Last updated: July 27, 2025

Introduction

Silodosin, marketed primarily under brand names such as Rapaflo, is a selective alpha-1 adrenergic receptor antagonist primarily prescribed for benign prostatic hyperplasia (BPH). Its specificity toward alpha-1A adrenergic receptors allows for targeted symptomatic relief with minimized cardiovascular side effects, positioning it as a preferred therapeutic agent in urology. Analyzing the market dynamics and financial trajectory of silodosin is essential for stakeholders, including pharmaceutical manufacturers, investors, and healthcare policymakers seeking to navigate opportunities and anticipate challenges within the urology drug sector.

Pharmacological Profile and Clinical Positioning

Developed by Kyorin Pharmaceutical Co., Ltd., silodosin’s mechanism involves relaxation of smooth muscle in the prostate and bladder neck, improving urine flow and reducing BPH symptoms. Its high affinity for alpha-1A receptors distinguishes it from less selective agents like tamsulosin, offering an improved side effect profile—particularly a reduced incidence of orthostatic hypotension. These attributes underpin its adoption in clinical guidelines and influence its market positioning, especially for patients intolerant to other alpha-blockers.

Clinical and Regulatory Landscape

Regulatory approval for silodosin varies across markets, with U.S. FDA approval obtained in 2012 for treating BPH symptoms. In other regions, approval timelines differ, influenced by local regulatory processes and clinical trial data submission. The incremental accumulation of robust efficacy and safety data supports ongoing regulatory evaluations and potential extensions to indications such as lower urinary tract symptoms (LUTS). However, safety concerns—such as retrograde ejaculation—have intermittently impacted its adoption, necessitating continued post-marketing surveillance.

Market Drivers

1. Increasing Prevalence of BPH:

The global prevalence of BPH, which escalates with aging populations, sustains demand for effective pharmacotherapies. According to the WHO, approximately 50% of men over 50 exhibit BPH symptoms, expanding the market size for drugs like silodosin.

2. Aging Demographics:

Developed countries display a significant demographic shift toward older populations, which correlates with higher BPH incidence. The U.S., Europe, and Japan report rising BPH-related healthcare costs, emphasizing the role of pharmacological interventions such as silodosin.

3. Therapeutic Advantages and Patient Compliance:

Silodosin’s receptor selectivity translates into improved tolerability, enhancing patient compliance. As adherence improves, so does demand. Its potential for fewer cardiovascular side effects makes it a preferred choice in patients with comorbidities, broadening its clinical utility.

4. Competitive Dynamics:

Silodosin’s differentiation from existing alpha-1 antagonists—such as tamsulosin and alfuzosin—positions it favorably but within a competitive landscape. The availability of generic formulations influences market share, with branded versions benefiting from physician awareness and proprietary positioning.

Market Constraints and Challenges

1. Side Effect Profile:

Retrograde ejaculation remains a notable adverse event associated with silodosin, potentially limiting its widespread use. Patient education and clinician awareness are critical to mitigate discontinuations.

2. Pricing and Reimbursement Policies:

Pricing strategies significantly influence market penetration. In markets with stringent reimbursement policies, cost-effectiveness analyses determine formulary placements and patient access.

3. Competition from Generics and Alternatives:

The advent of biosimilars and generic versions reduces prices, pressuring profit margins. Non-pharmacological treatments, such as minimally invasive surgical procedures, also pose competition, especially in advanced BPH cases.

4. Off-Label and Combination Therapy Trends:

Emerging research on combination regimens influences prescribing patterns. While silodosin is primarily monotherapy, its role within multidrug protocols remains under exploration, potentially affecting its market share.

Financial Trajectory and Market Forecast

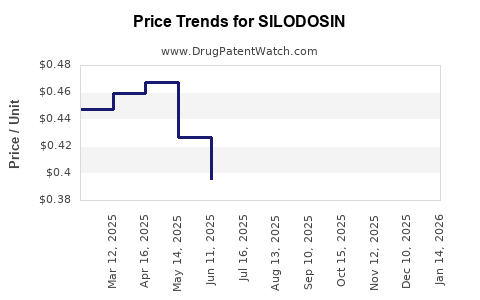

Revenue Trends:

Initially, silodosin experienced robust growth following regulatory approval, driven by its niche positioning. The North American market represented a significant revenue share, with sales volumes bolstered by healthcare provider awareness and favorable reimbursement policies.

Market Penetration and Sales Dynamics:

Sales trajectory exhibits a typical lifecycle pattern: rapid growth post-launch, plateauing due to market saturation, followed by periods of stabilization, especially as generic versions enter the market (e.g., in the U.S., generics became available around 2019). For instance, Kyorin reported sales of approximately JPY 36.4 billion (~$330 million) globally in FY2020, with the U.S. and Japan as primary revenue sources.

Impact of Patent Expirations and Generics:

Patent expiration reduces barriers for generic entry. While patent rights are limited, patent extension strategies and formulation patents may temporarily sustain exclusivity. Sensitivity analysis indicates that generic penetration could diminish brand revenues by up to 60% within five years of patent expiry unless differentiated through new formulations or indications.

Emerging Markets and Future Growth Potential

Developing economies with increasing BPH prevalence offer growth scope, contingent on regulatory approval, market access, and pricing. Penetration into these markets depends on local healthcare infrastructure and cost considerations, with potential for rapid expansion as awareness and screening programs improve.

Investment Outlook

Market analysts project moderate growth in silodosin’s global sales over the next 5–7 years. Growth drivers include demographic trends, increasing adoption in emerging markets, and potential expansion into indications such as LUTS. Challenges include pricing pressures, the proliferation of generics, and competition from new pharmacological agents, such as phosphodiesterase-5 inhibitors for BPH.

Strategic Considerations for Stakeholders

-

Pharmaceutical Companies:

Investment in innovative formulations, such as combination therapies or sustained-release variants, could extend product life cycles. Collaboration with healthcare providers to improve awareness of silodosin’s benefits may augment market penetration.

-

Investors:

Monitoring patent statuses, generic market entry, and regulatory developments is essential for risk assessment. Diversifying portfolio exposure to similar targeted therapies can mitigate market volatility.

-

Healthcare Policymakers:

Encouraging data transparency and supporting evidence-based guidelines for BPH can facilitate optimal utilization of silodosin, balancing efficacy and safety considerations.

Key Takeaways

- Market growth for silodosin hinges on demographic aging and increasing BPH prevalence, particularly in developed economies.

- Its selective alpha-1A antagonism offers clinical advantages but faces competition from generics and alternative therapies.

- Patent expirations and subsequent generic entries are pivotal in shaping revenue trajectories, often reducing profit margins and market share.

- Emerging markets present opportunities for expansion, conditioned upon regulatory policies and healthcare infrastructure development.

- Continuous innovation—through formulation improvements or combination therapies—is crucial for prolonging silodosin’s commercial viability.

FAQs

-

What factors influence the pricing and reimbursement of silodosin globally?

Pricing depends on regulatory approval, patent status, local healthcare budgets, and comparative cost-effectiveness analyses. Reimbursement policies vary, impacting patient access and profitability.

-

How does silodosin’s side effect profile compare to other BPH medications?

Silodosin has fewer cardiovascular side effects but is associated with higher rates of retrograde ejaculation. Its tolerability profile often favors patient adherence.

-

What is the expected impact of generic silodosin on the market?

Generic entry typically reduces prices and market share of branded formulations. The extent depends on patent protections, market acceptance, and physician prescribing habits.

-

Are there ongoing developments to expand silodosin’s indications?

Research is ongoing into using silodosin for LUTS and other urological conditions, which could diversify its use and bolster sales.

-

What are the key considerations for investors regarding silodosin’s future?

Monitoring patent expirations, generic competition, emerging competition, and evolving clinical data is vital. Strategic partnerships and innovation are essential for sustained growth.

References

- [1] Kyorin Pharmaceutical Co., Ltd. Annual Report 2020

- [2] U.S. FDA Approval Documentation for Silodosin (Rapaflo), 2012

- [3] World Health Organization (WHO), BPH Epidemiology Reports, 2020

- [4] Market Research Future, Urology Drugs Market Analysis, 2022

- [5] Industry-specific updates on Silodosin patent status and generics, 2023