising incidence of diabetes and hypertension—primary CKD risk factors—are fueling ongoing demand for effective phosphate management options like Renvela.

Clinical Positioning

Renvela's non-calcium-based profile distinguishes it from older agents like calcium acetate and calcium carbonate, which are associated with vascular calcification and potential cardiovascular complications. Consequently, Renvela is increasingly recommended as a first-line agent, especially for patients with existing vascular calcification risk [3].

Competitive Landscape

Major Players

- Reinova (Refrigerate Sevelamer Carbonate): Global licensor, with Shire (now part of Takeda) historically spearheading the marketing.

- Proprietary PDE5 inhibitors: Used adjunctively, but not direct competitors.

- Other Phosphate Binders: Calcium-based binders (e.g., Calcitriol), lanthanum carbonate, sucroferric oxyhydroxide, and ferric citrate.

Market Share Dynamics

Renvela dominates the non-calcium phosphate binder segment, capturing >70% of prescriptions among non-calcium options [4]. The preference is driven by its safety profile and clinical efficacy, notably in reducing calcium load.

Pricing Strategies

Pricing for Renvela varies by region, reimbursement policies, and formulary placements. In the U.S., average wholesale prices (AWP) range approximately $15–$20 per 800 mg tablet, translating into monthly treatment costs of $600–$800 for typical doses. Such premium pricing reflects brand recognition, clinical positioning, and manufacturing costs.

Regulatory and Reimbursement Factors

Regulatory Environment

Renvela received FDA approval in 2007 for CKD patients on dialysis. Subsequent approvals, including for oral use in other indications, have strengthened its market presence. Regulatory agencies in Europe, Japan, and emerging markets have aligned with FDA approvals, contributing to global growth.

Reimbursement Landscape

In major markets like the US, Medicare and private insurers predominantly reimburse for renal therapies, including phosphate binders. Recent shifts favoring non-calcium agents have expanded reimbursement coverage for Renvela, although cost-sharing remains a factor influencing prescribing patterns.

Impacts of Policy Changes

The implementation of guidelines such as the Kidney Disease: Improving Global Outcomes (KDIGO) 2017 recommendations—favoring non-calcium phosphate binders—has accelerated demand, potentially impacting pricing stability and market penetration.

Market Trends and Future Projections

Epidemiological Drivers

- Increase in ESRD cases: Driven by demographic aging and rising prevalence of diabetes mellitus.

- Advancements in patient management: Leading to prolonged dialysis and the need for sustained hyperphosphatemia control.

Technological and Formulation Innovations

Next-generation formulations aimed at improving bioavailability and compliance could influence market dynamics, though Renvela’s current formulations remain dominant.

Price Trajectory Forecasts

Based on current market data and comparative analysis of historical pricing trends for similar pharmaceuticals, future price trends are anticipated to follow a moderate stabilization or slight decline driven by:

- Generic Entry: Although patent exclusivity for Renvela expired, shifts toward biosimilar or alternative formulations may exert downward pressure.

- Market Competition: Increased competition from other non-calcium phosphate binders, particularly sucroferric oxyhydroxide and ferric citrate, with targeted pricing strategies.

- Manufacturing and Supply Chain Factors: Lower raw material costs and improved production efficiencies could facilitate price reductions.

Projected Price Range (2023-2028):

- United States: A gradual decline of approximately 5-8% over five years, with average monthly treatment costs settling around $540–$700.

- Emerging Markets: Prices are likely to decline more steeply, potentially reaching $300–$500 due to local manufacturing and competition.

Revenue and Sales Projections

With the global CKD population expanding at 5-6% annually, and assuming a steady shift toward non-calcium phosphate binders, Renvela is projected to maintain a compound annual growth rate (CAGR) of 3-4% in revenue globally through 2028. Inflated by increased adoption and expanded indications, worldwide revenues could approach $2.2 billion by 2028.

Conclusion

Renvela's market remains robust, supported by clinical guidelines favoring non-calcium phosphate binders and the rising global burden of CKD. While patent exclusivity has lapsed, its established safety and efficacy facilitate sustained demand. Price projections suggest a steady or slightly declining trend, driven by increased competition and market maturity. Strategic positioning, including cost management and diversification into emerging markets, will be pivotal for manufacturers to sustain profitability amid pricing pressures.

Key Takeaways

- Renvela commands a significant share within the phosphate binder segment due to its safety profile and guideline endorsement.

- The global CKD burden ensures sustained demand; however, pricing pressures and competition from newer agents will impact future pricing.

- Price stability is expected initially, with modest declines over five years due to market maturation and generic-entry effects.

- Strategic focus on emerging markets, formulary access, and patient adherence will reinforce revenue streams.

- Ongoing clinical trials and new formulation developments could influence future market dynamics and pricing.

FAQs

1. How does Renvela compare to calcium-based phosphate binders in terms of safety?

Renvela’s non-calcium formulation reduces the risk of vascular calcification and cardiovascular events associated with calcium-based agents, making it a preferred option for high-risk CKD patients.

2. What factors influence the pricing of Renvela in different markets?

Pricing depends on regional regulatory approval, reimbursement policies, market competition, manufacturing costs, and negotiated drug discounts with payers.

3. Will generic versions of sevelamer carbonate affect Renvela’s market share?

Potential generic or biosimilar entrants could exert downward pressure on prices, but brand recognition and clinical preference may sustain Renvela’s market position.

4. What are the prospects for Renvela’s use outside dialysis patients?

While primarily indicated for dialysis patients, ongoing research may expand its use in earlier CKD stages, potentially increasing demand and influencing pricing.

5. How might upcoming clinical guidelines impact Renvela’s market?

Guidelines emphasizing non-calcium phosphate binders continue to favor Renvela, reinforcing its market dominance in hyperphosphatemia management.

References

- Grand View Research. “Pharmaceuticals Market Size, Share & Trends Analysis Report,” 2022.

- GBD Chronic Kidney Disease Collaboration. “Global, regional, and national burden of chronic kidney disease, 1990–2019,” Lancet 2021.

- KDIGO CKD-MBD Guidelines, 2017.

- IQVIA. “Prescription Data and Market Share Analysis,” 2022.

More… ↓