Last updated: July 27, 2025

Introduction

Chlorthalidone, a thiazide-like diuretic primarily prescribed for hypertension and edema, occupies a significant niche within cardiovascular therapeutics. Its longstanding therapeutic efficacy, coupled with emerging market trends and evolving regulatory landscapes, influence its market positioning and financial trajectory. This analysis explores the key drivers, market barriers, competitive landscape, and financial outlook shaping chlorthalidone's future.

Therapeutic Profile and Market Positioning

Chlorthalidone, approved by the FDA in 1960, offers superior antihypertensive efficacy compared to traditional thiazide diuretics such as hydrochlorothiazide (HCTZ). Its longer half-life (approximately 40-60 hours) ensures sustained blood pressure control, which has positioned it favorably in guidelines for hypertension management [1].

Despite its clinical merits, chlorthalidone remains a generic medication with minimal direct patent protections since its exclusivity period ended decades ago. Its market presence largely depends on prescriber preferences, formulary decisions, and the competitive dynamics with other antihypertensive agents.

Market Drivers

Increasing Prevalence of Hypertension

Global hypertension rates continue to surge, driven by demographic shifts, lifestyle factors, and urbanization. The World Health Organization estimates that over 1.28 billion adults suffer from hypertension worldwide [2]. This escalating prevalence amplifies demand for effective antihypertensive therapies, including chlorthalidone, particularly as guidelines increasingly endorse its use.

Guideline Endorsements and Clinical Evidence

Major clinical guidelines, notably from the American College of Cardiology (ACC) and the American Heart Association (AHA), recognize chlorthalidone for arriving at optimal blood pressure reduction and cardiovascular risk mitigation [3]. Its superior efficacy over HCTZ has been demonstrated across multiple trials, fostering a preference among clinicians seeking durable blood pressure control.

Cost-Effectiveness and Accessibility

Being a generic drug, chlorthalidone offers a low-cost treatment option, critical in resource-constrained settings and for health systems aiming to curtail pharmaceutical expenditures. Its affordability sustains solid demand, especially where payers favor cost-effective management strategies.

Emerging Use in Related Indications

Recent studies suggest potential benefits in metabolic syndrome components and certain renal conditions, broadening its therapeutic scope. Although these indications are not yet widely adopted, they could stimulate incremental market growth.

Market Barriers and Challenges

Limited Commercial Incentives

As a widely used generic, chlorthalidone faces minimal R&D investment incentives, leading to potential supply chain vulnerabilities and limited product differentiation. Manufacturers have little motivation to innovate or promote the drug beyond existing channels.

Competition from Alternative Therapies

The market for antihypertensive medications is crowded, with classes such as ACE inhibitors, ARBs, calcium channel blockers, and newer agents like device-based therapies entering the mix. Combination therapies further fragment the market landscape. Despite chlorthalidone’s efficacy, clinicians often prefer well-established counterparts like HCTZ, which benefits from aggressive marketing and familiarity.

Evolving Clinical Preferences

Recent shifts in clinical practice favor single-pill combinations and newer drugs with favorable side effect profiles. Concerns over electrolyte disturbances and metabolic effects associated with diuretics can influence prescribing tendencies away from chlorthalidone.

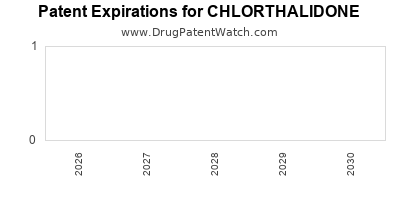

Regulatory and Patent Complexities

While chlorthalidone itself is off patent, patent expirations for combination drugs containing chlorthalidone or its formulations can influence market dynamics. Regulatory concerns about safety profiles, such as potential hypokalemia or hyperglycemia, may slow broader adoption.

Competitive Landscape

Market Share Dynamics

While chlorthalidone has seen a resurgence in some regions due to guideline endorsements, HCTZ remains the dominant diuretic due to early marketing and formulary access. The structural similarities between the two medications mean that market shifts depend heavily on clinical evidence dissemination and prescriber education.

Emergence of Combination Therapies

Fixed-dose combinations incorporating chlorthalidone with other antihypertensives are gaining popularity, potentially expanding the drug's usage. For instance, chlorthalidone combined with amlodipine or other agents offers convenience and improved adherence but faces competition from proprietary formulations.

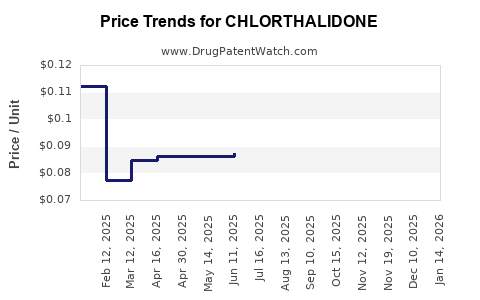

Manufacturing and Supply Chain Considerations

Key generic manufacturers vary by geography, affecting supply stability and pricing. Recent shortages or quality issues could impact market availability, influencing overall financial performance.

Financial Trajectory and Market Outlook

Revenue Trends and Forecasts

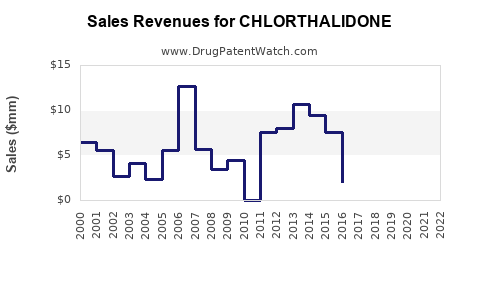

Given its generic status and diverse global usage, chlorthalidone’s revenue contributions are modest but steady, particularly in primary care and outpatient settings. The global hypertension market is projected to grow at a compound annual growth rate (CAGR) of approximately 5.2% through 2027 [4], supporting continued demand.

However, the nondifferentiated nature of chlorthalidone limits revenue growth potential compared to patented innovations or novel therapies. The primary sources of future revenue growth will likely stem from increased prescription adoption driven by guideline shifts and expanded indications.

Impact of Pharmacoeconomic Trends

Healthcare payers favor cost-effective medications; thus, chlorthalidone’s low cost ensures sustained inclusion in formulary lists. This economic advantage preserves its revenue base amidst intense competition.

Regulatory Influences

Future regulatory updates, including safety labeling revisions or new guideline recommendations, could sway prescribing patterns either positively or negatively. Some regulatory agencies have issued warnings regarding electrolyte disturbances, which might temper enthusiasm.

Innovation and Formulation Developments

Limited recent innovation exists for chlorthalidone. Investment in modified-release formulations or combination products could create niche markets, boosting financial trajectories. Such developments hinge on patent opportunities or exclusivity periods.

Key Market Trends and Drivers

- Guideline Integration: Adoption of chlorthalidone in hypertension treatment protocols influences prescribing behavior.

- Global Hypertension Burden: Rising awareness and screening programs increase demand.

- Cost Dynamics: Generic nature and low price point sustain accessibility and usage.

- Clinical Evidence: Reinforcement of efficacy over HCTZ fortifies its position.

- Competitive Pressures: Alternative therapies and combination drugs challenge market share.

Risk Factors and Market Limitations

- Market Saturation: Limited growth opportunities due to the availability of generic competition.

- Side Effect Profile: Electrolyte imbalance concerns may hinder broader use.

- Prescriber Preferences: Shifts toward novel or combination therapies may reduce reliance on single-agent diuretics.

- Regulatory Warnings: Safety concerns could affect formulary decisions.

Conclusion

The market dynamics for chlorthalidone are characterized by a balance of clinical efficacy, cost-effectiveness, and competitive pressures. Its financial trajectory is steady, bolstered by global hypertension trends and favorable guideline endorsements, yet constrained by the commoditized nature of generics and evolving prescriber preferences. Opportunities for growth may emerge from innovative formulations, expanded indications, and regional healthcare initiatives emphasizing affordable hypertension management.

Key Takeaways

- Strong Clinical Evidence and Guidelines: Reinforce chlorthalidone’s position as a first-line diuretic in hypertension management.

- Cost Advantage: Its status as a low-cost generic sustains demand across diverse healthcare markets.

- Limited Innovation: Lack of recent formulation enhancements constrains growth but offers opportunities for niche product development.

- Competition from Other Antihypertensives: Continual evolution of treatment paradigms favors combination therapies and newer agents.

- Global Burden of Hypertension: Rising prevalence supports steady demand; however, market share remains sensitive to prescriber preferences and safety considerations.

FAQs

1. What differentiates chlorthalidone from hydrochlorothiazide?

Chlorthalidone offers a longer half-life, resulting in more sustained blood pressure control. Clinical trials demonstrate superior efficacy in reducing cardiovascular events, promoting its preference in certain guidelines over hydrochlorothiazide.

2. Is chlorthalidone still under patent protection?

No. Chlorthalidone has been off patent for decades, classifying it as a generic medication with minimal proprietary restrictions, which limits revenue growth potential but ensures low-cost access.

3. What are the primary safety concerns associated with chlorthalidone?

Electrolyte disturbances such as hypokalemia and hyponatremia, as well as metabolic effects like hyperglycemia and hyperuricemia, are notable but manageable risks. Regulatory warnings may influence prescribing behavior.

4. How does market competition affect chlorthalidone's financial prospects?

The presence of numerous antihypertensive options, including combination therapies, limits chlorthalidone's market share. Its generic price advantage mitigates some competitive threats but does not prevent market saturation.

5. Are there experimental formulations or new indications for chlorthalidone?

Research explores modified-release formulations and ancillary uses in conditions like metabolic syndrome, but these are not yet standard and unlikely to significantly influence the overall market in the short term.

References

[1] US FDA. Chlorthalidone Drug Label.

[2] WHO. Hypertension Fact Sheet.

[3] ACS/AHA Guidelines. 2017 Hypertension Guidelines.

[4] Fortune Business Insights. Hypertension Drugs Market Forecast, 2022–2027.