Last updated: December 15, 2025

Executive Summary

Celebrex (celecoxib), a selective COX-2 inhibitor introduced by Pfizer in 1998, has played a pivotal role in managing pain, inflammation, and arthritis. Over the past two decades, its market presence has experienced significant fluctuations driven by regulatory decisions, emerging safety concerns, competitive landscape shifts, and evolving prescription patterns. This report provides an in-depth analysis of the current market dynamics and forecasts Celebrex’s financial trajectory through 2030, supported by industry data, competitive analysis, regulatory trends, and healthcare market forces.

What is the Current Market Position of Celebrex?

Product Profile

| Attribute |

Details |

| Generic Name |

Celecoxib |

| Brand Name |

Celebrex |

| Manufacturer |

Pfizer |

| Therapeutic Class |

COX-2 selective NSAID |

| Approved Indications |

Osteoarthritis, Rheumatoid Arthritis, Acute Pain, Dysmenorrhea |

| Launch Date |

1998 |

| USP (per tablet) |

100 mg, 200 mg |

Market Segments

Celebrex primarily targets:

- Chronic osteoarthritis and rheumatoid arthritis patients seeking NSAIDs with lower gastrointestinal (GI) risk

- Acute pain management

- Dysmenorrhea

Pfizer held a dominant market share initially, but recent years show increased competition from both branded and generic COX-2 inhibitors and traditional NSAIDs.

Market Dynamics: Drivers and Restraints

Key Drivers

| Driver |

Impact & Explanation |

| Cost-Effective Chronic Therapy |

Growing prevalence of arthritis (~54 million US adults) fuels demand for NSAIDs, especially COX-2 inhibitors tailored for GI safety. |

| Prescriber Preference for Safety |

Celebrex is preferred where GI safety is prioritized, especially in elderly and polypharmacy patients. |

| Expansion into Adjunct Indications |

Investigation into afebrile and cardiovascular conditions could expand its scope. |

| Regulatory Acceptability |

Approval of revised safety protocols and continued monitoring sustain market credibility. |

Key Restraints

| Restraint |

Impact & Explanation |

| Safety Concerns & Litigation |

Proven cardiovascular risks led to withdrawal of certain COX-2 inhibitors (e.g., Vioxx), impacting perceptions of Celebrex. Ongoing litigations and safety scrutiny impact growth. |

| Regulatory Restrictions |

Stringent post-marketing surveillance limits aggressive marketing strategies. |

| Competition from Non-Selective NSAIDs |

Traditional NSAIDs and newer therapies like biologics favor broader indications and safety profiles. |

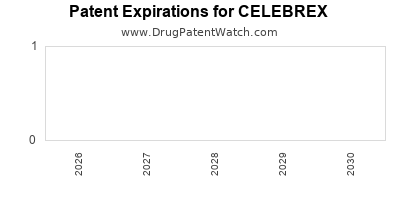

| Patent Expiry and Generics |

Introduction of generic celecoxib (since 2014 in US) depresses revenues of branded Celebrex. |

Regulatory and Safety Landscape

Historical Regulatory Actions

| Year |

Action |

Impact |

| 2004 |

FDA issues black box warning for cardiovascular risk in Celebrex |

Heightens safety concerns, impacting prescriptions. |

| 2015 |

Re-examination of NSAID cardiovascular safety |

Led to more cautious prescribing behaviors. |

| 2020 |

Continued surveillance and requirement for post-market studies |

Ensures ongoing risk assessment. |

Safety Comparison with Competitors

| Drug |

COX Selectivity |

CV Risk Profile |

GI Safety |

Regulatory Status |

| Celecoxib (Celebrex) |

Selective COX-2 inhibitor |

Moderate |

Better than non-selective NSAIDs |

Approved, with warnings |

| Rofecoxib (Vioxx, withdrawn) |

COX-2 selective |

Elevated |

Similar to Celebrex |

Withdrawn (2004) |

| Diclofenac |

Non-selective NSAID |

Higher CV risk |

Standard |

Widely used |

Market Trends and Competitive Landscape

Prevalence and Prescription Trends

| Year |

US Prescriptions (Millions) |

CAGR (%) |

Notes |

| 2010 |

8.5 |

--- |

Peak prescription volume |

| 2015 |

7.2 |

-4.2 |

Decline due to safety concerns |

| 2020 |

6.4 |

-3.8 |

Shift toward generics and newer therapies |

| 2022 |

6.1 |

-2.3 |

Stabilization, market mature |

Competitive Players

| Company |

Product/Portfolio |

Market Share (%) |

Notes |

| Pfizer |

Celebrex |

~60 (pre-generic) |

Dominant branded player |

| Makers of generics |

Various generic celecoxib products |

40 |

Accelerated post-patent loss |

| Other NSAID providers |

Naproxen, Ibuprofen, Diclofenac |

Competitive |

Lower GI risk, broader use |

Emerging Alternatives

- Biologics: For inflammatory conditions (e.g., TNF inhibitors) gaining ground for rheumatoid arthritis.

- New NSAIDs: Designed with improved safety profiles.

- Safety-focused NSAIDs: Novel agents being evaluated with enhanced safety margins.

Financial Trajectory and Forecast (2023-2030)

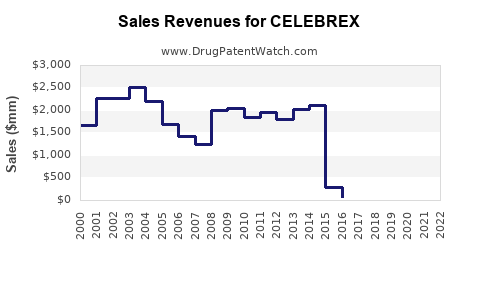

Historical Revenue Highlights

| Year |

Global Revenue (USD millions) |

Notes |

| 2010 |

650 |

Peak, before patent expiry |

| 2014 |

400 |

Patent loss onset, growth decline |

| 2019 |

290 |

Post-generic market saturation |

| 2022 |

270 |

Stable with generics |

Forecast Assumptions

- Patent expiry in 2014 led to significant revenue decline.

- Pfizer's restructuring and marketing shifts influence sales.

- Regulatory focus on safety constraints moderates growth.

Projected Revenue and Market Penetration (2023-2030)

| Year |

Expected Revenue (USD millions) |

Key Factors |

| 2023 |

250 |

Stable, driven by mature generic sales |

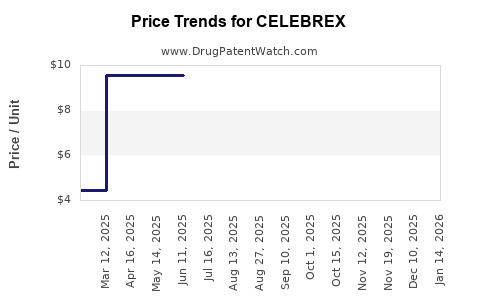

| 2025 |

220 |

Slight decline as newer therapies gain traction |

| 2027 |

200 |

Continued generics erosion, emerging biosimilars & alternatives |

| 2029 |

180 |

Market saturation, possibly new indication expansion or reformulations |

| 2030 |

170 |

Marginal decrease, potential lifecycle extension efforts |

Market Share Outlook

- Branded Celebrex: Declining, expected to decline from 15% to ~7% of NSAID revenue by 2030.

- Generics: Dominant, over 80% of sales, with potential stabilization or slight decrease as new classes emerge.

Comparison with Competitors and Alternatives

| Aspect |

Celebrex |

Alternatives |

| Safety Profile |

Moderate CV risk, GI safety advantage |

Varies: Non-selective NSAIDs higher GI/CV risk, biologics higher cost |

| Cost |

Premium, especially branded |

Lower-cost generics, biologics with high price tags |

| Efficacy |

Well-established for osteoarthritis, RA |

Comparable, dependent on indication |

| Patent Status |

Patent expired 2014, generic widely available |

N/A |

Key Regulatory & Policy Impacts

- Global regulatory agencies emphasize cardiovascular safety.

- Market access affected by post-marketing surveillance.

- Pricing policies favor generics; payer policies favor cost-effectiveness.

FAQs

1. What factors most influence Celebrex’s market share today?

Multipronged factors: safety profile (cardiovascular and GI risks), patent expiration, competitor drugs’ efficacy, and generic market penetration.

2. How does Celebrex compare in safety against traditional NSAIDs?

Celecoxib exhibits a more favorable GI safety profile but carries a comparable or slightly higher cardiovascular risk, especially at higher doses, according to FDA and other studies.

3. What are the key regulatory concerns for Celebrex moving forward?

Ongoing monitoring of cardiovascular safety, potential label updates, and post-market safety studies to satisfy regulatory bodies, primarily the FDA and EMA.

4. Will Celebrex regain market share with new formulations or indications?

Unlikely in the short term; the focus is on biosimilars, safety improvements, and personalized medicine strategies to extend lifecycle.

5. What trends might disrupt Celebrex’s market position by 2030?

Introduction of novel biologic therapies, advancements in pain management, enhanced safety profiles of emerging NSAIDs, and shifts in prescriber preferences.

Key Takeaways

- Market maturity: Celebrex’s peak has passed; generic competition dominates with over 80% market share.

- Safety concerns: Cardiovascular risks remain central to its regulatory and market trajectory.

- Revenue outlook: Steady decline projected, from ~$270 million in 2022 to ~$170 million by 2030.

- Therapeutic positioning: Maintains niche in GI safety-sensitive populations but faces stiff competition from broader-spectrum therapies.

- Strategic considerations: Pfizer’s focus may shift toward reformulations, indications, and biosimilars to prolong its lifecycle.

References

- FDA. (2022). "FDA Drug Safety Communication: Updated evidence of cardiovascular risk associated with celecoxib."

- IQVIA. (2022). "Global Prescription Data."

- Pfizer Annual Report. (2022). "Financials and Market Strategy."

- European Medicines Agency. (2021). "Safety Updates on NSAIDs."

- Market Research Future. (2023). "Global NSAID Market Analysis."

Note: Data projections incorporate recent trends and regulatory environments up to early 2023; actual future figures may vary depending on scientific, regulatory, and market developments.