Last updated: July 27, 2025

Introduction

Pantoprazole sodium, a proton pump inhibitor (PPI), is extensively prescribed for acid-related gastrointestinal disorders, including gastroesophageal reflux disease (GERD), Zollinger-Ellison syndrome, and peptic ulcers. Its mechanism involves irreversibly binding to gastric H+/K+ ATPase enzymes, suppressing gastric acid production. The drug's high efficacy and favorable safety profile have cemented its position within both prescription and over-the-counter (OTC) markets. Analyzing market dynamics and financial trajectories entails evaluating demand drivers, competitive landscape, patent considerations, and emerging trends.

Market Overview

The global pantoprazole sodium market exhibits robust growth, driven by the increasing prevalence of acid-related diseases, expanding aging populations, and the rising incidence of obesity, which correlates with GERD [1]. As of 2022, the compound’s market valuation was estimated at approximately USD 2.5 billion, with projections reaching USD 4 billion by 2030, reflecting a CAGR of around 6.4%. The dominant share belongs to North America, followed by Europe and Asia-Pacific, with emerging markets displaying accelerated growth potential.

Key Market Drivers

- Rising Prevalence of Acid-Related Disorders: The global burden of GERD and peptic ulcer disease fuels demand. Urbanization, dietary habits, and obesity contribute significantly to this trend.

- Expanding Aging Population: Older adults are more susceptible to gastrointestinal conditions, propelling sales.

- Generic Entry & Price Competitiveness: Patent expirations, notably in the U.S. and Europe, have fostered a surge in generic pantoprazole sales, reducing treatment costs and expanding access.

Regulatory & Patent Landscape

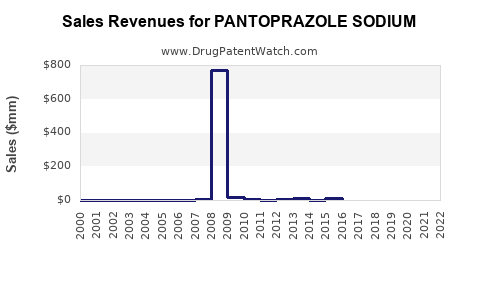

Initially patented in the early 2000s, pantoprazole sodium faced expiration of exclusive rights around 2010-2015 in key markets, leading to widespread generic manufacturing. This transition intensified price competition and altered profit margins for original developers like Takeda and pharma majors.

Market Dynamics Analysis

Competitive Landscape

The market is highly fragmented post-patent expiry, with numerous pharmaceutical companies producing generics. Leading manufacturers include Teva, Sandoz, Mylan, and Hikma. Major branded products, such as Protonix (Pfizer), reduced market share after patent loss, but remain relevant in specific markets due to brand loyalty and formulations.

Innovation and Formulation Developments: While traditional formulations dominate, there is a growing focus on enhanced delivery systems, including disintegrating tablets and IV formulations, to cater to hospitalized or geriatric patients.

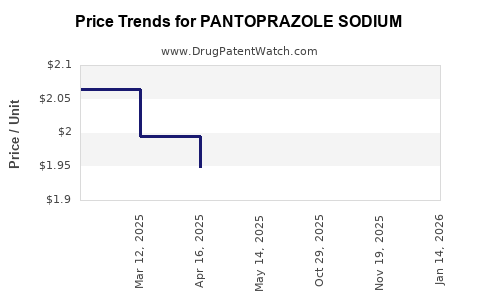

Pricing and Reimbursement Policies

Reimbursement frameworks heavily influence market penetration. In mature markets like the U.S., insurance coverage and formulary placements dictate sales volume. Price reductions owing to generic competition have significant implications for profit margins, with average prices decreasing approximately 30-50% post-patent expiry.

Supply Chain Considerations

Robust global supply chains underpin market stability. However, recent geopolitical tensions, raw material shortages, and manufacturing disruptions have temporarily affected supply, emphasizing the need for resilient logistics and diversified manufacturing bases.

Emerging Trends

- OTC Market Expansion: Over-the-counter availability in multiple markets enhances accessibility but exerts downward pressure on pricing.

- Dose and Formulation Innovation: Efforts to optimize bioavailability and reduce side effects could sustain competitive edge.

- Concerns Over Long-term Use: Growing awareness of PPI-associated risks, including deficiencies and renal complications, influence prescribing practices and market growth.

Financial Trajectory Projections

Revenue Forecasts

Post-patent expiration catalyzed a revenue decline for branded versions, but the generics segment experienced exponential growth. The market is expected to sustain moderate expansion driven by emerging markets and increased OTC sales.

- 2023-2030 Revenue Outlook: Estimated compound annual growth rate of approximately 5-7%. Market analysts project the overall market to reach USD 4 billion by 2030, with the OTC segment accounting for nearly 40% of this figure.

Profitability Trends

Profit margins for original manufacturers have diminished, often below 20%, due to intense price competition. Conversely, generic manufacturers capitalize on high-volume, low-margin sales. Investment in formulation improvements and niche indications might bolster margins for innovator companies.

Investment and R&D Outlook

Pharmaceutical companies are channeling R&D efforts into developing novel PPIs with enhanced pharmacokinetics, and into combination therapies targeting Helicobacter pylori eradication, creating avenues for differentiated products.

Potential Risks and Opportunities

- Regulatory Risks: Stringent guidelines or safety warnings could impact sales.

- Market Saturation: High generic penetration challenges profitability.

- Biosimilar and Alternative Therapies: Emerging biologics and non-PPI alternatives may threaten market share.

- Market Expansion: Drawn-out patent litigations and approvals in emerging markets offer growth opportunities.

Conclusion

Pantoprazole sodium's market is characterized by significant shifts post-patent expiry, intense competition, and evolving consumer and regulatory preferences. While branded revenues have declined, the overall market maintains growth due to rising global gastrointestinal disease burdens and market expansion into OTC and emerging regions. Companies investing in formulation innovation, focused branding, and strategic supply chain management are poised to capitalize on future opportunities. Careful navigation of regulatory landscapes and safety concerns will remain critical to capturing sustained financial gains.

Key Takeaways

- The global pantoprazole sodium market is projected to grow steadily, reaching USD 4 billion by 2030.

- Patent expirations prompted a surge in generics, intensifying price competition but expanding market access.

- Pricing strategies and reimbursement policies significantly influence revenue trajectories across geographies.

- Innovation in formulations and combination therapies present avenues for differentiation and higher margins.

- Market risks include safety concerns, biosimilar threats, and regulatory challenges, underscoring the need for strategic agility.

FAQs

1. How have patent expirations impacted Pantoprazole sodium’s market profitability?

Patent expirations led to a surge in generic manufacturing, significantly reducing prices and profit margins for original developers. While revenues for branded versions declined, the overall market growth accelerated through increased generic sales and OTC availability.

2. What are the primary drivers of demand for Pantoprazole sodium?

Rising prevalence of acid-related gastrointestinal conditions, aging populations, and increased obesity rates are primary demand drivers. Expanding OTC accessibility further fuels consumption.

3. How does the competitive landscape influence market innovation for Pantoprazole sodium?

Intense price competition encourages companies to innovate in delivery mechanisms, formulations, and combination therapies to differentiate their products and sustain profit margins.

4. What risks threaten Pantoprazole sodium’s market stability?

Safety concerns related to long-term PPI use, emerging biosimilars or alternative therapies, regulatory restrictions, and supply chain disruptions pose risks to stability.

5. What emerging trends could shape the future financial trajectory of Pantoprazole sodium?

Development of novel formulations, expansion into emerging markets, OTC growth, and strategic R&D investments in combination therapies are key trends shaping future prospects.

References

[1] MarketWatch. “Proton Pump Inhibitors Market Analysis.” 2022.