Last updated: July 28, 2025

rket Dynamics and Financial Trajectory for the Pharmaceutical Drug: Miconazole

Introduction

Miconazole, a broad-spectrum antifungal agent, has established itself as a pivotal player in the treatment of fungal infections since its introduction. As a member of the imidazole class, it disrupts fungal cell membrane synthesis, proving effective against dermatophytes, yeasts, and some molds. Its extended clinical use, diverse formulations, and evolving market landscape highlight significant shifts in demand, competitive positioning, and revenue potential. This article explores the core market dynamics and financial trajectory of miconazole, emphasizing current trends, growth drivers, challenges, and future outlooks shaping its market.

Market Overview and Segmentation

Miconazole is marketed predominantly as topical formulations—creams, powders, sprays, and vaginal suppositories. It is available over-the-counter (OTC) for superficial fungal infections such as athlete's foot, ringworm, and candidiasis, while some formulations are prescription-only. Its use spans healthcare sectors globally, with emerging markets significantly contributing to overall volume growth due to rising prevalence of dermatophytic infections and increasing awareness of fungal disease management.

Key Market Drivers

-

Rising Burden of Fungal Infections

Globally, fungal infections are proliferating, driven by factors including increased diabetes prevalence, immunosuppressive therapies, and climate change influences that facilitate fungal growth. The World Health Organization (WHO) reports a growing incidence of superficial and invasive candidiasis, coccidioidomycosis, and dermatophytoses, fueling demand for effective antifungal treatments like miconazole (WHO, 2021).

-

Expanding OTC Market and Self-Medication Trends

The availability of miconazole in OTC formats enhances accessibility, fostering self-medication, especially in low- and middle-income countries (LMICs). Growing consumer awareness about fungal infections and their treatments bolsters OTC sales, leading to robust volume expansion.

-

Product Innovation and New Formulations

Research into sustained-release topical formulations, combination therapies, and improved delivery systems aims to enhance efficacy, patient compliance, and safety profiles. These advancements sustain market relevance and open avenues for premium-priced products.

-

Increasing Healthcare Spending and Diagnostic Capabilities

Enhanced healthcare infrastructure leads to more accurate diagnostics and early intervention, increasing prescriptions of miconazole for confirmed infections, thus supporting its financial trajectory.

Market Challenges and Limitations

-

Generic Competition and Price Erosion

The patent expiry of primary miconazole formulations has led to a surge of generic equivalents. Price competition diminishes profit margins, especially in markets dominated by commoditized OTC products, pressuring leading manufacturers to innovate or diversify portfolios.

-

Limited Efficacy Against Serious Fungal Infections

While effective superficially, miconazole shows limited activity against invasive or resistant strains, such as certain Candida auris infections. This restricts its use to less severe cases, capping revenue potential.

-

Regulatory and Safety Considerations

The emergence of reports on resistance, misuse, and side effects may prompt regulatory scrutiny, influencing formulations' approval status and market access.

-

Competitive Landscape with Newer Agents

Newer antifungals like efinaconazole, tavaborole, and certain systemic agents (e.g., fluconazole, itraconazole) compete within fungal infection treatment, offering alternatives for practitioners and patients, sometimes replacing miconazole.

Financial Trajectory and Market Forecasts

-

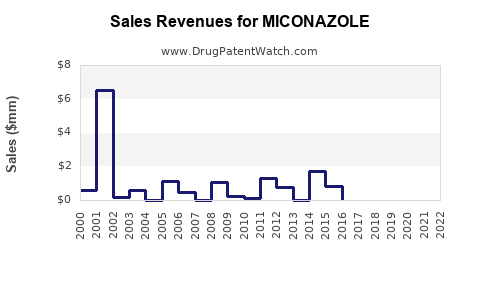

Historical Performance and Revenues

Global sales of miconazole have exhibited steady growth over the past decade, driven primarily by OTC segment expansion. According to IQVIA data (2022), the global topical antifungal market, where miconazole features prominently, is projected to grow at approximately 4-6% CAGR over the next five years. Within this, miconazole maintains a significant share, particularly in emerging markets.

-

Regional Market Trends

- North America and Europe: Mature markets with high OTC sales; growth driven by aging populations and increased awareness.

- Asia-Pacific: Rapid growth due to rising skin infection prevalence, urbanization, and expanding healthcare access. India and China represent lucrative markets due to large populations and increasing self-medication practices.

- Latin America and Africa: Emerging markets with high unmet needs, presenting growth opportunities despite infrastructural challenges.

-

Future Growth Catalysts

Advancements in formulation technology, expanding healthcare infrastructure, and increased awareness collectively support a positive financial outlook. The CAGR for miconazole-specific formulations is expected to be around 3-5% through 2028, with higher growth trajectories in LMICs.

-

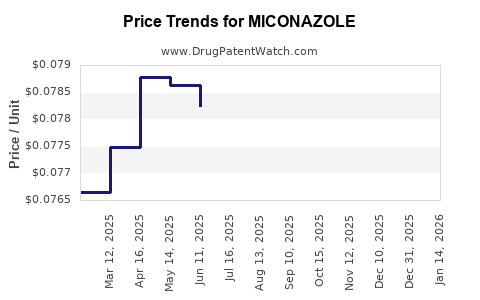

Impact of Patent and Market Entry Dynamics

Patent expirations have heightened competitive pressures but simultaneously foster generic proliferation, improving affordability and accessibility. Companies investing in niche formulations or combination therapies may sustain premium pricing and margins.

-

Potential Disruptors and Innovation Trends

Biotech innovations targeting resistant fungal strains, novel delivery methods (e.g., liposomal or nanotechnology-based systems), and biomarker-driven personalized antifungal therapies could reshape the market landscape, indirectly affecting miconazole’s market share and revenues.

Strategic Considerations for Stakeholders

- Manufacturers should prioritize product differentiation through formulation innovation, quality assurance, and targeted marketing to maintain market share amid intense generic competition.

- Investors should monitor regional market expansion, especially in emerging markets with rising fungal disease prevalence, to capitalize on growth opportunities.

- Regulatory Bodies play a crucial role in setting standards for resistance management, safety profiles, and approved indications, influencing revenue potential.

Conclusion

Miconazole's market remains resilient, buoyed by the global burden of fungal infections, OTC availability, and ongoing product innovation. Despite challenges from generics and competition, strategic positioning and expanding market access, particularly in emerging economies, underpin its robust financial trajectory. Continued advancements in delivery systems and combination therapies will be key to sustaining growth, with an optimistic outlook projected through 2028.

Key Takeaways

- The global miconazole market benefits from increasing prevalence of superficial fungal infections and expanding OTC sales.

- Patent expirations have intensified generic competition, pressuring margins but lowering prices and increasing accessibility.

- Growing markets in Asia-Pacific and Latin America represent significant future growth opportunities.

- Innovations in formulations and combination therapies are essential for maintaining competitive advantage.

- Regulatory vigilance and resistance management are critical to longevity in the market.

FAQs

1. How does the patent status of miconazole influence its market?

Patent expirations have led to widespread generic availability, increasing market competition, reducing prices, and impacting profit margins but expanding access and volume sales.

2. What are the primary formulations of miconazole?

Miconazole is primarily available as topical creams, powders, sprays, and vaginal suppositories, with OTC sales dominating superficial infections.

3. Which regions present the most growth potential for miconazole?

Emerging markets in Asia-Pacific, Latin America, and Africa exhibit substantial growth due to rising disease prevalence and increasing healthcare infrastructure.

4. What challenges could hamper miconazole’s market growth?

Key challenges include competition from newer antifungals, resistance development, regulatory restrictions, and the limited efficacy against invasive or resistant infections.

5. What future innovations could impact the miconazole market?

Advances in sustained-release formulations, nanotechnology, combination therapies, and diagnostics will influence its market dynamics and revenue potential.

References

[1] WHO, World fungal infections report, 2021.

[2] IQVIA, Global Antifungal Market Data, 2022.

[3] MarketWatch, Topical Antifungal Market Analysis, 2023.

[4] European Medicines Agency, Miconazole Data Sheet, 2022.

[5] Industry Reports, Emerging Trends in Antifungal Formulations, 2022.