Last updated: July 27, 2025

Introduction

Sevelamer carbonate is a non-calcium, phosphate-binding agent designed to manage hyperphosphatemia in patients with chronic kidney disease (CKD), particularly those on dialysis. Its unique mechanism—binding phosphate in the gastrointestinal tract—addresses a significant clinical challenge associated with CKD. As the global burden of CKD surges, the market for phosphate binders like sevelamer carbonate is poised for growth, influenced by evolving regulatory landscapes, competitive dynamics, and technological innovations. Understanding these factors is critical for stakeholders seeking to evaluate investment prospects, strategic positioning, or R&D priorities.

Market Overview and Size

The global phosphate binder market was valued at approximately USD 1.2 billion in 2022, with projections indicating a compound annual growth rate (CAGR) of around 4-6% through 2027 [1]. Among phosphate binders, sevelamer carbonate holds a substantial share, primarily due to its favorable safety profile compared to calcium-based alternatives, such as calcium acetate and calcium carbonate, which carry risks of vascular calcification and hypercalcemia.

Diverse geographic regions influence market dynamics significantly. North America leads segments owing to the high prevalence of CKD and robust healthcare infrastructure; Asia-Pacific showcases rapid growth driven by increasing CKD incidence and expanding healthcare access, especially in China and India.

Regulatory Landscape and Market Drivers

Growing CKD Prevalence

Global CKD prevalence is estimated at 8-16%, with approximately 850 million affected individuals worldwide [2]. The rising incidence underscores the demand for effective phosphate management—fueling the adoption of sevelamer carbonate.

Clinical Preference and Safety Profile

Sevelamer carbonate's demonstrated ability to lower serum phosphate without the calcium-associated risks gives it an edge over calcium-based agents. Multiple clinical trials showcase its additional benefits, including lowering LDL cholesterol and improving endothelial function, which incentivizes physicians to prefer this agent, thus supporting sustained demand.

Regulatory Approvals and Reimbursement Policies

Regulatory approvals in key markets such as the U.S. (by FDA), European Union (by EMA), and Japan bolster market access. Reimbursement policies are increasingly favorable, particularly in mature markets, facilitating broader patient access.

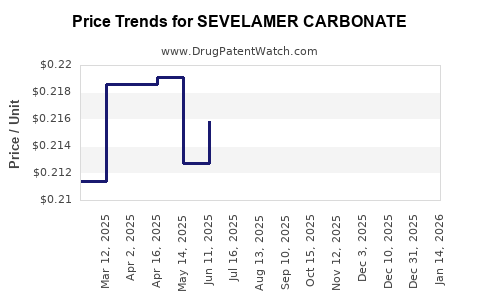

Patent Expiry and Generic Competition

Sevelamer carbonate’s original patents have begun to expire or face challenges, opening the door for generic manufacturing. While generics reduce prices and potentially expand market reach, they also compress profit margins for brand holders, introducing volatility into the financial trajectory.

Technological and Formulation Innovations

Emerging formulations—such as extended-release variants and combination therapies—aim to enhance patient adherence and outcomes. Innovations in drug delivery and bioavailability can influence market share shifts among competitors.

Competitive Landscape

Main industry players include Genzyme (a Sanofi subsidiary), Keryx Biopharmaceuticals, Vifor Pharma, and emerging generic manufacturers. Sanofi’s sevelamer hydrochloride was the first marketed, followed by Vifor with formulations of sevelamer carbonate. The competition centers on efficacy, safety profile, pricing, and patient compliance.

Market entry barriers are moderate, primarily due to regulatory requirements and manufacturing complexities. Strategic collaborations, licensing agreements, and patent litigations shape the competitive environment.

Financial Trends and Revenue Projections

Revenue Streams

Commercial revenue derives from product sales—driven by prescription volumes, pricing, and reimbursement levels. In the U.S., concurrent increases in dialysis patients correlate with higher sales. Licensing and royalty arrangements from generic manufacturers also contribute.

Revenue Trends

Between 2018 and 2022, leading brands like Renvela (Sanofi) reported steady growth, with revenues exceeding USD 500 million annually [3]. However, impending patent expirations threaten future revenue stability. Market analysts forecast a potential 10-15% decline in branded revenues post-patent expiry unless differentiated formulations or new indications emerge.

Cost Dynamics

Manufacturing costs are influenced by raw material prices, compliance with Good Manufacturing Practices (GMP), and supply chain efficiency. Cost reductions via process optimization could improve margins, especially for generic entrants.

Investment and R&D Outlook

R&D investments are focused on improving drug formulations, expanding indications, and exploring combined therapies. Investment in pipeline products targeting earlier CKD stages or adjunct therapies may diversify revenue streams.

Challenges Impacting Financial Trajectory

- Patent Cliff Risks: The expiration of key patents around 2025-2026 threatens market share and profit margins.

- Pricing Pressures: Payers’ push for cost containment will likely drive price reductions, especially for generics.

- Market Penetration in Emerging Economies: Payment and regulatory barriers impede rapid penetration in developing markets.

- Clinical Adoption Barriers: Variations in physician prescribing behaviors and adherence issues influence real-world effectiveness and sales.

Future Market Trajectory

Short-term Outlook (2023–2025)

Steady growth continues, driven by rising CKD prevalence and high drug adherence in developed markets. Patent expirations around 2025-2026 introduce price competition, potentially flattening revenue growth.

Medium to Long-term Outlook (2026 and beyond)

Innovative formulations and expanded indications (such as in early CKD or post-transplant hyperphosphatemia) could mitigate patent cliff impacts. Market consolidation, strategic collaborations, and pipeline diversification will influence revenue stability.

Biopharmaceutical and Digital Health Innovations

Integration of digital health tools to improve adherence and monitoring could enhance treatment outcomes, translating into sustained or increased demand. Additionally, research into alternative phosphate management therapies—like enzyme-based binders or prevention strategies—may reshape the competitive landscape.

Conclusion

Sevelamer carbonate's market is characterized by a macro trend of increasing CKD burden, shifting clinician preferences towards safer phosphate binders, and evolving regulatory and economic factors. While patent expiries and pricing pressures pose challenges, ongoing innovation and expanding clinical applications promise opportunities for sustained financial growth. Stakeholders must monitor regulatory developments, patent statuses, and technological advancements to adapt strategies effectively.

Key Takeaways

- The expanding global CKD population sustains demand for phosphate binders like sevelamer carbonate.

- Its safety profile offers a considerable competitive advantage over calcium-based alternatives.

- Patent expirations pose significant revenue risks, but pipeline innovations and indications expansion can offset decline.

- Competitive pressures, especially from generics, necessitate strategic focus on formulation, pricing, and market access.

- Technological advancements and digital health integration could redefine clinical adoption and financial trajectories.

FAQs

Q1: What factors contribute to sevelamer carbonate’s preference over calcium-based phosphate binders?

A1: Its reduced risk of vascular calcification, hypercalcemia, and associated cardiovascular complications makes sevelamer carbonate a safer choice, leading to increased clinical preference.

Q2: How will patent expirations impact the financial outlook of sevelamer carbonate?

A2: Patent expiry typically results in generic entry, which can reduce brand revenues and profit margins. However, competition may also lower prices, making the drug more accessible and potentially expanding total market volume.

Q3: Are there promising pipeline developments related to phosphate management?

A3: Yes. Research into new formulations, combination therapies, and alternative phosphate control methods—including enzyme-based binders and biodegradable agents—is underway to improve efficacy and adherence.

Q4: How does the regulatory landscape influence the market for sevelamer carbonate?

A4: Regulatory approvals facilitate market entry and reimbursement. Conversely, differing approval timelines and policies across regions can create segmentation and affect sales trajectories.

Q5: What strategic actions should pharmaceutical companies consider in this market?

A5: Companies should focus on innovation, patent strategy, expanding indications, optimizing manufacturing, and forming strategic alliances to maintain competitiveness amidst generic entry and changing market dynamics.

References

[1] MarketWatch. "Phosphate Binders Market Size & Share Analysis 2022-2027."

[2] Global CKD Burden: Lancet Global Health, 2021.

[3] Sanofi Annual Report, 2022.