Last updated: July 27, 2025

Introduction

Pravastatin sodium, a widely prescribed statin, belongs to the class of HMG-CoA reductase inhibitors used primarily for hypercholesterolemia and cardiovascular disease prevention. Since its introduction in the 1990s, pravastatin has experienced significant market shifts driven by evolving healthcare landscapes, regulatory pathways, and competitive pressures. This analysis explores the current market dynamics and forecasts the financial trajectory of pravastatin sodium, providing valuable insights for stakeholders ranging from pharmaceutical companies and investors to healthcare providers.

Market Overview

Historical Context and Market Position

Pravastatin sodium debuted as one of the first-generation statins, offering an effective cholesterol-lowering mechanism with a favorable safety profile. Originally marketed by Bristol-Myers Squibb and later by other key players, it captured substantial market share owing to its proven clinical efficacy and tolerability.

Over time, the market has seen an influx of newer statins—atorvastatin, rosuvastatin, and pitavastatin—offering enhanced potency or reduced dosing frequency. Despite this, pravastatin retained a significant niche, especially in populations with contraindications or sensitivities to more potent statins.

Current Market Dynamics

Patent Expiry and Generic Competition

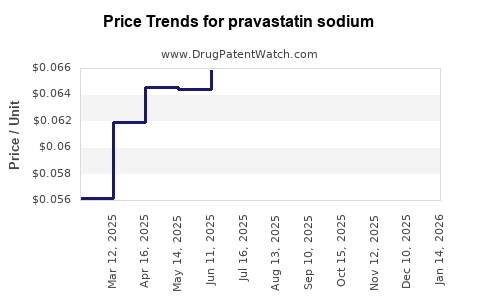

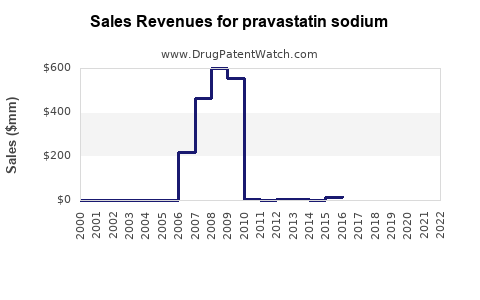

The expiration of patents in the early 2000s precipitated a surge in generic pravastatin availability, dramatically reducing prices and expanding accessibility. This commoditization intensified competition but also widened market reach, particularly in emerging economies, thereby stabilizing its sales volumes.

Regulatory Environment

Regulatory agencies worldwide, including the FDA and EMA, continue to approve formulations of pravastatin for various indications. However, stringent cardiovascular guidelines, like those from the American College of Cardiology/American Heart Association, have curated stricter prescribing practices, favoring high-potency statins in high-risk patients but maintaining pravastatin's relevance for specific subsets.

Clinical Guidelines and Prescribing Trends

Clinical guidelines favor high-intensity statins for secondary prevention. Nonetheless, pravastatin remains endorsed for primary prevention in patients at low to moderate risk due to its safety profile, especially in elderly populations and those with comorbidities such as liver disease.

Competitive Landscape

The pharmaceutical landscape features several generic suppliers, diluting the market price. Big Pharma continues to develop combination therapies incorporating pravastatin, such as fixed-dose combinations with ezetimibe, to maintain market share. Additionally, emerging therapies like PCSK9 inhibitors present competition in high-risk patients but remain cost-prohibitive for widespread use.

Market Drivers and Restraints

Drivers:

- Growing global burden of cardiovascular disease (CVD) fuels demand for lipid-lowering therapies.

- Increasing awareness and screening initiatives promote earlier intervention.

- Expanding healthcare access in emerging markets enhances market penetration.

- Cost-effective generics sustain continued use in economically constrained settings.

Restraints:

- Introduction of novel lipid-lowering agents with superior efficacy.

- Evolving guidelines favoring high-potency statins over moderate-acting drugs like pravastatin.

- Potential safety concerns or adverse effects, albeit minimal, may limit prescribing.

Financial Trajectory Forecast

Revenue Projections

Analysts project a steady decline in pravastatin sodium's global revenues over the next five years, primarily attributable to generic price erosion and market share redistribution. Nonetheless, in specific segments such as primary prevention among elderly and certain geographic regions, sales are anticipated to stabilize owing to established clinical use and affordability.

Regional Market Trends

North America: The mature market will see diminishing revenues owing to high penetration of high-potency statins and emerging competition from PCSK9 therapies. However, sustained demand persists in primary prevention, especially among Medicare beneficiaries.

Europe: Similar trends prevail, but increased adoption of clinical guidelines favoring optimized lipid management may preserve modest sales levels.

Asia-Pacific: Rapid healthcare infrastructure development and growing CVD prevalence code for expansion, with pravastatin serving as an affordable treatment option. Growth here will likely counterbalance declines elsewhere.

Emerging Economies: Price sensitivity, increased generic manufacturing, and government procurement policies favor continued use, fostering a resilient revenue stream.

Investment and R&D Outlook

Current R&D efforts focus on combination formulations and novel delivery systems to extend pravastatin's lifecycle. However, investment in new chemical entities remains limited, with most innovation directed toward pipeline drugs offering superior efficacy or safety. Pharmaceutical companies are increasingly leveraging strategic collaborations to develop such generics and biosimilars.

Strategic Opportunities

- Formulation Enhancements: Developing fixed-dose combinations can improve adherence and differentiate products.

- Patent Strategies: Exploiting secondary patents or new formulations may delay generic entry.

- Regional Expansion: Tailoring marketing strategies for emerging markets promises incremental revenue growth.

- Digital Health Integration: Incorporating digital compliance tools can enhance patient outcomes and loyalty.

Industry and Market Challenges

- Pricing Pressure: Continued generic competition exerts downward pricing force.

- Regulatory Hurdles: Variability in approval standards complicates market entry strategies.

- Therapeutic Substitutes: Emerging therapies, including PCSK9 inhibitors and gene-based interventions, threaten market share in high-risk cohorts.

- Patient Adherence: Polypharmacy and side-effects influence long-term adherence, impacting sales.

Conclusion

Pravastatin sodium remains a cornerstone in cardiovascular risk management, particularly in primary prevention and specific patient groups. While its revenues are expected to decline in developed markets due to generic competition and evolving prescribing patterns, significant growth opportunities persist in emerging economies and through strategic formulation innovations. Long-term viability hinges on adaptive marketing, regulatory navigation, and exploring combination therapies.

Key Takeaways

- The patent expiry precipitated price reductions, leading to a competitive, price-sensitive market dominated by generics.

- Regulatory guidelines favor higher-potency statins, slightly constraining pravastatin's growth but maintaining its market in targeted populations.

- Emerging markets offer substantial growth opportunities for pravastatin due to affordability and increasing cardiovascular disease burden.

- Strategic development of fixed-dose combinations and regional expansion are crucial for sustaining revenues.

- Competition from novel lipid-lowering therapies necessitates ongoing innovation and market adaptation.

FAQs

1. Will pravastatin sodium rebound in the future?

While potential exists through formulation innovations and regional market expansion, its overall global market share will likely continue to decline relative to newer statins and emerging therapies.

2. How does pravastatin compare to newer statins regarding efficacy?

Pravastatin offers moderate LDL cholesterol reduction, less potent than atorvastatin or rosuvastatin. Its safety profile is favorable, making it suitable for specific populations but less preferred for high-risk patients who require intensive lipid lowering.

3. What are the primary factors influencing pravastatin's declining revenues?

Patent expiration leading to generics, evolving clinical guidelines favoring high-potency statins, and the emergence of newer therapeutic classes primarily drive revenue decline.

4. Are there ongoing innovations in pravastatin formulations?

Yes, developing fixed-dose combinations and other delivery modifications aims to improve adherence and differentiation in a competitive market.

5. Which regions will drive pravastatin's growth in the coming years?

The Asia-Pacific region and other emerging economies will be pivotal, as increasing healthcare access and cardiovascular disease prevalence boost demand.

Sources:

- [1] Market research reports on statins and cardiovascular therapeutics

- [2] Clinical guidelines from the American College of Cardiology/American Heart Association

- [3] Regulatory agency publications and approval histories

- [4] Financial filings and pharmaceutical industry analyses

- [5] Market intelligence on generic drug manufacturing and regional healthcare expansion