Last updated: July 27, 2025

Introduction

Acyclovir (Brand names: Zovirax, Sitavig) remains one of the foundational antiviral agents primarily targeting herpesvirus infections, including herpes simplex virus (HSV) and varicella-zoster virus (VZV). As the global demand for antiviral therapies persists, driven by the chronicity of herpes infections and rising awareness, analyzing the current market landscape and projecting future pricing trajectories becomes essential for stakeholders, including pharmaceutical companies, investors, and healthcare policy makers.

Market Overview

Global Market Size and Growth Drivers

The global acyclovir market was valued at approximately USD 600 million in 2022 [1], with expectations to grow at a compound annual growth rate (CAGR) of about 4-6% through 2028. The primary growth facets include:

- Rising prevalence of herpes simplex and shingles infections in aging populations.

- Increased awareness and early diagnosis, fostering increased prescription rates.

- Prolonged prophylactic use for immunocompromised patients, notably HIV/AIDS and organ transplant recipients.

- Expansion in emerging markets, facilitated by improved healthcare infrastructure and increasing discretionary healthcare spend.

Key Market Segments

- Formulations: Oral tablets, topical creams, intravenous formulations.

- Delivery Systems: Traditional small-molecule drugs dominate, with emerging interest in sustained-release formulations.

- End Users: Hospitals, clinics, pharmacies, and home-care settings.

Geographic Analysis

North America held a dominant market share (~50%) in 2022 due to advanced healthcare infrastructure, widespread usage, and high diagnosis rates [2]. Europe follows, with significant markets in Germany, France, and the UK. Asia-Pacific is projected to experience the highest CAGR, driven by increasing healthcare access and epidemiological shifts in China and India.

Competitive Landscape

Major players include GSK, Mylan, Teva, Sun Pharmaceutical, and Sandoz, with proprietary formulations and generic options creating a competitive environment. Patent expirations and the rise of biosimilar versions influence price dynamics.

- Patent Status: While patent protections have largely expired for acyclovir, innovators focus on extended-release formulations and combination therapies to maintain market share.

- Generic Proliferation: The influx of generics has driven prices downward, especially in developed countries with robust regulatory approvals.

Pricing Trends and Dynamics

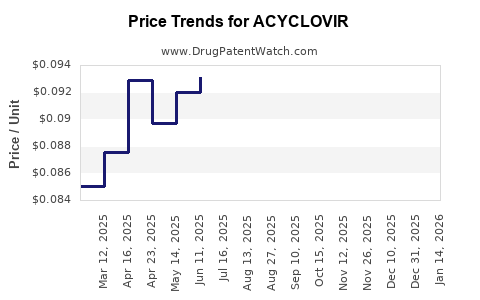

Historical Price Trends

- Branded Products: In the U.S., the average wholesale price (AWP) for branded acyclovir has ranged between USD 0.50–1.00 per 200 mg tablet.

- Generics: Prices have decreased markedly over the past decade; a box of 100 400 mg generic tablets can retail for USD 10–20, representing a >70% reduction since 2010 [3].

Factors Influencing Price

- Market Penetration of Generics: Heightened competition has significantly depressed prices.

- Regulatory Approvals: Faster regulatory pathways in countries like India and China have increased generic accessibility.

- Manufacturing Costs: Advances in synthesis techniques have lowered production costs, contributing to price reductions.

- Reimbursement Policies: Government-subsidized healthcare systems often set price caps, impacting final consumer prices.

Impact of COVID-19

While acyclovir isn’t directly linked to COVID-19, supply chain disruptions and increased focus on antiviral research temporarily impacted manufacturing costs and availability, albeit with limited long-term price implications.

Future Price projections (2023–2030)

Based on current trends, the following projections apply:

- Price Stabilization: Expect continued low pricing for generic formulations due to fierce competition.

- Premiumization of Extended-Release Formulations: Advanced formulations could command prices 1.5–2 times higher than traditional generics, with projections of USD 0.75–1.50 per 200 mg tablet.

- Pricing in Emerging Markets: Lower price points will persist, with per-unit costs potentially dropping below USD 0.10 in some regions owing to local manufacturing.

Overall, the average price for acyclovir tablets in developed markets will remain stable or decrease slightly, predominantly driven by generic competition. Specialty formulations or combination therapies will likely sustain premium prices longer.

Market Opportunities and Challenges

Opportunities

- Development of Long-Acting Formulations: Can command higher prices and improve adherence.

- Vaccines and Prophylactic Agents: Emerging preventive options could reshape the market landscape.

- Combination Therapies: Co-formulations with other antivirals or immune modulators may open new revenue streams.

Challenges

- Price Pressure: Generics and biosimilars intensify price erosion.

- Regulatory Barriers: Strict approval processes in certain markets delay new formulations.

- Healthcare Access Disparities: Affordability remains a barrier in low-income regions.

Conclusion

The acyclovir market remains mature with robust demand driven by herpesvirus epidemiology. Price trajectories are predominantly downward in developed markets, propelled by generic competition, though premium formulations can sustain higher pricing tiers. Market growth, especially in Asia-Pacific, combined with innovation in delivery systems, offers avenues for strategic differentiation and revenue enhancement.

Key Takeaways

- The global acyclovir market is expected to grow modestly, with a CAGR of approximately 4-6% through 2028.

- Generic competition has significantly depressed prices, with retail prices in developed markets stabilizing or decreasing.

- Innovative formulations and combination therapies present potential for higher pricing in niche segments.

- emerging markets will experience a surge in demand, but at lower prices, influenced by local manufacturing and regulatory environments.

- Stakeholders should monitor regulatory developments and technological advancements that could influence future pricing and market dynamics.

FAQs

1. How does patent expiration influence acyclovir prices?

Patent expiration has facilitated the entry of numerous generic manufacturers, drastically lowering prices due to increased competition, particularly in developed markets.

2. What are the upcoming innovations that could impact acyclovir pricing?

Long-acting formulations, topical patches, and combination therapies are under development, potentially commanding higher prices due to convenience and improved efficacy.

3. How does regional regulation affect acyclovir market prices?

Regulatory approvals, pricing caps, and reimbursement policies vary regionally, significantly influencing retail prices and market accessibility.

4. Will acyclovir demand decline with emerging herpes vaccines?

While vaccines could reduce disease incidence, current prophylactic and therapeutic needs ensure continued demand for acyclovir, especially in immunocompromised populations.

5. How are biosimilars impacting acyclovir pricing?

Although biosimilars are more relevant for biologics, similar trends in small-molecule generics mirror this impact, maintaining price competitiveness and constraining profits for branded products.

Sources

[1] Market Research Future, "Acyclovir Market," 2022.

[2] Grand View Research, "Antiviral Drugs Market," 2022.

[3] U.S. Medicaid Drug Price Search, 2022.