Last updated: December 7, 2025

Summary

Pregabalin, marketed as Lyrica among other names, is an anticonvulsant and neuromodulator approved primarily for neuropathic pain, epilepsy, and generalized anxiety disorder. Since its FDA approval in 2004, pregabalin has experienced rapid market expansion driven by its broad therapeutic application, patent lifecycle, and evolving regulatory landscape. This analysis explores the key drivers shaping pregabalin’s market dynamics, assesses its financial trajectory, and considers future trends amid generic competition, regulatory impacts, and emerging therapeutic alternatives.

What Are the Fundamentals of Pregabalin’s Market?

| Aspect |

Details |

| Therapeutic indications |

Neuropathic pain, epilepsy, generalized anxiety disorder, fibromyalgia (approved in select regions) |

| Current global sales (2022) |

Approximate revenue of $4.2 billion (IQVIA) |

| Major markets |

North America, Europe, Asia-Pacific |

| Manufacturers |

Pfizer (original patent holder), multiple generic producers post-expiry |

| Patent / Exclusivity Timeline |

Patented until around 2017-2018; generic competition increased thereafter |

What Are the Market Drivers of Pregabalin?

1. Broadened Therapeutic Use

- Approved for multiple indications since inception

- Expanded off-label use has further extended market demand

- Potential for new indications (e.g., refractory depression, PTSD) under exploration

2. Patent Expiry and Generic Entry

| Year |

Impact |

Response |

| 2018 |

Surge in generic competition |

Price erosion, increased accessibility |

| 2019 |

Shift towards biosimilars and alternatives |

Strategic brand positioning |

3. Regulatory Environment

- Stringent controls on prescribing and off-label use influence market size

- Variations across geographies impact market stability and growth

4. Pandemic and Healthcare Trends

- COVID-19 impacted supply chains and prescribing patterns

- Growing emphasis on chronic pain management sustains demand

5. Competitive Landscape

| Competitors |

Key Features |

| Gabapentin |

Similar profile, lower cost, generics available |

| Pregabalin |

Higher potency, broader indications, patent legacy |

What Is the Financial Trajectory of Pregabalin?

Pre-Patent Expiry Phase (2004–2017)

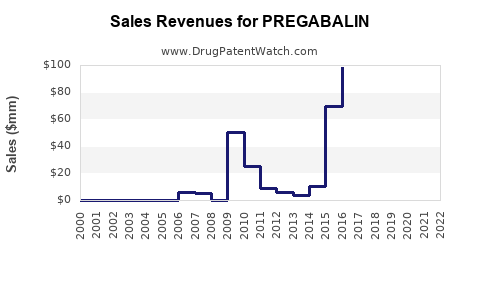

- Peak sales (2015–2016): Approx. $5 billion/year globally

- Profitability: High, driven by patent protection and minimal generic competition

- Market share: Dominated by Pfizer with Lyrica, capturing >80% in key markets

Post-Patent Expiry and Generic Competition (2018–Present)

- Revenue decline: Drop of approximately 70-80% in markets like the US and Europe

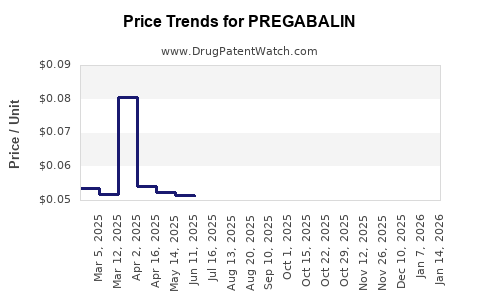

- Pricing erosion: Wholesale prices declined by 50-80% in major regions within 2 years post-generic entry

- Market adaptation: Pfizer and other originators shift focus to specialty indications, biosimilars, or novel formulations

Projected Revenue Trends (2023–2028)

| Year |

Forecasted Global Sales |

Key Factors |

| 2023 |

~$2.1 billion |

Continued generic penetration, regional growth in Asia |

| 2024 |

~$1.8 billion |

Market saturation, new regulatory restrictions |

| 2025 |

~$1.6 billion |

Emerging competition from new drugs (e.g., YKP3089) |

| 2026 |

~$1.4 billion |

Shift toward combination therapies and biosimilars |

| 2028 |

~$1.2 billion |

Possible decline unless new indications approved |

Financial Analysts’ Outlook

- Revenue stabilization expected in niche markets (e.g., treatment-resistant neuropathic pain)

- Profit margins to further compress due to price competition and manufacturing costs

- Strategic investments into biosimilar pipelines and patent litigation posit future growth avenues

How Do Future Trends Shape Pregabalin’s Market?

| Trend |

Implication |

| Expansion into new indications |

Potential for revenue growth if regulatory approvals granted |

| Biosimilar and generic proliferation |

Continued price erosion and market fragmentation |

| Regulatory restrictions on off-label use |

Potential decrease in overall prescription volume |

| Emergence of novel therapies (e.g., YKP3089, BTXC) |

Competition leads to revenue displacement |

| Digital health and telemedicine adoption |

May influence prescribing behaviors and drug utilization |

How Does Pregabalin Compare to Similar Drugs?

| Attribute |

Pregabalin |

Gabapentin |

Duloxetine |

Pregabalin’s Competitive Edges |

| Mechanism of Action |

α2δ ligand, modulates calcium channels |

Similar, less potent |

Serotonin-norepinephrine reuptake inhibitor |

Higher potency, broader approved indications |

| Indications |

Neuropathic pain, epilepsy, GAD |

Neuropathic pain, epilepsy |

Neuropathic pain, depression |

Wider FDA approvals, FDA label-specific indications |

| Market Price (2022) |

~$210 per 75mg capsule (brand), lower generic |

~$35 per 300mg capsule |

~$190 per 60mg capsule |

Higher price point but with patent exclusivity |

| Patent Status |

Expired (2018) |

Expired |

No patent (off-label use) |

Loss of exclusivity leading to volume-driven sales |

Historical Timeline of Pregabalin Market Evolution

| Year |

Milestone |

Impact |

| 2004 |

FDA approval in the US |

Initiated commercial market entry |

| 2005–2010 |

Sales growth phase under patent exclusivity |

Peak revenues, aggressive marketing |

| 2017 |

Generic patent deadlines approaching |

Anticipation of generic entry, strategic planning by Pfizer |

| 2018 |

First generics approved (US, EU) |

Rapid market share decline for original patent holder |

| 2019–2022 |

Market diversification and emerging competitors |

Stabilization in some niche markets, decline elsewhere |

Key Market Policies and Regulations Impacting Pregabalin

| Region |

Policy / Regulation |

Effect on Market |

| US |

DEA Schedule V classification for pregabalin (2019) |

Strict prescription monitoring, limited abuse potential concerns |

| EU |

Reimbursement policies restrict off-label use |

Affects prescribing volume and healthcare reimbursements |

| Japan |

Stringent clinical guidelines and off-label restrictions |

Reduced over-prescription, controlled expansion |

Conclusion and Strategic Insights

Pregabalin’s market landscape has undergone substantial transformation since its introduction. Initially a blockbuster with peak revenues exceeding $5 billion annually, its carving is now more niche, with revenues expected to stabilize around $1-2 billion globally in the near term. Patent expiration catalyzed price erosion and increased generic competition, compelling originator companies to innovate in formulations, indications, and delivery mechanisms.

The future of pregabalin hinges upon regulatory pathways for new indications, biosimilar developments, and the competitive landscape’s evolution with emerging therapies. Companies aiming to maintain or grow revenue must diversify portfolios, invest in pipeline innovation, and adapt to shifting prescribing patterns.

Actionable insights:

- Monitor regulatory approvals for novel indications that could rejuvenate demand.

- Prioritize formulation innovations to compound competitive advantages.

- Engage proactively in patent defense and biosimilar market strategies.

- Leverage regional market dynamics, especially in emerging economies, to offset mature market declines.

- Track the competitive pipeline of neuromodulators, including agents such as YKP3089 and BTXC.

FAQs

Q1: When will pregabalin lose its last patent protections?

A: The last patents for pregabalin expired in key markets like the US and Europe around 2018–2019, opening the door to widespread generic competition.

Q2: Can pregabalin’s revenue rebound with new indications?

A: Potentially, if regulatory agencies approve additional indications, such as refractory depression or PTSD, which could expand prescriber confidence and patient access.

Q3: How does generic competition affect the market?

A: Generic entry results in steep price declines (up to 80%), reduced profit margins for originators, but increased accessibility and overall volume.

Q4: What are the main challenges facing pregabalin’s market growth?

A: Patent expiry-related price erosion, regulatory restrictions on off-label use, competition from newer therapies, and concerns over misuse or abuse.

Q5: What emerging therapies threaten pregabalin’s market share?

A: New neuromodulators, such as selective alpha-2-delta ligands like YKP3089, and receptor-based agents with improved efficacy and safety profiles.

References

- IQVIA. (2022). Pharmaceutical Market Data Reports.

- Food and Drug Administration. (2004). Lyrica (Pregabalin) NDA 021759.

- European Medicines Agency. (2018). Summary of Product Characteristics for Pregabalin.

- U.S. Patent Office. (2017). Patent Expiry Data for Pregabalin.

- MarketWatch. (2023). Pregabalin Sales and Market forecast analysis.

This comprehensive review provides a strategic framework for understanding pregabalin’s current market position, future trajectory, and critical factors impacting its financial landscape.