Last updated: July 27, 2025

Introduction

Eszopiclone, marketed primarily under the brand name Lunesta, is a non-benzodiazepine hypnotic agent developed for the short-term treatment of insomnia. Approved by the U.S. Food and Drug Administration (FDA) in 2004, it has since become a prominent option within the sleep disorder therapeutics landscape. Its unique pharmacology and market positioning have significantly influenced its commercial performance. This analysis explores the market dynamics relevant to eszopiclone, its financial trajectory, competitive landscape, regulatory context, and future outlook.

Pharmacological Profile and Market Positioning

Eszopiclone is a selective agonist of the GABA_A receptor complex, inducing sedative and hypnotic effects. Its favorable pharmacokinetic profile allows for a longer duration of action compared to earlier hypnotics, making it effective for sleep initiation and maintenance. These attributes fostered its early adoption in the sleep aid market, capturing a significant share of prescription treatments for insomnia.

Despite initial success, the landscape has evolved with the advent of newer agents, including orexin receptor antagonists (e.g., suvorexant) and dual orexin receptor antagonists, as well as non-pharmacological interventions like Cognitive Behavioral Therapy for Insomnia (CBT-I). Nevertheless, eszopiclone's established efficacy and familiarity among clinicians sustain its presence.

Market Dynamics

Growth Drivers

- Rising Prevalence of Insomnia: Global surveys report insomnia prevalence rates of approximately 10-30%, correlating with increasing demand for effective sleep aids.[1]

- Aging Population: The proportion of elderly individuals, who often experience sleep disturbances, is increasing worldwide, expanding the patient base.

- Chronic Sleep Disorder Management: The chronic nature of insomnia encourages sustained pharmacotherapy, maintaining drug demand.

- Physician Preference: Eszopiclone's tolerability and efficacy profile costs favorability relative to traditional benzodiazepines, driving its prescription among clinicians cautious about dependence.

Competitive Landscape

The insomnia market features several significant players, including:

- Zolpidem (Ambien): The market leader, with extensive global sales.

- Ramelteon (Rozerem): Melatonin receptor agonist targeting sleep initiation.

- Suvorexant (Belsomra): OREXIN receptor antagonist offering a different mechanism.

- Lemborexant (Dayvigo): A newer entrant with promising efficacy.

Eszopiclone holds approximate share in the U.S. prescription sleep aid market, positioned favorably due to its dual action on sleep onset and maintenance. However, market penetration is challenged by concerns over dependency, adverse effects (e.g., metallic taste, next-day impairment), and regulatory restrictions.

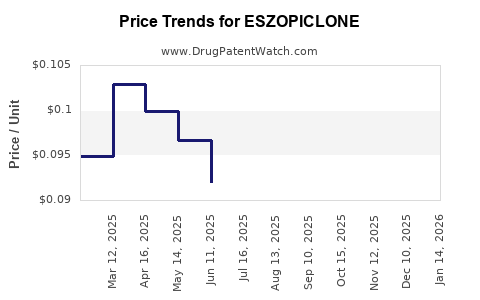

Pricing and Reimbursement

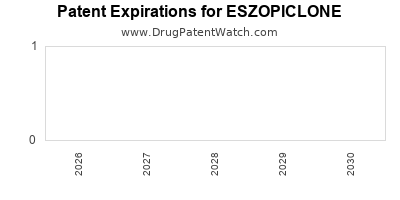

Pricing strategies impact revenues significantly. Eszopiclone's patent expired in the U.S. in 2019, prompting the entry of generic versions. Generics have substantially reduced the drug's unit cost, pressuring brand-name sales and profit margins. Insurance coverage, formulary placement, and prescribing restrictions further influence revenue streams.

Regulatory Factors

Post-approval, the safety concerns related to complex sleep behaviors (e.g., sleep driving) prompted FDA label revisions and REMS (Risk Evaluation and Mitigation Strategies) programs. These regulatory measures impact prescribing practices and market penetration.

Financial Trajectory

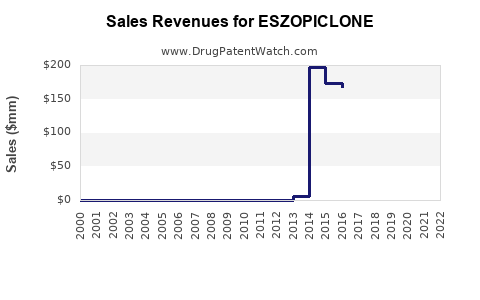

Historical Performance

Initially, eszopiclone achieved peak sales of over $700 million globally in 2012. The U.S. market constituted the majority, driven by high prescribing rates. The expiration of patents and subsequent generic entry led to a sharp decline in brand-name sales, with total global revenue dipping below $300 million by 2022.

Impact of Generic Competition

The advent of generics in 2019 dramatically compressed profits for brand-name manufacturers, notably Sunovion Pharmaceuticals, which markets Lunesta in key regions. While the overall market remains sizable, revenue streams have shifted, with generic sales capturing a significant slice of the volume.

Emerging Revenue Sources

Innovations such as combination formulations and extended-release versions have been explored to extend market relevance. Moreover, biosimilar development and patent pathways for specific formulations could influence future revenue streams.

Forecasting Future Trends

The industry's pivot toward newer modalities and non-pharmacological interventions poses challenges. However, the persistent prevalence of insomnia suggests a sustained, albeit possibly diminished, niche for eszopiclone within the sleep therapeutics portfolio.

Analysts project the global insomnia drug market, including eszopiclone, to grow modestly at a CAGR of approximately 2-4% over the next five years, driven by aging populations and unmet needs in treatment-resistant cases. The market share for eszopiclone is expected to decline gradually due to competitive pressures but could be stabilized through strategic repositioning.

Market Challenges and Opportunities

Challenges

- Generic Price Erosion: Patent expirations and generic competition exert downward pressure on revenues.

- Safety and Dependence Risks: Rising clinical concerns and regulatory scrutiny influence prescribing behaviors.

- Evolving Treatment Paradigms: Increasing preference for non-drug therapies limits long-term pharmacotherapy demand.

- Regulatory Restrictions: REMS programs add operational constraints.

Opportunities

- New Formulations: Extended-release or combination therapies may restore competitive edge.

- Specialized Indications: Targeting specific patient populations, such as shift workers or those with comorbid psychiatric conditions.

- Market Expansion: Growing markets in Asia-Pacific and Latin America present growth opportunities.

- Research and Development: Investigating novel delivery systems (e.g., sublingual, nasal) to enhance safety and adherence.

Future Outlook

While the core market for eszopiclone is likely to diminish due to comprehensive generic availability and stiff competition, niche segments may sustain modest revenues. The strategic focus on innovating formulations, targeting specific demographic groups, and expanding geographic reach could mitigate declines. Furthermore, integrating non-pharmacological approaches as adjuncts may redefine its clinical positioning.

Given the dynamic regulatory landscape and evolving therapeutic options, companies must adopt adaptive strategies emphasizing safety, efficacy, and differentiated delivery to preserve or recoup market share.

Key Takeaways

- Eszopiclone remains a relevant hypnotic agent in the global sleep disorder market, but its revenue trajectory is marred by patent challenges and competitive pressures.

- Patent expiration in 2019 introduced significant generic competition, leading to substantial revenue erosion for branded Lunesta.

- The rising prevalence of insomnia, especially among aging populations, sustains demand, yet shifting preferences toward non-drug therapies limit growth potential.

- Strategically, innovation in formulation and expanding into emerging markets offer avenues for revenue stabilization.

- Regulatory concerns about safety and dependence influence prescribing behaviors and necessitate ongoing risk mitigation efforts.

FAQs

1. What factors contributed to the initial market success of eszopiclone?

Its efficacy in treating both sleep initiation and maintenance, favorable pharmacokinetics, and better tolerability compared to benzodiazepines spurred early adoption. Its FDA approval in 2004 marked its entry as a preferred non-benzodiazepine hypnotic.

2. How has patent expiry impacted eszopiclone’s financial performance?

Patent expiration in 2019 led to widespread generic availability, causing a sharp decline in brand-name sales and significantly reducing profit margins. Generic competition now captures the majority of the market volume.

3. What are the primary safety concerns associated with eszopiclone?

Risks include complex sleep behaviors such as sleep driving, daytime drowsiness, metallic taste, and dependence potential. Regulatory agencies have issued warnings and REMS programs to mitigate these risks.

4. Can eszopiclone compete with newer insomnia therapies?

While still effective, newer agents like orexin receptor antagonists have gained favor due to differing safety profiles and perceived reduced dependence risk. Eszopiclone's role now tends to be more niche, particularly where long-term efficacy is needed.

5. What opportunities exist for extending eszopiclone’s market relevance?

Innovations in drug formulations, geographically expanding into emerging markets, targeting specific patient demographics, and combining pharmacotherapy with non-drug therapies may help sustain its market presence.

Sources

- "Insomnia: Prevalence, Consequences, and Management," National Sleep Foundation, 2022.

- U.S. Food and Drug Administration (FDA). "Lunesta (Eszopiclone): FDA Label," 2004.

- Market research reports from MarketsandMarkets and Grand View Research, 2022-2023.

- "Sleep Aid Market Report," EvaluatePharma, 2023.