Last updated: July 27, 2025

Introduction

Genzyme, a Sanofi company, has been a prominent player in the biotechnology and rare disease segments for over four decades. Renowned for its specialization in enzyme replacement therapies and rare disease treatments, Genzyme’s strategic focus positions it uniquely across the evolving pharmaceutical landscape. This analysis examines Genzyme’s market positioning, core strengths, competitive advantages, and strategic outlook crucial for informed decision-making in the biopharmaceutical sector.

Market Position of Genzyme

Historical and Current Standing

Since its founding in 1981, Genzyme developed a reputation as a pioneer in rare diseases and specialty care. Acquired by Sanofi in 2011 for approximately $20.1 billion, Genzyme’s integration expanded Sanofi's footprint within biologics and rare health conditions [1]. Today, Genzyme operates primarily within Sanofi’s specialty care division, contributing significantly to its revenue streams from niche therapeutic areas.

Core Therapeutic Areas and Product Portfolio

Genzyme’s market focus encompasses lysosomal storage disorders, hematologic conditions, and other rare genetic diseases. Its flagship products include Cerezyme (imiglucerase) for Gaucher disease, Fabrazyme (agalsidase beta) for Fabry disease, and Anderson-Fabry treatments. These products face limited direct competition due to the orphan status, but the pipeline and emerging therapies are critical in maintaining its niche dominance.

Market Share and Competitive Positioning

Despite the challenges posed by patent expirations and generic entry, Genzyme maintains a robust market share in its core orphan disease indications. Its early entry and continuous pipeline development have fortified its market leadership. However, intense competition from emerging biotech firms and generics companies leveraging advanced manufacturing and gene therapy options are challenging its pristine position.

Strengths of Genzyme

1. Expertise in Rare Diseases & Orphan Drugs

Genzyme pioneered orphan drug development, gaining regulatory and clinical expertise that various competitors now emulate. Its focus on rare diseases grants it a sustained revenue stream, driven by high unmet medical needs and premium pricing strategies.

2. Established Reputation & Customer Trust

Having launched multiple first-in-class medications, Genzyme benefits from strong brand recognition within specialists. Long-term relationships with healthcare providers and patient advocacy groups reinforce its market position.

3. Manufacturing Capabilities & Supply Chain

Genzyme’s manufacturing facilities are highly specialized, with expertise in complex biologics production. This affords high-quality, consistent supply, a critical factor in orphan disease treatments where supply stability often correlates with patient outcomes.

4. R&D Pipeline and Strategic Collaborations

Genzyme’s commitment to innovation is reflected in its R&D pipeline, which includes gene therapies and enzyme replacement therapies under development. Strategic alliances with biotech firms and academic institutions further enhance its innovation capacity.

5. Regulatory Expertise & Market Access

With extensive experience navigating regulatory pathways for orphan drugs worldwide, Genzyme secures accelerated approvals and favorable reimbursement terms, ensuring sustained market access.

Strategic Insights & Competitive Advantages

Focus on Personalized Medicine & Gene Therapies

Genzyme’s strategic pivot toward gene therapy signals its commitment to maintaining competitive relevance amid the rapidly evolving biotech landscape. Its investments in gene editing and vector technologies aim to address traditionally intractable rare diseases, positioning it ahead of traditional enzyme replacement therapies' decline phase.

Pipeline Diversification & Pipeline Expansion

By diversifying its pipeline beyond enzyme therapies, including initiatives in immune modulation and systemic rare diseases, Genzyme mitigates risks associated with patent cliffs and generic competition for mature products.

Operational Excellence & Cost Management

Optimizing manufacturing processes, adopting digital health tools, and leveraging automation enhance operational efficiencies. These measures are crucial for cost control in high-margin niche markets, where pricing pressures are increasing.

Market Penetration & Geographic Expansion

Genzyme strategically targets emerging markets with unmet needs. Strengthening distribution channels and local regulatory expertise expands access, especially in regions where orphan diseases are underdiagnosed or undertreated.

Collaborative Ecosystem & External Innovation

Engaging in collaborations, licensing, and acquisitions allows Genzyme to incorporate novel technologies rapidly. For example, alliances with biotech startups specializing in gene editing or novel delivery systems could accelerate drug development timelines.

Challenges and Risks

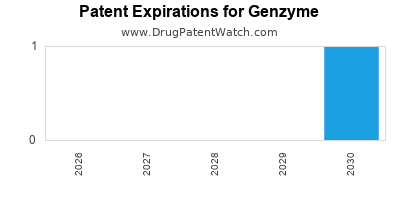

- Patent Expirations and Generic Competition: As patents for some key products lapse, revenues decline unless offset by new therapies.

- Regulatory Hurdles for Gene Therapies: Regulatory pathways for innovative therapies remain complex, potentially delaying product launches.

- Pricing and Reimbursement Pressures: Increasing scrutiny over drug pricing, especially in mature markets, may threaten profit margins.

- Market Saturation & Competition: Biotech disruptors and emerging therapies threaten to erode Genzyme’s core niche markets.

Strategic Recommendations

- Enhance R&D Focus on Next-Generation Therapies: Prioritize gene editing, mRNA, and cell-based therapies to stay at the forefront of innovation.

- Expand Global Access Initiatives: Accelerate market entry strategies in emerging markets with high unmet needs.

- Strengthen External Collaborations: Form strategic alliances with technological innovators to accelerate pipeline development.

- Invest in Digital and Data Analytics Capabilities: Improve forecasting, supply chain management, and personalized treatment approaches.

- Advocate for Favorable Regulatory Policies: Engage policymakers proactively to shape regulations supporting orphan and rare disease therapies.

Conclusion

Genzyme maintains a resilient and influential position within the niche pharmaceutical segment, driven by its deep expertise in rare diseases, robust product portfolio, and strategic innovation initiatives. By leveraging core strengths and addressing evolving challenges through targeted strategies, Genzyme can sustain its leadership and capitalize on emerging opportunities in personalized medicine and gene therapy. Stakeholders must monitor its pipeline developments, strategic partnerships, and market expansion efforts to gauge future growth trajectories.

Key Takeaways

- Market Leadership: Genzyme remains a pioneer in orphan drugs, with a historically strong market position rooted in specialized therapies for rare diseases.

- Core Strengths: Expertise in biologics manufacturing, regulatory navigation, and patient-centric relationships underpin its competitive advantage.

- Strategic Direction: Focus on pipeline diversification into gene therapies and aligned strategic collaborations will be pivotal for sustained relevance.

- Challenges: Patent cliffs, regulatory complexities, and pricing pressures demand proactive operational and strategic responses.

- Growth Opportunities: Expanding into emerging markets and leveraging digital health tools can unlock new revenue streams.

FAQs

-

What is Genzyme’s primary competitive advantage in the orphan drug market?

Its deep expertise in rare diseases, early product development, regulatory experience, and established manufacturing infrastructure collectively underpin its market leadership.

-

How is Genzyme adapting to the rise of gene therapies?

The company is heavily investing in gene editing technologies, pipeline expansion into gene therapies, and forming strategic partnerships to integrate these innovative modalities.

-

What are the main risks facing Genzyme in the coming years?

Patent expirations, increasing competition from biotech startups, regulatory hurdles for innovative therapies, and pricing pressures pose significant risks.

-

How does Genzyme plan to maintain market share amid generic erosion of some key products?

Through pipeline diversification, expansion into new therapeutic areas, geographic market expansion, and technological innovation.

-

What strategic moves could enhance Genzyme’s long-term growth?

Investing inNext-gen therapies like mRNA, strengthening global access, expanding collaborations, and leveraging digital health solutions are critical strategies.

References

[1] Sanofi Acquisition of Genzyme, Bloomberg, 2011.