Last updated: July 27, 2025

Introduction

Cyclosporine, an immunosuppressant drug primarily used to prevent organ rejection in transplant patients, has established a dominant position in the pharmaceutical landscape since its approval in the 1980s. Its intricate market dynamics, driven by evolving therapeutic indications, patent life cycles, regulatory landscapes, and emerging biosimilars, shape its financial trajectory. Understanding these elements is essential for stakeholders aiming to navigate the complex commercial environment surrounding cyclosporine.

Historical Context and Market Introductions

Cyclosporine was first approved in 1983 by the U.S. Food and Drug Administration (FDA) as Sandimmune, revolutionizing transplant medicine. Its mechanism as a calcineurin inhibitor suppressed T-cell activation, reducing rejection episodes. The drug's rapid uptake, coupled with the scarcity of alternatives initially, cemented its competitive advantage. However, patent protections and formulation innovations significantly influence market durability and profitability.

Current Market Landscape

Leading Players and Product Portfolio

Major players include Novartis with its brand Neoral, and newer entrants such as Teva Pharmaceuticals, which markets generic versions of cyclosporine[1]. The landscape is characterized by a mix of branded and generic products. The expiration of patent protections and exclusivities has prompted a surge in generic competition, affecting pricing and market share.

Therapeutic Indications and Market Segments

While primarily indicated for organ transplantation, cyclosporine's off-label uses, such as autoimmune diseases (e.g., psoriasis, rheumatoid arthritis), expand its market. Despite these indications, transplant-related applications comprise the majority of revenues, driven by stringent dosing and monitoring requirements. The rising prevalence of organ transplant procedures globally sustains demand, but growth is tempered by technological advances and alternative immunosuppressants.

Regulatory Environment

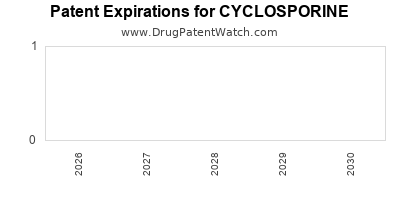

Regulatory pathways influence market entry and competition. The introduction of biosimilars and generics is guided by stringent bioequivalence and safety standards. Patent expirations—most notably the initial patents expired in the early 2000s, with subsequent formulations and synthesis methods covered by newer patents—directly impact market pricing strategies and revenue streams[2].

Market Drivers and Challenges

Drivers

- Growing Organ Transplant Procedures: An increase in solid organ transplants globally, fueled by rising degenerative and chronic diseases, sustains therapeutic demand[3].

- Innovative Formulations: Developments such as microemulsion formulations (e.g., Neoral) have improved bioavailability, supporting premium pricing.

- Regulatory Approvals for New Indications: Expanding indications, including treatment of autoimmune conditions, could unlock new revenue streams.

Challenges

- Generic Competition: Loss of patent exclusivity leads to price erosion. Generic versions often reduce the market share and profitability of branded formulations.

- Concerns over Safety Profile: Narrow therapeutic window and adverse effects such as nephrotoxicity, hypertension, and neurotoxicity impose monitoring challenges, influencing prescribing behaviors.

- Emerging Therapeutics: Novel immunosuppressant drugs (e.g., tacrolimus, belatacept) and biologics may supplant cyclosporine in certain indications.

Financial Trajectory Analysis

Revenue Trends

Global sales of cyclosporine peaked in the early 2000s, reaching approximately $2.5 billion annually, driven predominantly by Neoral and Sandimmune. Post-patent expiration, revenues declined due to increased generic penetration, with estimates indicating a contraction of approximately 25–30% over the past decade[4].

Market Forecast and Growth Outlook

Future growth prospects hinge on several factors:

- Market Penetration of Generics: Generics often comprise over 70% of the market share in developed countries, exerting downward pressure on prices.

- Emerging Markets Expansion: Developing economies with rising transplantation procedures and improving healthcare infrastructure present opportunities for growth, albeit at lower price points.

- New Formulations and Delivery Systems: Innovations such as extended-release formulations or targeted delivery could command premium pricing and bolster revenues.

Analysts project a compound annual growth rate (CAGR) of approximately 1–2% over the next five years, predominantly driven by emerging markets and incremental indication expansion[5].

Profitability and Investment Considerations

Patent expiries and generic competition challenge profit margins, compelling pharmaceutical companies to diversify portfolios and invest in biosimilars or adjunct therapies. Lifecycle management strategies, including reformulations and new delivery methods, remain essential to sustaining revenue streams.

Impact of Biosimilars and Patent Expirations

The entry of generic and biosimilar products notably impacts cyclosporine’s financial trajectory. While biosimilars—large, complex molecules with significant manufacturing intricacies—are less prevalent in cyclosporine due to its small-molecule nature, the rise of generics in this domain illustrates a broader market trend. Patent expiries in the early 2000s have precipitated price competition, with some reports indicating price reductions of up to 50%[2].

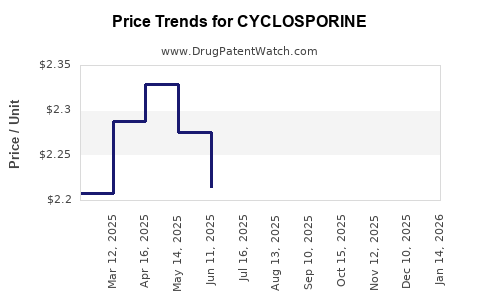

Pricing Strategies Post-Patent

Post-patent expiration, manufacturers often resort to aggressive pricing to gain market share. Price differentials between branded and generic products can reach 40–60%, leading to significant revenue declines for original innovator products. Such dynamics necessitate strategic realignment focusing on cost-efficient manufacturing and differentiated formulations.

Emerging Trends and Future Outlook

Therapeutic Innovation and Companion Diagnostics

Advances in personalized medicine, including pharmacogenomics, may optimize immunosuppressant therapy, improving outcomes and reducing adverse events. This evolution could influence demand and use patterns for cyclosporine.

Regulatory and Policy Changes

Health authorities’ emphasis on cost containment and biosimilar adoption will shape the competitive landscape. Favorable policies regarding biosimilar substitution and interchangeability can accelerate generic uptake and pressure pricing further.

Market Consolidation and Strategic Alliances

Large pharmaceutical corporations are increasingly engaging in mergers, acquisitions, and licensing agreements to expand their immunosuppressant portfolios, diversify revenue streams, and develop next-generation analogs.

Key Takeaways

- Patent expiration and generic competition significantly influence cyclosporine's market revenues, necessitating strategic lifecycle management.

- Global growth in organ transplantation and expanding indications support ongoing demand, especially in emerging markets.

- Innovative formulations and delivery mechanisms may offer avenues to sustain profitability amidst pricing pressures.

- Market stakeholders should monitor biosimilar developments and regulatory policies that could alter competitive dynamics.

- Investments in personalized medicine and combination therapies could redefine cyclosporine’s role in immunosuppressive protocols.

Conclusion

The market dynamics surrounding cyclosporine are characterized by a mature, highly competitive environment influenced by patent timelines, biosimilar proliferation, and evolving therapeutic paradigms. While revenues have declined from historical peaks due to generic entries, global demographic trends and technological innovations continue to sustain moderate growth prospects. Strategic adaptation, including focus on emerging markets and formulation innovations, will be critical for pharmaceutical companies seeking to optimize the financial trajectory of cyclosporine in the coming decade.

FAQs

1. How have patent expirations impacted cyclosporine's market size?

Patent expirations in the early 2000s led to a surge in generic versions, causing price erosion and a reduction in overall revenue for branded formulations, with market sizes shrinking by approximately 25–30% over the past decade.

2. What are the primary therapeutic indications for cyclosporine today?

Beyond organ transplantation, cyclosporine is used in autoimmune diseases such as psoriasis, rheumatoid arthritis, and atopic dermatitis, though transplantation remains its main application.

3. Are biosimilars relevant to cyclosporine’s market?

No, since cyclosporine is a small-molecule drug; however, generic versions fill a similar role, and biosimilars are more relevant for biologic immunosuppressants.

4. What future innovations could influence cyclosporine's market outlook?

Formulation advancements, personalized treatment approaches, and combination therapies may help maintain or enhance its market position.

5. How do emerging markets influence cyclosporine's global sales?

Growing transplantation procedures and healthcare infrastructure improvements increase demand, offering growth opportunities despite lower price points compared to developed nations.

References

[1] IMS Health. (2020). Global Immunosuppressant Market Analysis.

[2] U.S. Patent and Trademark Office. (2019). Patent Timeline for Cyclosporine.

[3] Transplant Trends. (2021). Global Organ Transplant Statistics.

[4] Market Watch. (2022). Post-Patent Market Dynamics for Immunosuppressants.

[5] Future Market Insights. (2023). Cyclosporine Market Forecast.