Last updated: July 27, 2025

Overview of Atovaquone

Atovaquone is an antiprotozoal medication primarily utilized to treat Pneumocystis pneumonia (PCP), malaria, and certain other parasitic infections. Its mechanism involves disrupting mitochondrial electron transport in protozoa, leading to parasite death. Marketed notably as Mepron for PCP and Malarone (combination of atovaquone and proguanil) for malaria prophylaxis and treatment, it has carved a significant niche within infectious disease pharmacotherapy.

Current Market Landscape

Global Market Size and Trends

The global atovaquone market was valued at approximately USD 150 million in 2022, with projections indicating a compounded annual growth rate (CAGR) of 4-6% through 2030. Key factors driving this growth include rising prevalence of opportunistic infections among immunocompromised populations, increasing travel to malaria-endemic regions, and expanding indications for combination therapies.

Major Geographies

- North America: Dominates the market, driven by high healthcare expenditure, awareness, and availability of advanced healthcare infrastructure.

- Europe: Steady growth fueled by increased parasitic disease management and aging populations.

- Asia-Pacific: Emerging market with rapid growth potential owing to higher malaria endemicity, increasing healthcare access, and generic drug proliferation.

- Rest of World: Developing economies expanding access to proven antiprotozoal therapeutics.

Market Drivers

- Rising Malaria Burden

Malaria remains a significant global health challenge, particularly in sub-Saharan Africa and Southeast Asia. The WHO estimates over 200 million cases annually, with atovaquone (notably when combined in Malarone) being pivotal in prophylactic and therapeutic regimes[^1]. Government and NGO campaigns promoting malaria prevention are bolstering demand.

- HIV/AIDS and Opportunistic Infections

The persistent global HIV burden sustains the need for PCP prophylaxis. Increased screening and early management extend the use of atovaquone, especially among immunocompromised individuals.

- Emergence of Drug-Resistant Parasites

Resistance to traditional therapies like chloroquine and sulfadoxine-pyrimethamine is prompting clinicians to adopt atovaquone-based regimens, despite their higher cost, as second-line options.

- Generic Entry and Cost Accessibility

The expiration of several patents has facilitated generic manufacturing, reducing prices and broadening access, especially in low-income regions. This influx of generics catalyzed a substantial uptick in treatment coverage.

- Expanded Indications and Research

Ongoing research into novel uses—such as atovaquone's potential antiviral properties or roles in emerging parasitic diseases—may further expand its market footprint.

Market Challenges

- High Chlorine and Manufacturing Costs: Complex synthesis pathways increase costs relative to other antiparasitic agents.

- Limited Breadth of Indications: The drug’s primary reliance on PCP and malaria limits diversification; no substantial new indications are imminent.

- Adverse Effect Profile: Though generally well-tolerated, side effects like gastrointestinal disturbances and rash can hinder adherence, especially in combination therapies.

Competitive Landscape

The landscape encompasses brand-name products like Mepron and Malarone, along with a growing array of generics. Key players include GSK, Mylan, Teva, and others, competing on price, formulation, and supply stability.

Innovative therapies targeting resistant strains or alternative delivery methods (e.g., long-acting formulations) remain in early development stages.

Financial Trajectory

Revenue Trends

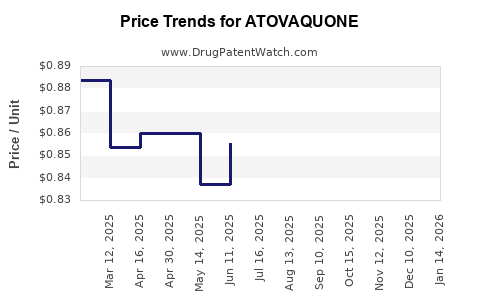

Revenue has demonstrated steady growth, influenced by increased utilization in endemic regions and expanding prophylactic use in travelers and immunocompromised patients. The introduction of generics has exerted downward pressure on prices but simultaneously increased sales volume.

Pricing and Market Penetration

Prices vary considerably: brand-name drugs like Malarone cost approximately USD 70-100 per treatment course in the U.S., while generics are priced as low as USD 10-20[^2]. This price elasticity impacts revenue dynamics, especially in lower-income markets.

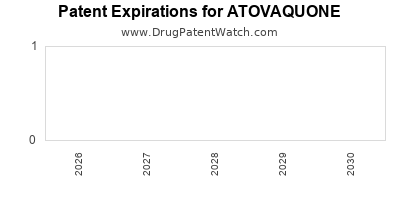

Impact of Patent Expiries

Patent expirations over the past decade in key markets have significantly broadened market access, eroding margins for original developers. However, ongoing research, new formulations, and expanded indications could mitigate this impact.

Forecasting

By 2030, revenues are expected to stabilize with moderate growth aligning with the overall parasitic infection market expansion. The shift toward combination therapies and potential new indications could influence future revenue streams.

Regulatory and Patent Outlook

Patent protections for core formulations generally expired or are nearing expiry, prompting a shift towards pipeline development and formulation innovations. Regulatory environments continue to evolve, with some regions streamlining approval pathways for generic atovaquone products, further impacting market dynamics.

Strategic Considerations for Stakeholders

- Investors should monitor patent expiry timelines, generic entry, and emerging indications.

- Pharmaceutical companies must balance the high R&D costs against the relatively mature market, exploring new formulations and potential secondary uses.

- Healthcare policymakers focus on affordability and access, especially in endemic regions, influencing pricing and procurement strategies.

Key Takeaways

- The atovaquone market exhibits steady growth driven by the global parasitic disease burden, rising opportunistic infections, and expanded prophylactic use.

- Generic drug proliferation and patent expiries have lowered prices, broadening markets but challenging margins for original developers.

- Limited indications and resistance issues constrain growth prospects; innovation and pipeline development are vital to sustain long-term revenue.

- Asia-Pacific markets present substantial growth opportunities, driven by endemic malaria and increasing healthcare infrastructure.

- Strategic partnerships, formulation innovations, and exploring new therapeutic domains will be pivotal for companies aiming to capitalize on atovaquone’s potential trajectory.

FAQs

Q1: What are the primary clinical applications of atovaquone?

A: Atovaquone is chiefly used for Pneumocystis pneumonia prophylaxis and treatment, and for malaria prophylaxis and treatment, especially in combination therapies like Malarone.

Q2: How has patent expiry affected the atovaquone market?

A: Patent expirations have facilitated generic manufacturing, leading to lower prices and expanded access, but have also pressured profits of original brand manufacturers.

Q3: What future developments could influence the atovaquone market?

A: The development of new formulations, introduction of long-acting delivery systems, and expansion into novel indications may bolster market growth.

Q4: Which regions are expected to see the highest growth in atovaquone demand?

A: Asia-Pacific and Africa are poised for significant growth due to endemic parasitic diseases and increasing healthcare infrastructure.

Q5: What challenges could impede atovaquone’s market expansion?

A: Resistance development, limited indications, and competition from alternative therapies or emerging drugs could restrain growth.

References

[1] World Health Organization. World Malaria Report 2022.

[2] GoodRx. Pricing information for Malarone and Atovaquone generics.