Last updated: July 28, 2025

Introduction

PRAVACHOL, known generically as pravastatin, is a widely prescribed statin medication used to reduce low-density lipoprotein cholesterol (LDL-C) and cardiovascular risk. Since its approval by the FDA in 1989, pravastatin has carved a significant niche within hyperlipidemia management, contributing to both domestic and global markets. Analyzing its market dynamics and financial trajectory offers insights into its commercial resilience and potential growth avenues amidst evolving therapeutic landscapes.

Historical Market Context and Product Profile

Pravastatin belongs to the class of HMG-CoA reductase inhibitors, with a mechanism of action involving the lowering of serum cholesterol synthesis. Its favorable safety profile compared to earlier statins initially propelled its widespread adoption. The drug's patent expired in recent years (patent broadly expired around 2006-2009), leading to increased generic competition that significantly impacted pricing and market share.

PRAVACHOL's commercial success was bolstered by its positioning as an effective yet well-tolerated therapy, supported by extensive clinical trials demonstrating its efficacy in primary and secondary prevention of cardiovascular events. Over the decades, it maintained robust sales, bolstered by increasing awareness of cardiovascular disease risk factors.

Market Dynamics

1. Patent Expiry and Generic Competition

The expiration of pravastatin’s patent opened a floodgate for generic manufacturers, which dramatically altered the competitive landscape. Price erosion ensued, causing existing brand-name sales to decline but simultaneously expanding the accessible market due to lower costs. Generics now dominate the pravastatin segment, making pricing strategies and manufacturing efficiencies critical for sustained profitability.

2. Evolving Therapeutic Guidelines and Market Size

Advances in lipid management, including the development of PCSK9 inhibitors and alternative lipid-lowering agents, have introduced competition that impacts pravastatin's market share. Nonetheless, its entrenched position as a first-line therapy in many guidelines continues to support steady demand, especially in primary care settings where cost remains a significant factor.

The global burden of cardiovascular disease sustains a substantial market volume. Developing regions exhibit rising prevalence of dyslipidemia and cardiovascular risks, expanding potential markets for affordable generic pravastatin. Meanwhile, in developed markets, premium pricing diminishes as generics proliferate, affecting overall profitability but maintaining volume.

3. Regulatory and Reimbursement Environment

Strict regulatory standards govern approval processes, manufacturing practices, and post-marketing surveillance, influencing supply chain stability and market entry. Reimbursement policies significantly impact patient access; regions with comprehensive coverage facilitate higher utilization rates, bolstering sales. Conversely, cost-containment measures drive the shift toward generic options, pressuring margins on branded formulations.

4. Competitive Landscape

Beyond generics, numerous brand-name competitors—such as atorvastatin and rosuvastatin—offer comparable or superior efficacy profiles, challenging pravastatin’s market share. Pharmaceutical companies deploy aggressive pricing, targeted marketing, and formulation innovations to maintain relevance. Additionally, emerging therapies like PCSK9 inhibitors and novel lipid agents present future competition, especially for patients with resistant dyslipidemia.

5. Market Trends and Consumer Preferences

Patients increasingly favor combination therapies and personalized medicine approaches, prompting manufacturers to develop fixed-dose combinations involving pravastatin. There is also heightened demand for high-quality manufacturing and bioequivalence assurance to retain trust in generic formulations.

Financial Trajectory

1. Pre-Patent Expiry Performance

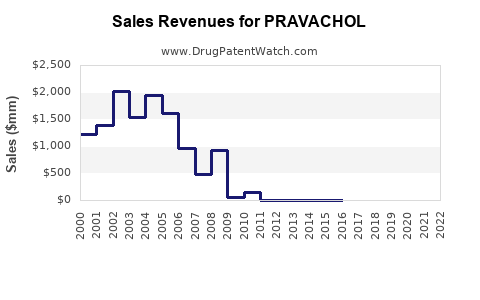

Prior to patent expiration, PRAVACHOL enjoyed strong revenue streams, supported by clinical confidence and limited generic competition. This period saw stable financial performance, with revenue peaks aligning with patent life and market penetration.

2. Post-Patent Expiry Decline and Transition to Generics

Following patent expiration, sales declined sharply due to price erosion and market saturation by generics. Companies that owned the patent—such as Bristol-Myers Squibb (original patent holder)—faced a revenue downturn, necessitating strategic shifts toward cost optimization, biosimilars, and alternative markets.

3. Current and Future Revenue Streams

Today, pravastatin’s revenue predominantly stems from generic sales, with volume-driven income offsetting reduced margins. The global market for pravastatin was estimated at approximately USD 1-2 billion annually prior to patent expiry, with current valuations reflecting a sustained decline in branded sales but a stable contribution from generics in various regions.

Forecast models suggest a slow, steady decline in overall pravastatin revenues, influenced by market saturation and competitive therapies. However, significant growth potential exists in emerging markets where regulatory barriers are lower, and healthcare infrastructure is expanding.

4. Impact of Pricing Strategies and Market Penetration

Manufacturers employing strategic pricing, supply chain efficiencies, and formulations that improve patient adherence can sustain profitability in mature markets. Additionally, investments in biosupplied formulations targeting specific patient demographics or resistance profiles may create niche opportunities.

5. Strategic Diversification and Portfolio Integration

Bio-pharmaceutical firms increasingly leverage pravastatin's established baseline within broader cardiovascular portfolios. Licensing agreements, combination therapies, and entry into specialty markets could mitigate revenue stagnation and bolster long-term financial stability.

Market Outlook and Future Trends

-

Regulatory Developments: An evolving landscape with harmonized standards and accelerated approval pathways for biosimilars and generics will influence pravastatin’s market presence.

-

Therapeutic Innovations: The integration of genetic testing and personalized medicine could redefine patient selection, potentially impacting pravastatin’s usage patterns.

-

Market Penetration: Expansion into developing regions, where healthcare infrastructure improves and lipid management awareness increases, offers growth pathways for affordable pravastatin formulations.

-

Competitive Strategies: Investment in formulation innovation, such as sustained-release versions, and partnerships for combination therapies will be pivotal for maintaining relevance.

Key Takeaways

-

The expiration of patent protection significantly shifted pravastatin’s market from branded dominance to a highly competitive, generic-driven environment.

-

Despite challenges from emerging therapies and alternative lipid-lowering agents, pravastatin maintains a stable demand base due to its efficacy, safety profile, and cost advantages.

-

Market growth is principally driven by emerging markets, where increasing cardiovascular disease prevalence and expanding healthcare access create new opportunities.

-

Strategic pricing, formulation innovations, and portfolio diversification remain essential for sustaining profitability amid commoditization.

-

The future landscape demands continual adaptation to regulatory changes, therapeutic advances, and evolving consumer preferences to optimize revenues.

FAQs

1. How has patent expiration impacted pravastatin’s market share?

Patent expiration led to a surge in generic pravastatin availability, resulting in significant price reduction and a decline in branded sales. However, overall volume remained robust due to the drug’s established role in lipid management, with generics capturing the majority of market share globally.

2. What are the primary competitive threats to pravastatin today?

Emerging therapies such as PCSK9 inhibitors and newer statins with superior efficacy or safety profiles pose competitive threats. Additionally, combination therapies and personalized treatment approaches may further challenge pravastatin’s dominance in certain patient populations.

3. In which regions does pravastatin have the highest growth potential?

Developing economies in Asia, Africa, and Latin America offer significant growth potential due to expanding healthcare infrastructure, increasing cardiovascular disease prevalence, and cost-sensitive treatment options favoring generics.

4. How are manufacturers maintaining profitability amid price erosion?

Through cost efficiencies, formulation innovations, strategic market positioning, and diversification into combination therapies or niche markets, manufacturers aim to sustain margins despite declining prices.

5. What is the outlook for pravastatin’s financial trajectory over the next decade?

While overall revenues are expected to decline steadily due to market saturation and competition, growth in emerging markets and strategic product differentiation can stabilize income streams, ensuring continued relevance within cardiovascular therapy portfolios.

References

- [1] European Medicines Agency. Pravastatin: Summary of Product Characteristics.

- [2] U.S. Food and Drug Administration. Drug Approvals and Database.

- [3] MarketsandMarkets. Statins Market by Type and Region.

- [4] World Health Organization. Cardiovascular Diseases Fact Sheet.

- [5] EvaluatePharma. Pharmaceutical Revenue Trends and Forecasts.