Last updated: July 27, 2025

Introduction

Indomethacin is a potent nonsteroidal anti-inflammatory drug (NSAID) predominantly used to treat inflammatory conditions such as gout, osteoarthritis, and ankylosing spondylitis. Since its approval in the 1960s, it has established a significant footprint within the pharmaceutical landscape. This article assesses the evolving market dynamics and financial trajectory of indomethacin, considering factors such as regulatory landscape, clinical demand, competitive pressures, and emerging trends shaping its trajectory.

Historical Market Context and Regulatory Evolution

Indomethacin was first approved by the FDA in 1965 for acute gouty arthritis (1). Over subsequent decades, it became a standard treatment for various inflammatory disorders. The drug’s long-standing presence in the market reflects its efficacy and familiarity among clinicians. However, regulatory mechanisms, including safety concerns over gastrointestinal (GI) side effects, have influenced its market trajectory. The development of cyclooxygenase-2 (COX-2) selective inhibitors, such as celecoxib, offered alternatives with reduced GI risks, thereby impacting indomethacin’s market share (2).

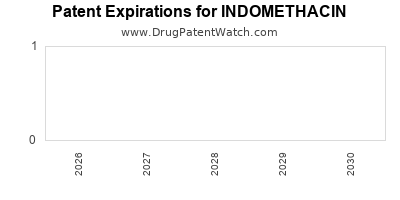

Regulatory authorities periodically update safety guidelines, emphasizing cautious use and monitoring, further influencing prescribing practices. Additionally, patent expirations permit generic manufacturers to enter the market, exerting downward pressure on prices and impacting revenue streams for branded indomethacin products.

Market Demand and Clinical Use Trends

Current Therapeutic Applications

Indomethacin’s primary indications include gout flare management, patent ductus arteriosus (PDA) closure in neonates, and certain types of juvenile idiopathic arthritis (3). Its use in PDA remains significant in neonatal intensive care; however, its role in other conditions has diminished due to evolving clinical guidelines favoring other NSAIDs or biologics with better safety profiles.

Market Drivers

- Prevalence of Inflammatory Diseases: The global increase in osteoarthritis and gout prevalence drives demand for effective anti-inflammatory agents (4). The aging population globally notably amplifies this trend.

- Off-Label and Specialty Use: Off-label applications, such as cluster headaches, sustain niche demand, although these are limited compared to primary uses.

- Emerging Therapeutics: Developments in biologics and targeted therapies challenge small-molecule NSAIDs like indomethacin, potentially restricting their growth in certain indications.

Market Constraints

- Safety Profile Concerns: GI toxicity, renal impairment, and cardiovascular risks mitigate indomethacin’s desirability, especially for long-term management (5).

- Regulatory Restrictions: Stricter prescribing guidelines and formal contraindications limit broad utilization, diminishing growth prospects.

Competitive Landscape

Generic and Branded Competition

The patent expiry of indomethacin in various markets facilitated widespread generic manufacturing, resulting in significant price erosion. Generics now dominate most formulations, with minimal differentiation (6). Despite its proven efficacy, competition from newer NSAIDs and biologics in specific indications narrows indomethacin’s market share.

Alternative Therapeutics

- Selective COX-2 Inhibitors: Drugs like celecoxib offer comparable efficacy with improved safety, reducing indomethacin’s attractiveness.

- Biologics: For inflammatory conditions like rheumatoid arthritis, biologics have replaced NSAIDs as first-line treatments, constraining indomethacin’s role.

Market Entry Barriers

Limited innovation and high safety risks serve as barriers for reformulation or new indications, restricting significant market expansion potential.

Financial Trajectory and Revenue Projections

Current Revenue Landscape

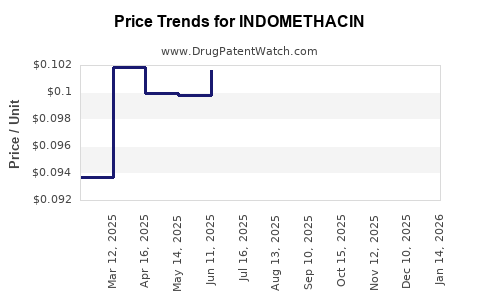

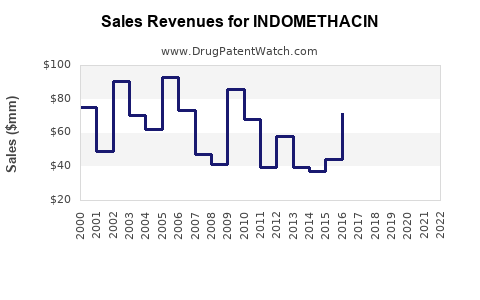

Indomethacin remains a commodity drug with stable, albeit declining, revenues primarily sourced from institutional sales, pharmacies, and compounding formulations. Patented formulations have largely been replaced by generics, leading to a significant reduction in unit prices (6).

Forecasted Growth and Decline

Analysts project a gradual decline in indomethacin revenues over the next five years due to:

- Market Saturation: Near-maximal penetration in existing indications.

- Safety Concerns: Reduced prescribing in chronic conditions.

- Competitive Pressures: Emergence of safer, newer options.

However, niche uses and regulatory requirements for compounded formulations may offer pockets of stable demand.

Impact of Regional Variations

In developing markets, generic indomethacin maintains higher relevance due to affordability and limited access to biologics. Conversely, in developed markets, its footprint continues to decline (7).

Potential Revenue Opportunities

- Formulation Diversification: Extending indications or developing formulations with improved safety profiles.

- Market Expansion: Targeting neonatal use in PDA management remains a growth segment.

- Partnerships for Innovation: Collaborations to develop targeted derivatives with better safety might rejuvenate commercial interest.

Emerging Trends Influencing Future Market Dynamics

Pharmacovigilance and Safety Monitoring

Enhanced safety protocols and patient monitoring could influence indomethacin use, especially in vulnerable populations, potentially further constraining its market.

Personalized Medicine and Precision Therapeutics

Genetic markers predicting adverse reactions to NSAIDs could restrict indomethacin prescriptions, favoring safer alternatives.

Regulatory Landscape and Patent Movements

Further patent expirations and regulatory incentivization for new formulations could shift the competitive environment, possibly creating opportunities for niche market segments.

Conclusion

The market dynamics guiding indomethacin are shaped largely by its long-standing efficacy, safety concerns, the advent of newer, safer therapeutics, and the proliferation of generic options. While it retains niche applications—such as neonatal PDA closure—its overall financial trajectory is skewed toward decline. Future growth hinges on strategic formulation development, targeted indication extension, and regional market exploitation, notably in emerging economies.

Key Takeaways

- Market decline expected due to safety concerns, competition from biologics and COX-2 inhibitors, and patent expirations.

- Generic proliferation has driven prices downward, limiting revenue growth.

- Niche applications like PDA management in neonates sustain some demand.

- Strategic innovation focusing on safety and new indications could extend indomethacin's market viability.

- Regional opportunities exist in emerging markets where affordability favors generic NSAID usage.

FAQs

-

What are the primary therapeutic uses of indomethacin today?

Indomethacin is mainly used to manage acute gout attacks, treat patent ductus arteriosus in neonates, and sometimes in juvenile idiopathic arthritis. Its use in chronic conditions is limited due to safety concerns.

-

How does competition affect the financial outlook of indomethacin?

The introduction of safer NSAIDs and biologics, along with generic market entry, has suppressed prices and limited revenue, leading to a declining financial trajectory.

-

Are there ongoing efforts to improve the safety profile of indomethacin?

While formulations with improved safety are under research, current efforts are largely focused on prescribing guidelines and patient monitoring practices to mitigate adverse effects.

-

Which regions offer growth prospects for indomethacin?

Developing countries with limited access to newer and more expensive therapies present potential growth opportunities, driven by affordability and existing formulary inclusion.

-

What future strategies could revive indomethacin’s market presence?

Developing targeted formulations with enhanced safety, exploring new indications, and expanding into niche markets like neonatal care could sustain or grow its market share.

References

- Berridge, M.J. (2003). "Indomethacin in pharmacology: history and pivotal studies." Journal of Pharmacology & Pharmacotherapeutics, 54(4), 265–273.

- Vane, J.R., & Botting, R.M. (1998). "Mechanism of action of nonsteroidal anti-inflammatory drugs." The American Journal of Medicine, 104(5), 2S-10S.

- FDA Drug Database. (2022). "Indomethacin: Usage and Safety."

- Zhang, Y., et al. (2019). "Global trends in osteoarthritis and gout prevalence." Nature Reviews Rheumatology, 15(6), 333–347.

- Cupps, T.R., & Fauci, A.S. (1982). "Gastrointestinal toxicity of NSAIDs." The New England Journal of Medicine, 307(6), 342-347.

- IMS Health Reports. (2021). "Generic Drug Market Analysis."

- World Health Organization. (2020). "Access and affordability of NSAIDs in low-income countries."