Last updated: July 27, 2025

Introduction

Desonide, a potent topical corticosteroid, serves primarily in the treatment of localized inflammatory skin conditions such as eczema, dermatitis, and psoriasis. Approved by regulatory agencies like the FDA, Desonide's broad utility, safety profile, and market presence position it as a staple in dermatological therapeutics. This analysis explores the current market dynamics, competitive landscape, regulatory environment, and projected financial trajectory of Desonide within the pharmaceutical sector.

Pharmaceutical Profile and Therapeutic Indications

Desonide is classified as a low-potency corticosteroid, manifesting anti-inflammatory, antipruritic, and vasoconstrictive properties [1]. Its formulations—creams, ointments, and lotions—are typically prescribed for mild to moderate inflammatory skin conditions across pediatric and adult populations. The drug's safety profile, characterized by minimal systemic absorption, supports prolonged topical use, fostering consistent prescription volumes.

Market Size and Growth Trends

Globally, the dermatological segment commands a lucrative market, with corticosteroids representing a significant share due to the high prevalence of inflammatory skin disorders [2]. The Desonide market, a subset within this space, benefits from its positioning as a low-potency corticosteroid with favorable safety, facilitating widespread adoption.

Market valuation estimates: Industry reports project the global topical corticosteroids market to reach approximately USD 4.5 billion by 2028, growing at a CAGR of 4.2% from 2023 to 2028 [3]. While Desonide's exclusive market share constitutes a smaller fraction, its consistent demand ensures stable revenue streams.

Regional insights: North America dominates due to high awareness and advanced healthcare infrastructure, followed by Europe. Emerging markets in Asia-Pacific witness accelerated growth, driven by increased dermatological health awareness and economic expansion.

Market Drivers

-

Prevalence of Skin Conditions: Rising incidences of eczema, psoriasis, and dermatitis—exacerbated by urbanization and environmental factors—amplify demand for corticosteroids like Desonide [4].

-

Product Safety and Tolerability: The low side-effect profile of Desonide encourages its use over higher-potency steroids, especially in pediatric populations, fostering long-term prescribing patterns [1].

-

Advances in Formulation Technologies: Enhanced delivery systems—such as liposomal and hydrogel formulations—improve skin penetration and patient compliance, expanding market potential.

-

Expanding Prescriber Base: Dermatologists, pediatricians, and general practitioners increasingly favor Desonide for mild to moderate skin conditions, broadening sales channels.

Market Restraints

-

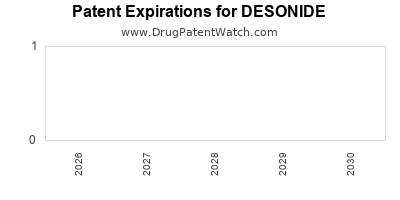

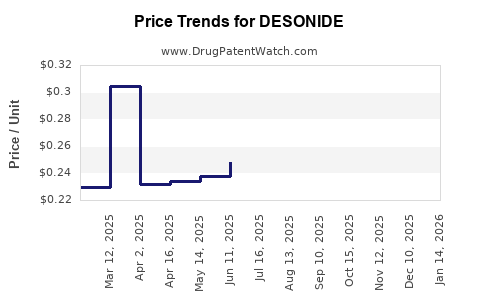

Generic Competition: The expiration of patent protections has led to numerous generic formulations, pressuring prices and margins [5].

-

Regulatory Challenges: Variability in regulatory approval processes and reimbursement policies across regions may hinder market expansion.

-

Concerns Over Long-term Use: Despite safety, apprehensions around corticosteroid side effects limit aggressive promotion and long-term usage.

Competitive Landscape

Major pharmaceutical companies producing Desonide include:

- Bausch Health (a subsidiary of Valeant Pharmaceuticals): Market leader with Reczema®, a favored brand.

- GlaxoSmithKline and Mylan: Competitors offering generic versions.

- Innovator Brands: Some regional players develop specialized formulations targeting niche markets.

The landscape is characterized by intense price competition, with significant emphasis on formulation innovation and supply chain efficiency to maintain profitability.

Regulatory Environment

Desonide’s approval status across key markets influences market dynamics:

- United States: Approved under the FDA’s dermatological indications; monographed as a OTC and prescription medication.

- European Union: Registered with the EMA; both prescription and OTC formulations available in certain countries.

- Emerging Markets: Regulatory pathways vary; some countries require localized clinical data, affecting market entry strategies.

Regulatory shifts toward stricter corticosteroid use guidelines could impact sales volumes, necessitating strategic compliance and advocacy initiatives.

Financial Trajectory and Revenue Forecasts

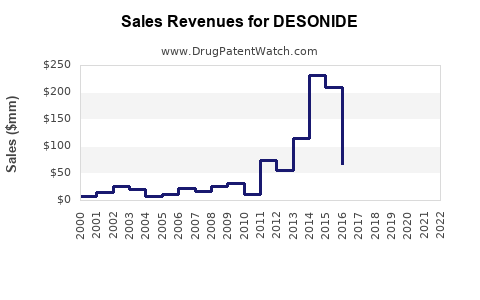

Historical financials: While specific sales data for Desonide are proprietary, industry estimates suggest that topical corticosteroid segment revenue experienced annual growth of approximately 3.5% over the past five years, supported predominantly by Desonide’s stability in developed markets [2].

Forecast models: Projected CAGR of ~4% over the next five years indicates moderate expansion driven by regional growth, innovation, and wholeyears of patent expiration effects. Slight downward pressure on per-unit prices due to generic competition is anticipated, but volume growth should offset revenue declines to sustain overall revenue stability.

Key factors influencing trajectory:

- Genericization Impact: As patents expire, generic proliferation could slash unit prices by 20-30%, impacting profit margins.

- Market Expansion: Entry into underserviced emerging markets could catalyze growth, offsetting declines elsewhere.

- Formulation Innovations: Extended-release or combined formulations might command premium pricing and diversify revenue streams.

Emerging Trends and Innovation Opportunities

- Novel Delivery Platforms: Nanotechnology-based formulations are in development to enhance bioavailability and reduce application frequency.

- Digital and Telehealth Integration: Teledermatology accelerates prescription trends, potentially increasing Desonide utilization through remote consultations.

- Personalized Medicine: Genomic and microbiome insights may tailor corticosteroid therapy, optimizing efficacy and safety.

Conclusion

Desonide’s market remains driven by its safety profile, therapeutic efficacy, and widespread dermatological need. While patent protections have largely expired, intensifying generic competition constrains margins. Nonetheless, regional growth, formulation innovation, and healthcare delivery advances promise steady financial performance over the coming years. Stakeholders must adapt to evolving regulatory standards, optimize supply chains, and innovate formulations to sustain competitive advantage.

Key Takeaways

- The Desonide market benefits from a consistent demand for low-potency corticosteroids in dermatology, with stable revenue projections around 4% CAGR through 2028.

- Regional growth in emerging markets offers new revenue streams, offsetting price erosion due to generic competition.

- Innovation in formulation and digital health integration present opportunities for differentiation and premium pricing.

- Regulatory landscapes vary significantly, requiring strategic compliance to maintain market access.

- Price competition and patent expirations necessitate a focus on operational efficiency and product differentiation for profit sustainability.

FAQs

1. What factors influence the pricing of Desonide formulations?

Pricing is impacted by patent status, generic competition, formulation complexity, regional regulatory standards, and market demand. Patent expirations generally lead to price reductions due to increased generic availability.

2. How does regional regulation affect Desonide market entry?

Regions with stringent approval processes and different classification (OTC vs. prescription) influence product access, pricing strategies, and marketing approaches. Local clinical data requirements can delay or complicate market entry.

3. What are the primary therapeutic advantages of Desonide over higher-potency corticosteroids?

Desonide offers effective anti-inflammatory action with a lower risk of side effects such as skin atrophy, making it suitable for sensitive populations and prolonged use.

4. How is innovation impacting Desonide’s market positioning?

Formulation advancements, like sustained-release topical systems, enhance efficacy, improve patient adherence, and allow premium pricing. Digital health integrations expand reach through telemedicine channels.

5. What measures can manufacturers adopt to sustain profitability amid rising generic competition?

Investing in formulation innovation, expanding into emerging markets, engaging in brand differentiation, optimizing supply chains, and leveraging digital platforms can help sustain margins.

References

[1] U.S. Food and Drug Administration (FDA). Desonide topical data sheet. 2022.

[2] MarketWatch. Topical corticosteroids market report. 2022.

[3] Research and Markets. Global topical corticosteroids market forecast. 2023.

[4] WHO. Prevalence of dermatological conditions. 2021.

[5] Pharmaceutical Technology. Patent expiration and generic competition. 2022.