Last updated: July 29, 2025

Introduction

Carbidopa is a critical pharmacological agent primarily used in the treatment of Parkinson’s disease. As a dopamine precursor, it enhances the efficacy of levodopa while mitigating peripheral side effects, such as nausea and cardiovascular issues. Given its established therapeutic role, understanding the evolving market dynamics and financial trajectory of carbidopa offers valuable insights for pharmaceutical stakeholders, investors, and healthcare decision-makers aiming to navigate this niche yet impactful segment.

Market Overview

Historical Context and Market Formation

Since its introduction in the late 1960s, carbidopa has been a cornerstone in Parkinson’s disease management, often marketed in combination formulations such as Sinemet (carbidopa/levodopa). The drug’s long-standing clinical utility has cemented its status within the pharmaceutical landscape. The origins trace back to the need for more targeted dopaminergic therapies that could minimize peripheral adverse effects associated with levodopa administration.

Current Market Landscape

The global demand for carbidopa remains robust, driven by the rising prevalence of Parkinson’s disease, which estimates indicate affects approximately 10 million individuals worldwide, with a projected increase due to aging populations (Source: WHO). The United States, Europe, and Japan form the primary markets, supported by established healthcare infrastructure and a high prevalence rate.

Market Segmentation and Composition

The market predominantly comprises prescription drugs that contain carbidopa, either as monotherapy or, more predominantly, in combination therapies. Key formulations include:

- Levodopa/Carbidopa: The gold standard therapy (e.g., Sinemet, Parcopa)

- Generic Variants: Cost-effective options supplied by multiple manufacturers

- Neurological Treatment Market: A subset with specific focus on Parkinson’s disease management

Market Drivers

- Aging Population: The global rise in elderly demographics sustains demand.

- Diagnosis Rates: Increased awareness and improved diagnostic protocols lead to higher treatment initiation.

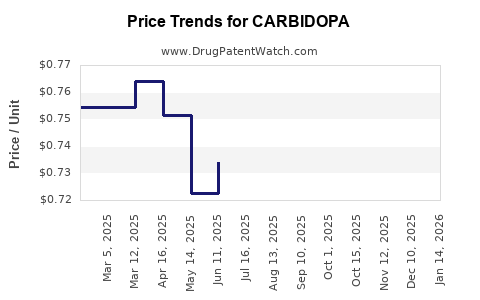

- Generic Entry: Expiration of patents has facilitated market entry for generics, exerting downward pressure on prices but expanding accessibility.

- Healthcare Infrastructure Growth: Expanding healthcare coverage in emerging markets boosts sales.

Market Challenges

- Pipeline Competition: Development of alternative therapies, including advanced dopaminergic agents and gene therapies, threaten market share.

- Pricing Pressures: Governments and payers seek cost reductions, favoring generic formulations.

- Regulatory Scrutiny: Stringent policies around drug approvals, especially for novel formulations, impact market entry strategies.

Financial Trajectory

Revenue Trends

The financial outlook for carbidopa is characterized by stable revenue streams, primarily maintained by existing formulations. For example, leading pharmaceutical companies report consistent income from their Parkinson’s treatment portfolios, with branded drugs like Sinemet providing significant market share.

Historical Revenue Data:

- United States (2010-2020): Steady compound annual growth rate (CAGR) of approximately 3-4%, reflecting stable demand with minor fluctuations primarily due to patent expirations and generic competition (Source: IQVIA).

- Global Market: Estimated revenues surpassing USD 1.2 billion in 2022, with projections indicating moderate growth over the next five years driven chiefly by emerging markets.

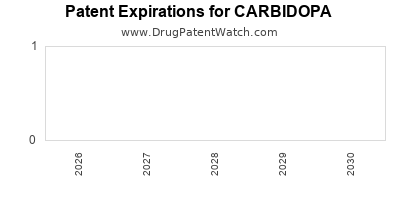

Impact of Patent Expirations

The expiration of key patents for combination formulations has shifted revenue composition. Companies shifted focus toward generic markets, resulting in volume-driven growth but compressing margins.

Emerging Opportunities and Financial Growth

Innovations in drug delivery (e.g., sustained-release formulations) and combination therapies with additional neuroprotective agents could augment market value. Though these are still in nascent stages, they present projected revenue uplift potential, especially if approved for broad indications.

Profitability Outlook

Profit margins are increasingly influenced by the proliferation of generics. While branded formulations historically yielded margins between 50-70%, generic versions often operate at margins in the 20-30% range, reflecting pricing pressures.

Forecasts (2023-2028):

- Compound Annual Growth Rate (CAGR): Expected to hover around 2-4% globally, assuming consistent Parkinson’s disease prevalence and stable healthcare policies.

- Market Expansion: Emerging markets expected to contribute a significant share to incremental revenue, supported by economic growth and healthcare investments.

- Pricing Dynamics: Continued erosion of margins is anticipated unless innovative delivery methods or combination drugs gain regulatory approval and market acceptance.

Competitive Landscape

Major players include:

- AbbVie: Historically dominant with Sinemet and other formulations.

- Teva Pharmaceuticals: Strong presence in generic markets.

- Mylan (now part of Viatris): Several generic carbidopa options.

- Other Regional Manufacturers: Increasing market penetration in Asia-Pacific and Latin America.

Emerging biotech firms exploring novel dopaminergic agents or adjunct therapies could alter the competitive balance over the coming decade.

Regulatory Environment and Market Entry

Patents for combination formulations have primarily expired, but regulatory environments remain rigorous, especially concerning bioequivalence and manufacturing standards. Strategic partnerships and licensing agreements continue to be vital for market access and revenue stabilization.

Future Market Drivers

- Novel Delivery Platforms: Transdermal patches and implantable devices may improve patient compliance, expanding market potential.

- Biotechnological Advances: Gene therapies targeting Parkinson’s pathology could diminish reliance on symptomatic pharmacotherapy, impacting long-term revenues.

- Global Healthcare Expansion: Economic growth in Asia, Africa, and Latin America will intensify market penetration, especially for affordable generic formulations.

Risks and Uncertainties

- Development of Disease-Modifying Therapies: Advances here could reduce reliance on symptomatic drugs like carbidopa.

- Regulatory Changes: Price control policies and changing drug approval standards threaten profit margins.

- Patent Challenges: Legal disputes and patent thickets could impact market exclusivity.

Key Takeaways

- Carbidopa maintains a stable but gradually declining revenue stream due to generics and patent expirations.

- The market is poised for steady growth driven by rising Parkinson’s prevalence, especially in aging populations of emerging economies.

- Innovation in drug delivery and combination therapies offers future growth opportunities, although profitability may be pressured by fierce generic competition.

- Strategic alliances and regulatory navigation remain critical for market access and financial performance.

- Monitoring biotechnology developments and healthcare policy shifts is crucial to anticipate long-term market evolution.

FAQs

1. How will patent expirations affect the profitability of carbidopa formulations?

Patent expirations have historically led to an influx of generic competitors, significantly reducing prices and profit margins for branded drugs. While volume increases partially offset lower prices, overall profitability tends to decline unless new formulations or delivery methods are introduced.

2. What emerging markets hold the most growth potential for carbidopa sales?

Emerging markets in Asia-Pacific, Latin America, and Africa present substantial growth prospects due to expanding healthcare infrastructure, rising disease awareness, and affordability of generic drugs.

3. Are there any promising innovations in carbidopa delivery or formulation?

Yes. Research into sustained-release formulations, transdermal patches, and implantable devices aims to improve patient adherence and reduce side effects, potentially opening new revenue streams.

4. How could new therapies impact the demand for carbidopa in the future?

Advances in disease-modifying therapies, gene editing, and neuroprotective agents may reduce reliance on symptomatic drugs like carbidopa, possibly leading to a decline in demand over the long term.

5. What role do regulatory policies play in shaping the market for carbidopa?

Regulatory frameworks influence drug approval, pricing, and patent protections. Increased scrutiny and price controls can suppress revenues, while supportive policies for generics may enhance access and volume.

References

[1] World Health Organization. Parkinson’s disease prevalence factsheet. 2022.

[2] IQVIA. Global Parkinson’s Disease Treatment Market Data. 2022.

[3] U.S. Food and Drug Administration. Bioequivalence requirements for generic drugs. 2021.