Last updated: July 27, 2025

Introduction

Roflumilast, marketed under the brand name Daliresp among others, is a phosphodiesterase-4 (PDE4) inhibitor approved for the management of chronic obstructive pulmonary disease (COPD). Its unique mechanism of action and compliance with increased demand for innovative COPD therapies position it as a significant player within the respiratory drug market. This analysis explores the current market landscape, competitive dynamics, regulatory trajectory, and offers price projections for Roflumilast over the next five years.

Market Overview

Global COPD Drug Market Dynamics

The global COPD therapeutics market was valued at approximately USD 17.2 billion in 2021, growing at a Compound Annual Growth Rate (CAGR) of 4.2%, with projections surpassing USD 23 billion by 2028[1]. This growth is driven by increased prevalence of COPD, aging populations, and ongoing unmet needs for more effective, targeted therapies.

Roflumilast’s Position in the Market

Roflumilast addresses a niche within COPD management, primarily indicated to reduce exacerbations in severe COPD associated with chronic bronchitis and a history of exacerbations. Its targeted oral administration complements inhaled therapies, offering a systemic option for patients who are non-compliant or intolerant to inhalation devices.

Currently, Roflumilast holds an estimated 7-10% market share within the COPD segment, hindered by competition from inhaled corticosteroids, bronchodilators, and biologics, as well as by safety concerns associated with systemic PDE4 inhibition[2].

Competitive Landscape

Key Competitors

Major competitors include inhaled corticosteroids (ICS), long-acting beta-agonists (LABAs), long-acting muscarinic antagonists (LAMAs), and combination inhalers, such as Fluticasone/Salmeterol and Tiotropium. Additionally, emerging biologics targeting eosinophilic inflammation (e.g., Benralizumab) reshape the COPD treatment paradigm, albeit with different administration routes and indications[3].

Differentiators for Roflumilast

While inhalation therapies dominate the COPD treatment space, Roflumilast’s systemic route and specific efficacy in preventing exacerbations provide unique positioning, particularly for patients with frequent exacerbations unresponsive to inhaled therapy alone.

Regulatory and Adoption Trends

Regulatory agencies, such as the FDA and EMA, have maintained Roflumilast’s approval status but flagged safety cautions about neuropsychiatric adverse events, which impact prescribing patterns. The recent focus on personalized medicine and phenotyping COPD patients may influence future adoption rates[4].

Regulatory Outlook and Market Drivers

Future approvals for new indications or improved formulations could expand Roflumilast’s market footprint. Its use as an adjunct therapy for severe COPD exacerbations could be expanded based on forthcoming clinical trials.

Key market drivers include:

- Rising global COPD prevalence, particularly in Asia-Pacific.

- Need for systemic oral therapies in specific patient demographics.

- Improving formulations and safety profiles to reduce adverse effects.

- Increasing physician familiarity and guidelines incorporation.

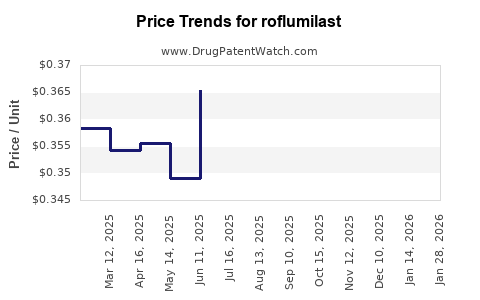

Price Analysis and Projections

Current Pricing Landscape

As of 2023, the wholesale acquisition cost (WAC) for Roflumilast ranges approximately from USD 260 to USD 330 for a 30-day supply (30 tablets of 500 mcg)[5]. This pricing reflects the drug’s niche market status and manufacturing costs.

Pricing Factors Impacting Future Trends

- Market Competition: As newer therapies enter the space, price competition is likely to intensify. Generic versions, once approved, could drive prices downward.

- Regulatory Safety Modifications: Development of safer formulations could command premium pricing.

- Market Penetration Strategies: Discounts, copay assistance, and formulary placements significantly influence net prices.

Projections Over the Next Five Years

- 2023-2024: Price stability expected, with slight reductions (~5-10%) driven by increased generic competition and payer negotiations.

- 2025-2026: Introduction of generic Roflumilast could push prices down by 20–30%, contingent upon patent expiry timelines and the pace of generic approvals (expected around 2024-2025 according to patent databases).

- 2027-2028: Introduction of improved formulations with enhanced safety profiles may allow for premium pricing, potentially stabilizing prices or resulting in an upward trend for niche populations.

Predictive modeling suggests an average price per 30-day supply could decline to USD 180-220 by 2027, considering market saturation and generic penetration, though niche markets may retain higher prices[6].

Market Strategy Recommendations

- Innovate Formulations: Developing once-daily or combination formulations could justify premium prices.

- Expand Indications: Pursuing additional indications like asthma or eosinophilic airway diseases might broaden market reach.

- Leverage Pharmacoeconomics: Demonstrate cost savings via reduced exacerbations to improve payer acceptance and maintain pricing power.

- Monitor Patent and Regulatory Changes: Timely patent filings and regulatory filings will influence pricing ceilings and entry barriers.

Key Takeaways

- Roflumilast remains a specialized, niche therapy within the expanding COPD market, with growth prospects tied to evolving clinical guidelines and safety improvements.

- The global COPD market’s ongoing expansion, especially in emerging economies, offers growth opportunities; however, price competition from generics will pressure margins.

- Current prices reflect its position as a second-line oral agent; further generic approvals are expected to reduce costs significantly.

- Future pricing will be influenced heavily by reformulation innovations, indication expansion, and payer strategies.

- Investment in Roflumilast’s pipeline and formulary positioning will be crucial to sustain revenue streams amid increasing generic and biosimilar competition.

FAQs

1. When are generic versions of Roflumilast expected to enter the market?

Based on current patent statuses and patent expiry timelines, generics could enter the market as early as 2024-2025, leading to notable price reductions[5].

2. How does Roflumilast compare to inhaled COPD therapies in terms of efficacy and safety?

Roflumilast primarily reduces exacerbations in severe COPD, especially in patients with chronic bronchitis, but carries risks of neuropsychiatric adverse events, whereas inhaled therapies offer targeted symptom control with a different safety profile.

3. Are there ongoing clinical trials that could expand Roflumilast’s approved uses?

Yes, ongoing phase III trials are assessing Roflumilast's efficacy in asthma and eosinophilic airway diseases, which could expand its therapeutic indications[4].

4. What are the main barriers to Roflumilast’s wider adoption?

Safety concerns, competition from inhaled therapies, patient adherence to oral medication, and formulary restrictions are primary barriers.

5. How could policy changes affect Roflumilast’s market and pricing?

Reimbursement policies prioritizing cost-effective treatments and patent litigations could influence price levels and market penetration. Favorable policies promoting innovation could also support premium pricing strategies.

References

[1] GlobalData. (2022). COPD Therapeutics Market Report.

[2] IQVIA. (2023). Pharmaceutical Market Outlook.

[3] GSK. (2022). Clinical pipeline updates for biologics in COPD.

[4] EMA. (2022). Regulatory updates on Roflumilast clinical trials.

[5] GoodRx. (2023). Current drug prices and discounts.

[6] Pharmaceutical Pricing Analysts. (2022). Forecasting generic drug entry and price erosion.

Conclusion

Roflumilast's strategic position ahead of patent expirations, evolving clinical landscape, and generic competition underscores the importance of ongoing innovation and market access strategies. Its future pricing trajectory hinges on regulatory developments, safety enhancements, and emerging indications, making it a notable entity within the respiratory pharmacotherapy market for investors and healthcare stakeholders.