Last updated: August 1, 2025

Introduction

NAMENDA XR (memantine hydrochloride extended-release) is a prescription drug primarily approved for the treatment of moderate to severe Alzheimer's disease. As a differentiated formulation of memantine, NAMENDA XR offers sustained therapeutic plasma levels, potentially improving patient adherence and clinical outcomes. This analysis explores the current market landscape, competitive positioning, regulatory environment, and financial trajectory impacting NAMENDA XR’s commercial prospects.

Market Landscape for Alzheimer's Treatment

Alzheimer’s disease (AD) presents significant unmet medical needs amid a rapidly aging global population. The estimated global prevalence exceeds 55 million as of 2023, projected to double by 2050, amplifying demand for efficacious therapeutics [1]. Current pharmacotherapies, including cholinesterase inhibitors and NMDA receptor antagonists like NAMENDA XR, are primarily symptomatic, with limited impact on disease progression.

The pharmaceutical market for Alzheimer’s drugs is characterized by:

- High unmet medical needs: No curative options exist; disease-modifying therapies remain under development.

- Established blockbusters: Existing drugs like NAMENDA generate substantial revenues, incentivizing continued innovation.

- Growth potential: The aging demographic ensures a steady demand trajectory, with estimates indicating a compound annual growth rate (CAGR) of approximately 4-6% for AD pharmacotherapy through 2030 [2].

Product Profile and Competitive Advantages of NAMENDA XR

NAMENDA XR is formulated as an extended-release capsule, offering once-daily dosing compared to the immediate-release (IR) formulation’s twice-daily schedule. The advantages include:

- Improved adherence: Simplified dosing regimens foster higher compliance among elderly patients.

- Steady pharmacokinetics: Maintains consistent therapeutic plasma levels, potentially enhancing efficacy.

- Enhanced tolerability: Reduced peaks may lower adverse event incidences.

These benefits have allowed NAMENDA XR to position itself as a preferred option in the symptomatic management of AD, especially among patients who benefit from simplified medication regimens.

Regulatory Environment and Impact

NAMENDA XR received FDA approval in 2014, with subsequent approvals in several markets globally. Regulatory pathways for extended-release formulations tend to be straightforward if bioequivalence and safety are established, yet novel indications face more rigorous scrutiny.

Recent regulatory trends include increasing emphasis on disease-modifying therapies, such as aducanumab (Aduhelm), which target underlying pathology. While NAMENDA XR is symptomatic, its role remains vital, particularly in combination therapies, highlighting ongoing demand stability.

Market Dynamics Influencing NAMENDA XR

1. Competition and Market Share

NAMENDA XR faces competition from both branded and generic memantine IR formulations, as well as other NMDA receptor antagonists. Key competitors include:

- Generic memantine IR: Significantly price-competitive, capturing substantial market share.

- Other AD drugs: Donepezil, rivastigmine, and emerging agents target different disease pathways but often used in combination.

Despite competition, NAMENDA XR distinguishes itself with the convenience of extended-release formulation, which appeals to adherence-conscious prescribing.

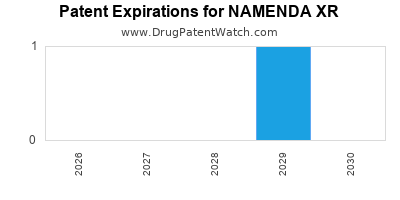

2. Patent Expirations and Generics

Patent expiry timelines critically influence revenue streams. The original patent exclusivity for NAMENDA XR expired around 2018 in the US, leading to increased generic penetration. However, secondary patents and formulation patents may provide residual protection for specific markets or formulations.

The encroachment of generics typically reduces pricing power but opens access channels through competitive dynamics, especially in price-sensitive markets like the US and emerging economies.

3. Prescriber and Payer Dynamics

Physicians often prefer NAMENDA XR for its dosing convenience; however, insurance reimbursement policies and formulary restrictions influence prescribing patterns. Payer pressures for cost containment favor generics, but formulary inclusion of branded NAMENDA XR remains vital for maintaining premium pricing and market share.

4. Emerging Therapies and Pipeline Developments

While NAMENDA XR remains a symptomatic treatment, the landscape is evolving with the advent of disease-modifying therapies (DMTs) and combination regimens. The potential for DMTs to reshape treatment paradigms could impact long-term demand for symptomatic agents like NAMENDA XR.

5. Market Expansion Opportunities

Expanding into developing markets with rising AD prevalence and increasing healthcare infrastructure investment represents a strategic growth avenue. Regulatory approvals in novel indications or combination therapies could further extend NAMENDA XR's revenue potential.

Financial Trajectory and Revenue Forecasts

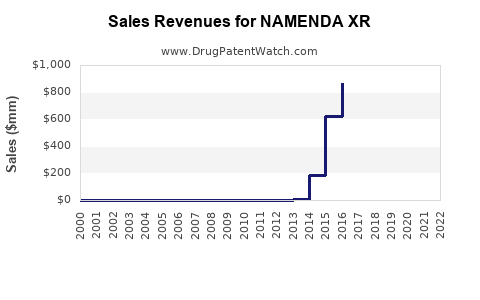

Historical Performance

Post-approval, NAMENDA XR experienced initial robust sales, leveraging brand loyalty and clinical advantages. However, generic competition post-2018 contributed to a gradual decline in average selling prices (ASP), typical in pharmaceutical markets facing patent expiry.

Forecast Scenarios

- Conservative Scenario: A decline in revenue led primarily by generic erosion, stabilizing around $300-400 million annually in mature markets.

- Optimistic Scenario: Uptake in emerging markets, tailored formulations, or new indications sustains higher revenues, potentially exceeding $500 million annually over the next 5 years.

Key Revenue Drivers

- Pricing Power: Hinges on brand strength, patent protection, and reimbursement policies.

- Market Penetration: Expansion into underserved regions enhances volume.

- Competitive Dynamics: The presence of generics pressures ASPs but may be offset by premium formulations or combination therapies.

Profitability Outlook

Despite declining gross margins due to generics, operational efficiencies and strategic market expansion can sustain profitability. The drug’s lifecycle management through reformulations or new indications remains a critical factor in maintaining revenue and margin stability.

Regulatory and Patent Strategies

Continued patent protection and lifecycle extensions via new formulations, dosing schedules, or combination patents influence financial trajectory. Engaging with regulatory authorities to secure approvals for novel uses or combination regimes can diversify revenue streams.

Conclusion

NAMENDA XR operates within a complex, evolving Alzheimer’s disease treatment landscape marked by aging populations, intense competition, patent expirations, and pipeline innovations. While generic erosion poses challenges, strategic focus on market expansion, formulation innovation, and positioning as an adherence-enhancing therapy can sustain its long-term financial trajectory.

Key Takeaways

- The global Alzheimer's market's growth trajectory favors continued demand for symptomatic agents like NAMENDA XR.

- Patent expiries and generics exert downward pressure on revenues, but extended-release advantages and market expansion mitigate losses.

- Strategic positioning in emerging markets and pipeline development prove essential to offset impending generic competition.

- Formulation and combination regimen innovations can extend the product lifecycle and sustain profitability.

- Regulatory strategies and patent protections are pivotal in maintaining market exclusivity and revenue stability.

FAQs

1. How does NAMENDA XR compare to its immediate-release counterpart in terms of clinical efficacy?

Clinical studies show that NAMENDA XR's extended-release formulation provides similar efficacy to IR formulations with comparable safety profiles, but offers improved adherence due to once-daily dosing.

2. What is the impact of patent expiry on NAMENDA XR's revenue?

Patent expiry has led to increased generic competition, causing ASP reductions and pressure on revenues, especially in mature markets like the US.

3. Are there ongoing efforts to develop disease-modifying therapies for Alzheimer's, and how might they affect NAMENDA XR?

Yes, several DMTs are in late-stage development. Their approval could shift treatment paradigms from symptomatic management to disease modification, potentially reducing demand for drugs like NAMENDA XR in the long term.

4. Which markets offer the highest growth potential for NAMENDA XR?

Emerging markets in Asia, Latin America, and parts of Africa present high growth opportunities due to rising prevalence, increasing healthcare access, and expanding insurance coverage.

5. What strategic measures can pharmaceutical companies adopt to sustain NAMENDA XR’s market share?

Strategies include lifecycle management through new formulations, seeking approvals for additional indications, expanding into new geographies, and engaging payers through value-based pricing models.

Sources

[1] World Health Organization. Dementia Fact Sheet. 2023.

[2] IQVIA. Global Alzheimer's Disease Market Report, 2023.