Last updated: December 3, 2025

Summary

Acyclovir, a pioneering antiviral medication developed by GlaxoSmithKline (GSK) in the 1970s, has maintained a significant market position in the treatment of herpes simplex virus (HSV) and varicella-zoster virus (VZV) infections. This analysis explores the current market landscape, factors influencing its financial trajectory, competitive dynamics, and future outlook.

Key insights include:

- The global acyclovir market was valued at approximately USD 1.2 billion in 2022, with steady compound annual growth rate (CAGR) projections of 3-4% over the next five years.

- Increasing prevalence of herpesvirus infections, growing aging populations, and expanding healthcare access are primary drivers.

- Patent expirations, generic competition, and evolving antiviral therapies influence revenue streams.

- Emerging regions such as Asia-Pacific present lucrative growth opportunities.

- Innovations in antiviral formulations and combination therapies may redefine market dynamics.

- Major players include GSK, Teva, Mylan, and Sun Pharma, each with varying strategic focus.

This report synthesizes market data, competitive positioning, regulatory policies, and forecast models to inform stakeholder decision-making.

What are the current market dynamics for acyclovir?

Global Market Size and Growth Trends

| Parameter |

Details |

| Market Value (2022) |

USD 1.2 billion |

| CAGR (2023–2028) |

3.0–4.0% |

| Regional Distribution |

North America (40%), Europe (25%), APAC (20%), ROW (15%) |

Source: Grand View Research, 2022

Key Drivers

| Factor |

Impact |

| Increasing Herpesvirus Incidence |

Herpes labialis, genital herpes, and shingles are prevalent globally, driving demand. |

| Aging Population |

Older demographics exhibit higher infection rates, especially VZV. |

| Expanding Healthcare Access |

Improved diagnostics and acceptance in emerging markets broaden utilization. |

| Generic Market Penetration |

Patent expirations have increased affordability and access, expanding volumes. |

| Healthcare Spending Growth |

Increased healthcare budgets enable broader antiviral prescriptions. |

Major Market Challenges

| Barrier |

Implication |

| Patent Expirations |

Accelerates generic competition, exerting downward pressure on prices. |

| Emergence of Resistance |

Viral resistance reduces efficacy, necessitating new formulations. |

| Competition from Novel Antivirals |

Drugs like valacyclovir and famciclovir pose substitutes. |

| Regulatory Hurdles |

Variability in approvals across regions may delay entry or expansion. |

Competitive Landscape

| Company |

Market Share (Estimate, 2022) |

Key Strategies |

| GSK (Acyclovir Original) |

35% |

Maintaining brand dominance via established efficacy. |

| Teva Pharmaceuticals |

20% |

Focus on generics and biosimilars. |

| Mylan (Now part of Viatris) |

15% |

Price competitiveness and product diversification. |

| Sun Pharma |

10% |

Expanding regional presence, especially in APAC. |

| Others |

20% |

Independent generics, regional players. |

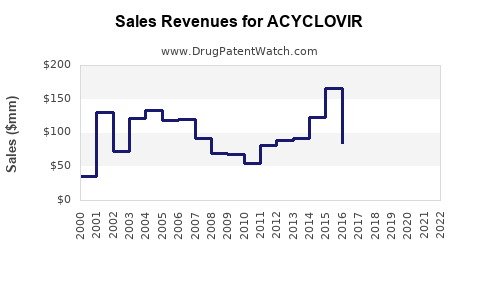

What factors influence the financial trajectory of acyclovir?

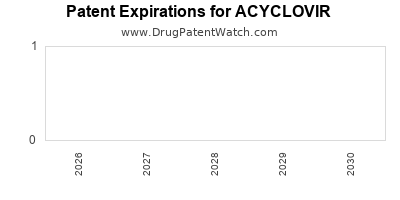

Patent and Exclusivity Landscape

| Timeline |

Details |

| Original Patent Expiry (US) |

2006 |

| International Patent Status |

Varies by country; many patents expired or are nearing expiration. |

| Impact on Revenue |

Significant decline post-patent expiry; increased generics entry. |

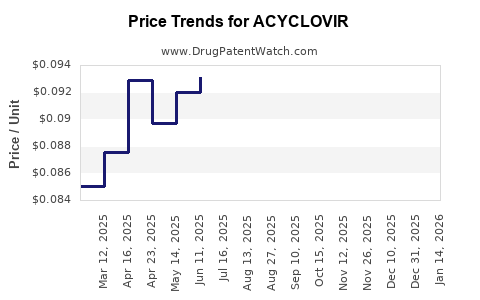

Pricing Dynamics

| Pre- and Post-Patent Expiry |

Impact |

| Pre-expiry |

Higher margins via patent protection. |

| Post-expiry |

Price erosion due to generic competition, volume-driven revenue focus. |

Regional Revenue Contributions

| Region |

2022 Share |

Growth Drivers |

| North America |

40% |

High healthcare expenditure, established infrastructure. |

| Europe |

25% |

Prescriptive norms, aging populations. |

| Asia-Pacific |

20% |

Rapid market expansion, increasing infection rates, affordability. |

| Rest of World |

15% |

Growing awareness and local manufacturing. |

Emerging Opportunities

| Market Segment |

Potential Impact |

| Pediatric & Geriatric Use |

Growing age groups with higher infection risk. |

| Chronic HSV Management |

Shift toward long-term suppressive therapies. |

| Combination Therapies |

Synergy with immunomodulatory agents to mitigate resistance. |

| Biosimilar Market Entry |

Cost-effective alternatives, especially in price-sensitive markets. |

How do regional and regulatory policies shape the trajectory?

Regulatory Policies Overview

- US FDA: Approves generic formulations post-patent expiration; encourages biosimilar development.

- EMA (Europe): Follows similar pathways; incentivizes generic entry with accelerated review pipelines.

- Asia-Pacific: Regulatory frameworks vary; some countries lack generic approval pathways, influencing market access.

Policy Impact Analysis

| Policy Element |

Effect on Market |

| Patent Laws and Exclusivity |

Dictate timing of generic entry; influence revenue peaks. |

| Healthcare Reimbursement Policies |

Determine affordability and prescribing patterns. |

| Quality and Manufacturing Standards |

Affect market entry barriers for generics and biosimilars. |

Trends & Future Outlook

- Increased focus on biosimilar registration procedures.

- Potential for bilateral or regional patent litigations delaying generic competition.

- Harmonization efforts could accelerate market entry and reduce disparities.

Comparative Analysis: Acyclovir versus Valacyclovir and Famciclovir

| Parameter |

Acyclovir |

Valacyclovir |

Famciclovir |

| Formulations |

Oral, topical, intravenous |

Oral |

Oral |

| Bioavailability |

10–20% |

55–70% |

75–77% |

| Dosing Frequency |

Multiple daily doses |

Once or twice daily |

Twice daily |

| Cost |

Lower (generics widely available) |

Higher |

Similar or higher than acyclovir |

| Efficacy |

Established, for initial and recurrent infections |

Similar, with better bioavailability |

Similar, with improved convenience |

Implication: While acyclovir remains cost-effective, newer agents like valacyclovir offer convenience, influencing prescribing preferences especially in developed markets.

Future Market Outlook and Innovation Trajectories

Technological and Pharmacological Innovations

- Prodrug Development: Enhanced formulations for better bioavailability and patient compliance.

- Combination Therapies: Synergistic agents targeting resistance mechanisms.

- Nanotechnology: Targeted delivery systems reducing adverse effects.

- Gene-Based Therapies: Potential future shift towards curative approaches over antiviral suppression.

Market Expansion Opportunities

| Region |

Drivers for Growth |

| Asia-Pacific |

Population growth, rising healthcare expenditure, urbanization. |

| Latin America |

Increasing access to healthcare, regional manufacturing hubs. |

| Africa |

Growing prevalence of herpes infections, expanding clinics. |

Potential Disruption Factors

- Transition towards personalized medicine.

- Regulatory barriers to novel delivery systems.

- Cost pressures limiting innovation investments.

Key Takeaways

- Acyclovir's market remains stable due to its longstanding efficacy, but faces margin compression post-patent expiry.

- Generics significantly influence pricing, expanding access but reducing overall revenue for brand holders.

- Rising herpesvirus prevalence and aging demographics drive demand growth, especially in emerging regions.

- Competition from newer antivirals and resistance patterns necessitate ongoing innovation.

- Regulatory frameworks and regional policies are critical determinants in market accessibility.

- Future growth hinges on technological innovation, regional market expansion, and strategic partnerships.

FAQs

1. What is the primary driver for the current growth of acyclovir?

The primary driver is the increasing global prevalence of herpesvirus infections, coupled with aging populations and expanding healthcare access, especially in emerging markets.

2. How do patent expirations impact acyclovir’s market?

Patent expirations lead to increased generic competition, lowering prices, and expanding volume-driven sales, but also reduce profit margins for originator companies.

3. Which regions are expected to see the fastest growth in acyclovir markets?

Asia-Pacific and Latin America are anticipated to experience the fastest growth owing to demographic shifts, improving healthcare infrastructure, and higher infection rates.

4. How is resistance affecting acyclovir's future?

Viral resistance, especially among immunocompromised patients, compels the development of new formulations and combination therapies to maintain efficacy.

5. What innovative developments could reshape the acyclovir market?

Prodrug formulations with improved bioavailability, combination therapies targeting resistance, and gene editing approaches represent key future innovations.

References

[1] Grand View Research. "Herpesvirus Treatments Market Size, Share & Trends Analysis." 2022.

[2] U.S. Food and Drug Administration. "Acyclovir Drug Approvals & Patent Status." 2022.

[3] European Medicines Agency. "Antiviral Drugs Regulatory Framework." 2022.

[4] MarketWatch. "Global Acyclovir Market Forecast and Trends." 2023.

[5] World Health Organization. "Herpes Simplex Virus Epidemiology." 2021.