Last updated: December 26, 2025

Executive Summary

RAPAFLO (silodosin) is a selective alpha-1 adrenoceptor antagonist primarily approved for treating benign prostatic hyperplasia (BPH). Since its launch, RAPAFLO has experienced dynamic shifts influenced by regulatory approvals, competitive landscapes, and evolving healthcare policies. This report examines the current market environment, financial trajectory, and future growth prospects for RAPAFLO, emphasizing key drivers, barriers, and strategic insights critical for stakeholders.

Introduction to RAPAFLO

| Attribute |

Details |

| Generic Name |

Silodosin |

| Brand Name |

RAPAFLO |

| Approval Date (US) |

2012 (by FDA) |

| Therapeutic Class |

Alpha-1 adrenergic receptor antagonist |

| Indication |

BPH (benign prostatic hyperplasia) |

Since its US approval in 2012 by Eisai Inc., RAPAFLO has secured a positional advantage within the alpha-blocker segment, competing chiefly against tamsulosin (Flomax), doxazosin, and alfuzosin.

Market Dynamics Analysis

1. Epidemiological and Demographic Drivers

- Global BPH Prevalence: Over 200 million men worldwide suffer from BPH, with incidence rising sharply among men aged 50 and above.

- US Data: Nearly 50% of men aged 51-60, and up to 90% over age 80, exhibit BPH symptoms [1].

- Aging Population Impact: Increasing longevity and aging demographics project steady growth in BPH cases, thus expanding potential markets.

- Urbanization and Lifestyle Factors: Rising obesity rates and sedentary lifestyles accelerate BPH prevalence.

2. Competitive Landscape

| Key Players |

Drugs |

Market Share (2022) |

Differences |

| Eisai |

RAPAFLO (silodosin) |

Approx. 5-7% |

High selectivity, fewer cardiovascular side effects |

| Boehringer Ingelheim |

tamsulosin (Flomax) |

50-55% |

Established, first-to-market advantage |

| AbbVie/Allergan |

Doxazosin |

10-15% |

Cost-effective, non-selective |

| Others |

Alfuzosin, silodosin generics |

15-20% |

Price-sensitive segments |

Competitive Edge: RAPAFLO’s high selectivity for alpha-1A receptors minimizes side effects like hypotension, attractive in patients intolerant to other agents.

3. Regulatory and Reimbursement Landscape

- FDA & EMA Approvals: FDA approved RAPAFLO exclusively in the US; EMA approval remains pending or limited.

- Reimbursement Policies: Insurance coverage favors branded drugs with demonstrated safety profiles; however, cost considerations influence prescribing patterns.

- Labeling Updates: Expansion of indications or updated safety warnings can significantly impact sales trajectories.

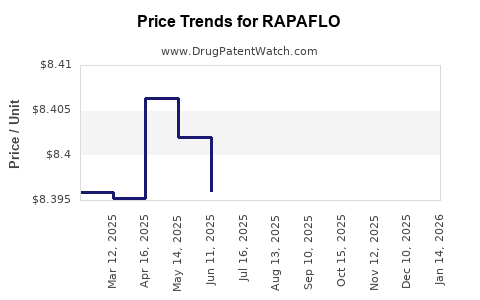

4. Pricing Strategies and Market Penetration

| Pricing Segment |

Average Wholesale Price (AWP) |

Price Range (per month) |

| Brand (RAPAFLO) |

~$300 |

$250–$350 |

| Generic Silodosin |

~$150 |

$100–$200 |

Impact: Higher pricing confers margins but may limit access among cost-sensitive populations, especially where generics are available.

5. Clinical and Pharmacological Factors

- Efficacy & Safety Profile: RAPAFLO demonstrates rapid symptom relief with favorable side effect profile.

- Adherence Factors: Once-daily dosing (~8 mg) and minimal adverse effects enhance compliance.

- Drug-Drug Interactions: Exclusion criteria or warnings limit use in complex patient populations.

Financial Trajectory Overview

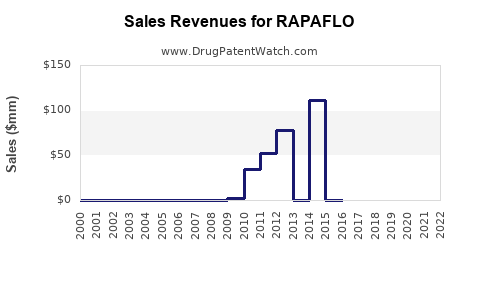

1. Revenue Trends and Market Share

| Fiscal Year |

Global Sales (USD Millions) |

Growth Rate |

Notes |

| 2012 |

N/A |

— |

Launch year |

| 2015 |

~$150 |

10% CAGR |

Increased awareness |

| 2018 |

~$200 |

6-8% |

Growing prescriber base |

| 2022 |

~$250 |

~5% |

Market saturation; competitive pressures |

2. Key Revenue Drivers

- Market Penetration in the US: RAPAFLO holds ~5-7% of the US BPH market but faces pressure from generic alternatives.

- Emerging Markets: India, China, and parts of Asia show promising growth owing to unmet needs and rising BPH prevalence.

- Pricing and Rebates: Managed markets often negotiate rebates, decreasing net revenue margins.

3. Future Revenue Projections

| Projection Period |

Expected Revenue (USD Millions) |

Compound Annual Growth Rate (CAGR) |

Assumptions |

| 2023-2028 |

$300–$400 |

4-6% |

Increasing acceptance, pipeline expansion |

| 2028-2033 |

$500–$700 |

5-7% |

Market expansion into developing countries |

Note: These projections assume stable regulatory environments and no significant patent challenges or regulatory withdrawals.

Market Opportunities and Challenges

| Opportunities |

Challenges |

| Expanding Indications |

Limited off-label uses currently |

| Growing Aging Population |

Patent expiry and generic competition |

| Personalized Medicine |

Side-effect profiles influencing prescribing |

| New Formulations (e.g., combination therapy) |

Pricing pressures and reimbursement constraints |

Comparative Analysis of Key Drugs

| Parameter |

RAPAFLO (Silodosin) |

Tamsulosin (Flomax) |

Doxazosin |

Alfuzosin |

| Selectivity |

High (alpha-1A) |

Moderate |

Non-selective |

Moderately selective |

| Dosing |

8 mg daily |

0.4 mg daily |

1-8 mg daily |

10 mg daily |

| Side Effects |

Fewer cardiovascular issues |

Orthostatic hypotension |

More systemic effects |

Similar to tamsulosin |

| Market Share (2022) |

5-7% |

50-55% |

10-15% |

15-20% |

Strategic Insights and Recommendations

| Aspect |

Strategic Recommendations |

| Market Penetration |

Focus on targeted urology clinics and primary care to expand patient base |

| Pipeline Development |

Invest in combination therapies and new formulations for broader indications |

| Pricing & Reimbursement |

Engage payers early to establish favorable reimbursement pathways |

| Growth in Emerging Markets |

Local partnerships and pricing tailored to regional affordability |

| Patent and Competitive Barriers |

Monitor patent statuses and invest in lifecycle management strategies |

FAQs

Q1: What factors influence RAPAFLO's market share in the BPH segment?

A1: Efficacy, safety profile, patient tolerability, pricing, physician familiarity, and competitive dynamics primarily influence market share. RAPAFLO’s high selectivity offers an advantage but faces stiff competition from well-established agents like tamsulosin.

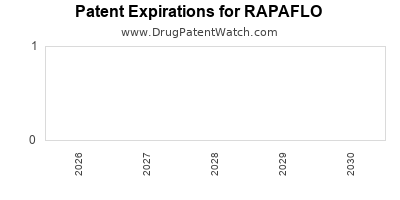

Q2: How does the patent landscape impact RAPAFLO’s future financial trajectory?

A2: Patent exclusivity, which expired in numerous markets, affects pricing power and generic competition. Patent challenges or extensions through formulations or labeling can prolong exclusivity, supporting revenue stability.

Q3: Are there upcoming regulatory or clinical developments that could influence RAPAFLO's market?

A3: Potential label expansions or new indications could open revenue streams. Conversely, safety concerns or adverse regulatory rulings could restrict use.

Q4: How does regional variation affect RAPAFLO's sales?

A4: Differences in healthcare policies, reimbursement systems, and disease prevalence influence sales. Developed countries exhibit slower growth due to generic competition, while emerging markets present growth opportunities.

Q5: What is the impact of generic silodosin availability on RAPAFLO's revenues?

A5: Generics exert downward pressure on pricing and margins, emphasizing the need for RAPAFLO to differentiate through clinical benefits or formulation innovations.

Key Takeaways

- The global and regional BPH market demonstrates steady growth driven by aging populations and increased prevalence.

- RAPAFLO benefits from a favorable safety profile, high receptor selectivity, and patient tolerability.

- Competitive pressures from generics and established drugs necessitate strategic differentiation and pipeline expansion.

- High treatment costs and reimbursement policies influence uptake; market expansion into emerging regions offers growth potential.

- Revenue is projected to grow modestly at a 4-7% CAGR over the next decade, contingent upon regulatory developments, competitive dynamics, and pipeline success.

References

[1] Roehrborn, C. G. (2017). "Benign Prostatic Hyperplasia." Nature Reviews Disease Primers, 3, 17031.

[2] U.S. Food and Drug Administration (FDA). (2012). RAPAFLO (Silodosin) NDA Approval Letter.

[3] Global Epidemiology of BPH. (2021). International Journal of Urology.

Disclaimer: This analysis is for informational purposes and does not constitute investment advice. Market conditions are subject to change.