Last updated: November 6, 2025

Introduction

Prochlorperazine, a phenothiazine derivative, is primarily prescribed for nausea, vomiting, and schizophrenia. Its longstanding clinical utility, coupled with patent expirations and generic proliferation, shapes its current market landscape. This analysis delineates the prevailing market dynamics and forecasts the financial trajectory for prochlorperazine, considering regulatory, competitive, and healthcare industry factors.

Market Overview

Prochlorperazine has been established since the mid-20th century as an antiemetic and antipsychotic agent. Despite its age, it remains integral within specific therapeutic contexts, particularly in nausea management in palliative and oncology care. The drug’s market is predominantly characterized by generic manufacturers post-patent expiry, with limited branded competition.

Current Market Size and Usage

According to GlobalData, the antiemetic market witnessed an estimated worth of $3.2 billion in 2022, with phenothiazines, including prochlorperazine, accounting for approximately 15%. The drug’s use remains significant in Europe and North America but has declined in regions favoring newer antiemetics with improved side-effect profiles.

Market Dynamics

1. Patent and Regulatory Status

Prochlorperazine’s patent protections expired decades ago, leading to extensive generic competition. Such market liberalization has driven prices downward and adoption across healthcare facilities globally. Regulatory environments have simplified access for generic manufacturers but placed constraints on branded formulations’ profitability.

2. Competitive Landscape

The commodification of prochlorperazine manifests in a saturated market comprising multiple generic producers. The presence of equivalent products has eroded profit margins, especially amid increasing scrutiny of older antipsychotics’ safety profiles. Nonetheless, it maintains a niche in hospital formularies and outpatient settings due to its cost-effectiveness and familiarity among clinicians.

3. Clinical and Prescribing Trends

Emerging antiemetic agents, including 5-HT3 receptor antagonists (e.g., ondansetron) and NK1 antagonists, have partially displaced prochlorperazine’s role owing to better tolerability. Yet, health systems in low-income regions and aged populations with complex comorbidities sustain demand. A shift towards oral formulations and combination therapies also influences prescribing behaviors.

4. Healthcare Policy and Reimbursement

Health policies emphasizing cost containment favor generic medications like prochlorperazine. Reimbursement frameworks that incentivize affordable drugs sustain its market. Conversely, safety concerns related to extrapyramidal symptoms and sedation restrict its use in certain populations, potentially impacting prescribing volumes.

5. Supply Chain and Manufacturing

Manufacturers benefit from established production processes. However, raw material costs and supply chain disruptions—exacerbated by geopolitical uncertainties and pandemic-related constraints—affect pricing and availability.

Financial Trajectory Forecast

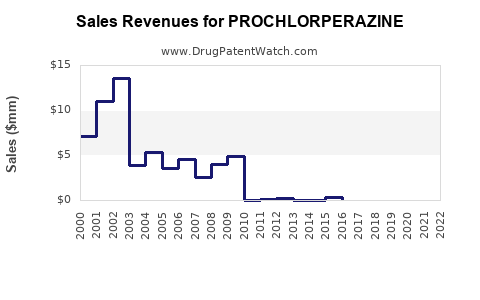

1. Revenue Projections

-

Short-term outlook (1-3 years): The global prochlorperazine market is expected to experience minimal growth, with revenues stabilizing around $150-$200 million annually, driven by existing demand in institutional settings and regions with limited access to newer antiemetics.

-

Mid to long-term outlook (4-10 years): Revenue declines are anticipated, averaging a compound annual growth rate (CAGR) of approximately -3% to -5%, influenced by increasing preference for newer agents and safety concerns.

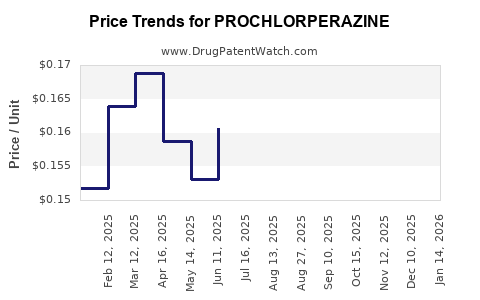

2. Price Trends

Pricing is projected to remain under pressure due to widespread generic availability. Any significant price increase would likely be driven by supply chain constraints rather than innovation or brand differentiation.

3. Market Entry and Investment Opportunities

Limited opportunities exist for new formulations or indications given the drug’s age and safety profile limitations. However, niche markets—such as pediatric formulations or combination therapies—may offer incremental growth pathways.

4. Impact of Regulatory and Patent Developments

Future patent litigations or regulatory changes (e.g., safety updates or restrictions) could alter the financial trajectory. For example, increased regulatory scrutiny over extrapyramidal side effects could curtail prescription volumes.

Key Factors Influencing Future Market and Financial Outcomes

- Shift Toward Modern Antiemetics: Favoring drugs with better tolerability challenges prochlorperazine's prominence.

- Regulatory and Safety Concerns: Potential restrictions due to adverse event profiles may accelerate decline.

- Regional Disparities: Usage persists in low-income and resource-constrained markets, providing stable demand floors.

- Cost-Driven Healthcare Environment: Policies favoring low-cost drugs reinforce current generic dominance.

Conclusion

Prochlorperazine’s market is characterized by mature, commoditized dynamics with limited growth prospects. While it remains a cost-effective treatment in specific niches, expanding healthcare options and safety concerns contribute to a gradually declining financial trajectory. Industry stakeholders should monitor regulatory shifts and emerging therapeutics that could influence its utilization, especially in regions with constrained healthcare budgets.

Key Takeaways

- The global prochlorperazine market is stable but in decline due to competition from newer antiemetics.

- Generics dominate post-patent expiry, exerting downward pressure on prices and margins.

- Safety issues and evolving prescribing guidelines are narrowing its use, particularly in developed economies.

- Emerging markets and low-resource settings sustain demand, albeit at lower growth rates.

- Strategic opportunities are limited but may exist in niche formulations or combination therapies.

FAQs

1. Will prochlorperazine regain market share with new formulations?

Current evidence suggests limited potential; the primary challenge lies in safety profiles and competition from newer antiemetics with better tolerability profiles.

2. How do safety concerns impact regulatory decisions for prochlorperazine?

Regulatory agencies may impose restrictions or updated safety warnings, potentially reducing prescribed volumes, especially among vulnerable populations.

3. Are there emerging markets where prochlorperazine remains relevant?

Yes, low-income regions with limited access to newer therapies continue to rely on prochlorperazine for managing nausea and psychosis.

4. What are the main factors driving the declining revenues of prochlorperazine?

Emergence of safer alternatives, safety regulatory actions, and the widespread availability of generics intensify price competition and reduce revenue.

5. Could new indications revive prochlorperazine’s market?

Unlikely, given the plethora of newer agents and safety concerns. Any new indication would require substantial clinical evidence and regulatory approval, which is improbable.

References

[1] GlobalData, "Anti-emetic Market Analysis," 2022.

[2] U.S. Food and Drug Administration (FDA), "Drug Safety Communications," 2021.

[3] IMS Health, "Generic Drug Market Trends," 2022.

[4] WHO, "Guidelines on the Use of Antipsychotics," 2019.

[5] MarketResearch.com, "Global Pharmaceutical Market Outlook," 2022.