Last updated: July 27, 2025

Introduction

Celecoxib, marketed primarily under the brand name Celebrex, is a nonsteroidal anti-inflammatory drug (NSAID) that specifically inhibits cyclooxygenase-2 (COX-2). Since its approval in 1998 by the U.S. Food and Drug Administration (FDA), celecoxib has become a significant player in the anti-inflammatory and analgesic markets. Its popularity stems from its targeted mechanism of action, which offers reduced gastrointestinal side effects compared to traditional NSAIDs. This report explores the evolving market dynamics and financial trajectory of celecoxib, considering factors such as patent protection, competition, regulatory landscape, and global demand.

Market Overview and Historical Performance

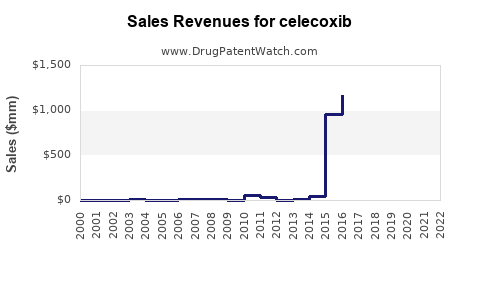

Initially introduced by Pfizer, celecoxib quickly gained considerable market share due to its favorable safety profile for certain patient populations. During its patent exclusivity period, peak sales in the US exceeded $2 billion annually (Pfizer's 2005-2010 reports). However, subsequent market attrition owing to the patent cliff, generic entry, and competition significantly impacted revenues.

The historically high revenues showcased celecoxib's prominence in osteoarthritis, rheumatoid arthritis, and acute pain management markets. Its initial commercial success was underpinned by clinical advantages over older NSAIDs and a well-established prescribing pattern by healthcare providers. Nevertheless, the entry of generics—beginning around 2014 following Pfizer's patent expiry—marked a pivotal shift in its market dynamics.

Patent Expiry and Generic Competition

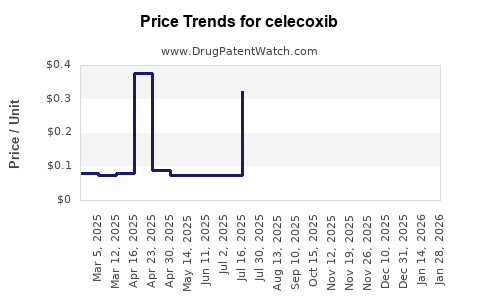

The loss of patent protection in major markets such as the U.S. and Europe led to rapid erosion of brand-name sales and proliferation of generic equivalents. Generics typically retail at a significant discount, drastically reducing revenue for the originator. Today, multiple manufacturers produce generic celecoxib, leading to intense price competition and shrinking profit margins.

Pfizer, the original innovator, faced revenue declines post-patent expiry, aligning with typical pharmaceutical patent cliffs. Nonetheless, strategic cost management and increased focus on emerging markets have mitigated some financial impacts. The generic market accounts for over 80% of celecoxib prescriptions, reflecting the compound's commoditized status within NSAID therapy.

Market Evolution and Therapeutic Positioning

Despite generic competition, celecoxib maintains relevance owing to its unique COX-2 selective mechanism, which is favored in specific clinical contexts that require reduction of gastrointestinal adverse events associated with non-selective NSAIDs. Prescribing patterns underscore its use in osteoarthritis, rheumatoid arthritis, ankylosing spondylitis, and certain cancer-related pain indications.

The drug's patent protections granted exclusivity until approximately 2015-2016 in key regions, after which marketing shifted to generic manufacturers. Ongoing research and post-market surveillance have supported its safety profile, although concerns over cardiovascular risks have tempered broader expansion.

Regulatory and Safety Considerations

Regulatory agencies have issued warnings regarding cardiovascular risks associated with celecoxib, paralleling findings from the VIGOR trial (2000). As a result, physicians exercise caution, limiting broader use to specific patient cohorts. These safety concerns influence demand, especially in markets with strict regulatory oversight.

Moreover, regulatory bodies continue to scrutinize the drug for potential adverse effects, which can impact market access and reimbursement policies. Despite this, regulatory approvals in multiple countries sustain celecoxib's market presence, and ongoing Post-Approval Commitments support long-term viability.

Global Market Dynamics

The global market for celecoxib remains sizeable, propelled by the increasing prevalence of osteoarthritis and rheumatoid arthritis—particularly in aging populations. The expanding burden of chronic inflammatory conditions ensures sustained demand in mature markets such as North America and Europe.

Emerging markets, including Asia-Pacific and Latin America, exhibit rising prescriptions driven by increasing healthcare access and the expanding middle class. Generic competition has facilitated wider adoption through lower retail prices, making celecoxib competitively viable in price-sensitive regions.

Financial Trajectory and Future Outlook

The financial outlook for celecoxib is characterized by a decline in revenue from its peak years—driven by patent expirations—but also opportunities arising from new formulations, such as combination drugs or extended-release versions. The current primary revenue streams originate from generic sales, with relatively modest contributions from the original patent-holder.

Industry forecasts suggest a continued decline in brand-name sales over the next five years, with overall market volume stabilizing as chronic disease prevalence persists. Revenue is expected to plateau in mature regions but could sustain growth through market expansion in developing countries.

Furthermore, ongoing research into Cardiovascular safety profiles could influence long-term usage patterns, with potential shifts toward safer alternatives or new targeting modalities. The competitive landscape remains robust, with other NSAIDs and analgesics vying for market share.

Impact of Market Factors on Revenue

- Patent expiration: Sharp decline post-2015, with generic proliferation reducing prices.

- Generic entry: Significant price erosion, leading to revenue decline for originator companies.

- Regulatory scrutiny: Ongoing safety concerns temper expansive prescribing, impacting revenue streams.

- Market penetration in emerging economies: Offers potential growth despite generic competition.

- New formulations or indications: Minor revenue contributors but may extend market viability.

Conclusion

Celecoxib’s market dynamics underscore a quintessential lifecycle pattern for patented drugs—initial blockbuster success followed by decline post-patent expiry. While generic competition has markedly reduced revenue, the drug maintains a niche owing to its COX-2 selectivity and favorable safety profile in select populations. Future growth prospects hinge on regional market expansion, innovative drug formulations, and evolving safety profiles. Industry participants must navigate patent expirations, regulatory considerations, and competitive pressures to optimize financial outcomes.

Key Takeaways

- Patent expirations in 2015-2016 precipitated a sharp decline in brand-name revenues; generic competition dominates the market now.

- Celecoxib maintains a critical niche due to its COX-2 selectivity, especially in patients at risk of gastrointestinal adverse events.

- Regulatory safety concerns, notably cardiovascular risks, influence prescribing patterns and market demand.

- Emerging markets present growth opportunities owing to increased prevalence of chronic inflammatory diseases and lower generic prices.

- Future revenues depend on market expansion, new formulations, and ongoing safety assessments, with legacy sales declining gradually.

FAQs

1. How has patent expiration affected celecoxib's market?

Patent expiration around 2015-2016 allowed multiple pharmaceutical manufacturers to produce generic versions, leading to a dramatic reduction in brand-name sales and increased price competition, which eroded profit margins for the original innovator.

2. What are the primary safety concerns impacting celecoxib's market?

The primary safety concern is an elevated risk of cardiovascular events, as identified in clinical trials like VIGOR. These concerns restrict broader use and influence regulatory decisions, subsequently affecting market demand.

3. Which regions show promising growth opportunities for celecoxib?

Emerging markets in Asia-Pacific and Latin America demonstrate growth potential due to rising prevalence of arthritis and chronic inflammatory conditions, coupled with broader healthcare access and affordability of generics.

4. Can celecoxib's new formulations revive its financial trajectory?

While minor in impact, novel formulations such as extended-release versions or combination drugs could offer incremental revenue streams and prolong market relevance, especially if they address safety or efficacy concerns.

5. What is the long-term outlook for celecoxib's revenues?

Expect a continued decline in revenues in mature markets due to generics and safety considerations. Long-term growth prospects are tied to market expansion in developing regions and potential niche indications, with overall revenues stabilizing or gradually declining.

Sources:

[1] Pfizer Inc. Annual Reports (2005–2010).

[2] U.S. Food and Drug Administration (FDA) approvals and safety warnings.

[3] Market research reports on NSAIDs and osteoarthritis therapeutics.

[4] Clinical trial data (VIGOR trial, 2000).

[5] Industry financial analysis publications on patent cliffs and generic drug markets.