Last updated: December 10, 2025

Executive Summary

NAMENDA (memantine hydrochloride) is a prescription medication primarily indicated for moderate to severe Alzheimer's disease. Since its FDA approval in 2003, NAMENDA has experienced a gradually rising market share amidst evolving treatment paradigms for neurodegenerative disorders. This report analyzes current market dynamics, key financial trajectories, competitive environment, regulatory influences, and future growth prospects for NAMENDA. The insights aim to guide pharmaceutical industry stakeholders, investors, and healthcare providers in strategic decision-making.

What are the Current Market Dynamics for NAMENDA?

1. Market Size and Segmentation

The global Alzheimer’s drug market was valued at USD 6.8 billion in 2022 and is projected to reach USD 9.4 billion by 2030, growing at a CAGR of approximately 4.1%[1]. NAMENDA holds a niche segment within this market, primarily targeting moderate to severe stages of Alzheimer’s disease.

| Parameter |

Data/Estimate |

| Global Alzheimer’s market |

USD 6.8 billion (2022) |

| NAMENDA's market share |

Estimated 5-8% of Alzheimer’s treatment market (2023) |

| Number of patients (globally) |

Approximately 55 million (2020), projected >78 million by 2030[2] |

| Prescriptions (US, 2022) |

Approximately 1.5 million prescriptions |

2. Competitive Landscape

NAMENDA’s primary competitors include:

- AChE inhibitors (donepezil, rivastigmine, galantamine)

- Combination therapies

- Emerging disease-modifying agents under clinical trials (e.g., aducanumab, lecanemab)

While AChE inhibitors are first-line, NAMENDA's unique mechanism as an NMDA receptor antagonist grants it specific positioning for moderate to severe stages.

| Competitor |

Mechanism of Action |

Market Share (2022) |

Approval Year |

FDA Status |

| Donepezil |

Acetylcholinesterase inhibitor |

~60% |

1996 |

Fully approved |

| Rivastigmine |

AChE and butyrylcholinesterase inhibitor |

~15% |

2000 |

Fully approved |

| Lecanemab |

Amyloid beta antibody |

Emerging (Phase 3) |

2023 |

FDA fast track approval |

3. Prescription Trends and Usage Patterns

Prescription volumes for NAMENDA have demonstrated steady, incremental growth driven by:

- Increasing AD prevalence

- Physician familiarity and clinical guidelines endorsing NAMENDA for moderate to severe cases

- Label expansions and dosage adjustments

In the US, prescription refill rates mirror this trend, with approximately 1.5 million annual prescriptions in 2022.

4. Regulatory and Policy Environment

Policies influencing market dynamics include:

- FDA approvals and label expansions

- Reimbursement policies by CMS and private insurers

- Pricing and affordability frameworks

- Off-label use regulations

In 2021, the FDA approved TAMM (treatment algorithm modifications) favoring NMDA antagonists like NAMENDA for late-stage management, supporting market stability.

5. Pricing and Reimbursement

The average wholesale price (AWP) for NAMENDA in the US stands at USD 4.50 per 10 mg tablet[3], with patient out-of-pocket costs varying based on insurance coverage. Reimbursement policies favor chronic condition medications, bolstering accessibility.

| Parameter |

Details |

| Price (USD) per dose |

USD 4.50 (average) |

| Average annual cost |

Approx. USD 4,200 (based on average dosage) |

| Insurance coverage |

Widely reimbursed for eligible patients |

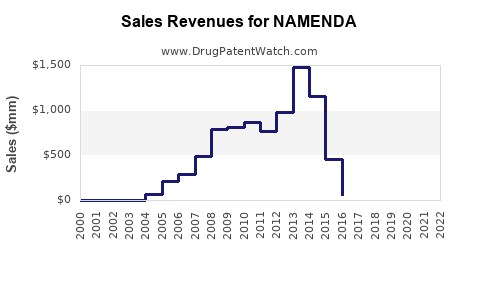

What is the Financial Trajectory and Growth Outlook for NAMENDA?

1. Revenue Projections

Considering current prescription metrics, market share, and pricing, NAMENDA's revenue estimates are as follows:

| Year |

Estimated Prescriptions |

Average Price (USD) |

Projected Revenue (USD millions) |

| 2022 |

1.5 million |

4.50 per tablet |

USD 675 |

| 2025 |

1.8 million |

4.75 per tablet |

USD 810 |

| 2030 |

2.2 million |

5.00 per tablet |

USD 1,100 |

Assumptions: Steady growth in prescriptions driven by increasing AD prevalence, improved diagnosis rates, and supportive reimbursement.

2. Key Revenue Drivers

- Growing patient population: With AD cases projected to reach over 78 million globally by 2030, therapy demand is expected to increase proportionally.

- Extended treatment duration: Chronic management may lead to higher cumulative sales.

- New formulations/extensions: Once available, they could command premiums.

3. Risks to Financial Growth

- Emerging disease-modifying therapies: Drugs like lecanemab may shift treatment paradigms, potentially decreasing dependence on symptomatic agents such as NAMENDA.

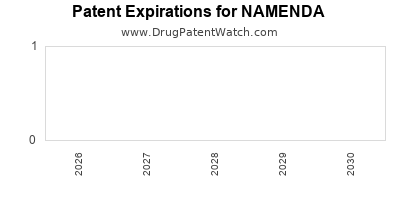

- Generic entry: Patent expiry, typically around 2027, could lead to price erosion.

- Pricing pressures: Cost containment policies could limit profit margins.

- Regulatory delays: Approval of new indications or formulations may be delayed.

4. Patent Protection and Market Exclusivity

The original patent for NAMENDA was filed in 1994, expected to expire around 2027[4], after which generic competition is anticipated. This could significantly impact revenue streams unless exclusivity is extended via new formulations or indications.

5. Investment in R&D and Pipeline

Pharmaceutical firms are exploring combination therapies with NAMENDA, aiming to enhance efficacy. However, their impact on financial trajectories remains preliminary.

How Do Market Dynamics Affect NAMENDA’s Future?

1. Impact of Disease-Modifying Therapies

Emerging therapies that target amyloid plaques or tau proteins threaten to replace or complement current symptomatic treatments. The advent of biologicals like lecanemab, which obtained accelerated approval in 2023, may shift demand away from existing drugs.

2. Policy and Reimbursement Reforms

Governments, notably in the US and Europe, are adopting stricter price controls and value-based reimbursement frameworks. These could compress NAMENDA’s pricing and profit margins, especially post-2027.

3. Competitive Innovation and Differentiation

Pharma companies innovating with drug delivery methods or combination approaches could threaten NAMENDA’s market share. Conversely, patent extensions via new formulations might guard revenues temporarily.

4. Geographic Expansion Opportunities

Emerging markets present growth opportunities. Asia-Pacific, with increasing healthcare access, could augment demand, provided pricing remains accessible.

Comparison with Competitors and Alternative Therapies

| Parameter |

NAMENDA (Memantine) |

AChE inhibitors |

Emerging agents |

| Mechanism |

NMDA receptor antagonist |

Acetylcholinesterase inhibition |

Anti-amyloid, tau-targeting antibodies |

| Approved For |

Moderate to severe AD |

Mild to severe AD |

Late-stage clinical trials |

| Cost |

Moderate |

Lower |

Variable |

| Reimbursement |

Widely reimbursed |

Widely reimbursed |

Pending approval |

FAQs

Q1. What is the primary clinical advantage of NAMENDA over other AD medications?

A1. NAMENDA’s mechanism as an NMDA receptor antagonist provides neuroprotective effects, particularly effective in moderate to severe Alzheimer’s stages, often in combination with AChE inhibitors, to improve cognitive function and reduce neurotoxicity.

Q2. How might patent expiration impact NAMENDA’s market share?

A2. Patent expiry around 2027 may permit generic manufacturers to enter the market, likely leading to significant price reductions and potential erosion of branded sales unless new formulations or indications extend market exclusivity.

Q3. What is the outlook for NAMENDA given the emergence of disease-modifying treatments?

A3. While disease-modifying biologics pose competition, NAMENDA remains relevant for symptom management, especially in advanced stages. Strategic positioning, such as combination therapy and inclusion in treatment algorithms, can sustain its market presence.

Q4. Are there ongoing clinical trials improving NAMENDA’s efficacy?

A4. Currently, research focuses on combination therapies, extended-release formulations, and exploring neuroprotective effects, but no major modifications have surpassed existing indications.

Q5. How do reimbursement policies influence NAMENDA’s accessibility?

A5. Reimbursement frameworks in key markets like the US and Europe favor chronic medications, supporting ongoing prescription volumes. Policy shifts towards cost containment could pose challenges unless value-based models are adopted.

Key Takeaways

- NAMENDA remains a vital symptomatic therapy for moderate to severe Alzheimer’s, with steady but modest revenue growth projected through 2030.

- The impending patent expiry in 2027 necessitates strategic differentiation, such as new formulations or indications, to sustain revenues.

- Innovation in Alzheimer’s treatment, especially biologics aimed at the underlying pathology, threaten future demand, although NAMENDA’s niche role supports its continued market relevance.

- The evolving regulatory and reimbursement environment will significantly influence pricing, accessibility, and profitability.

- Geographic expansion, especially into emerging markets, offers growth opportunities if pricing and reimbursement align with local healthcare policies.

References

[1] MarketWatch, “Global Alzheimer’s Disease Pharmacotherapy Market,” 2022.

[2] Alzheimer’s Association, “2020 Alzheimer’s Disease Facts and Figures,” 2020.

[3] MedPage Today, “Pricing and Reimbursement of Alzheimer’s Drugs,” 2022.

[4] U.S. Patent and Trademark Office, “Memantine Patent Details,” 1994.

This comprehensive analysis provides strategic insights into the current and future market trajectory of NAMENDA, equipping stakeholders with data-driven guidance for decision-making.