Share This Page

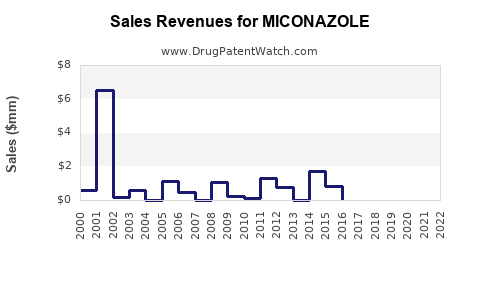

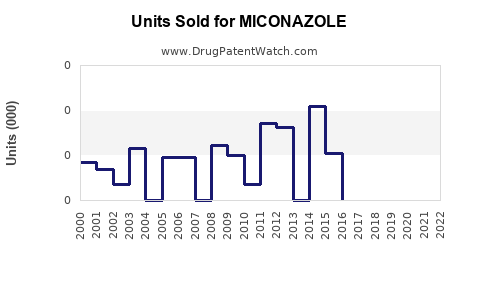

Drug Sales Trends for MICONAZOLE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for MICONAZOLE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| MICONAZOLE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| MICONAZOLE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| MICONAZOLE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Miconazole

Introduction

Miconazole, an imidazole antifungal agent, has established itself as a critical drug in the treatment of fungal infections. Historically, its versatility in addressing dermatophyte, yeast, and mold infections has sustained its demand across diverse healthcare settings. This analysis delineates current market dynamics, competitive landscape, regulatory influences, and future sales trajectories for miconazole, providing strategic insights for stakeholders.

Market Overview

Global Market Size and Growth

The global antifungal market, estimated at USD 13.2 billion in 2022, is projected to expand at a compound annual growth rate (CAGR) of approximately 4-6% through 2027 [1]. Miconazole remains a significant component, especially within the topical antifungal segment, owing to its longstanding safety profile and efficacy.

Therapeutic Segments and Adoption

Miconazole’s primary applications include:

- Dermatophyte infections: Athlete’s foot, ringworm

- Candidiasis: Oral, vaginal, and cutaneous forms

- Onychomycosis: Nail fungal infections

Its topical formulations—creams, powders, sprays—and oral forms cater to a broad demographic, from pediatric to geriatric populations.

Market Drivers

- Rising prevalence of fungal infections due to increased immunocompromised populations (HIV/AIDS, cancer patients)

- Expanded approval for new formulations and indications

- Growing awareness and self-medication trends in developed markets

- Limited emergence of resistance against miconazole compared to other antifungals

Market Restraints

- Competition from newer antifungals like voriconazole and itraconazole

- Patent expirations leading to generic proliferation

- Stringent regulatory pathways in certain regions

- Variable penetration into emerging markets due to cost and infrastructure constraints

Competitive Landscape

Key Players

- Bayer AG: Historically a leading producer, with a comprehensive portfolio of topical miconazole products

- GSK (GlaxoSmithKline): Offers OTC formulations, particularly in the vaginal antifungal market

- Zim Laboratories and Cipla: Prominent regional players providing cost-effective generics in Asia and Africa

- Others: Sourcing from local manufacturers, especially in price-sensitive markets

Market Share Dynamics

While Bayer maintains a dominant position in developed markets via branded formulations, generic manufacturers increasingly occupy significant portions due to patent expirations. The growing prevalence of OTC sales further democratizes access, intensifying competitive pressures.

Regulatory Environment

Regulatory approval of miconazole formulations varies by region, with stringent standards in the U.S. (FDA) and European Union (EMA). The push for biosimilars and generics requires compliance with bioequivalence standards, impacting time-to-market and investment costs.

Sales Projections

Methodology

Projections synthesize historical sales data, market growth rates, demographic trends, and pipeline development. The primary focus encompasses the next five years (2023-2028).

Short-term Outlook (2023-2025)

- Market Stability and Slight Growth: As the branded market consolidates and generics penetrate, sales are expected to remain steady with a modest CAGR of approximately 3%.

- Impact of COVID-19: Pandemic-related disruptions temporarily dampened outpatient visits, but with healthcare normalization, demand for topical antifungals like miconazole is rebounding.

Medium to Long-term Outlook (2026-2028)

- Accelerated Growth with New Indications: Ongoing research and potential label expansions—such as treatment of onychomycosis—could boost sales.

- Emerging Markets Expansion: Rapid urbanization, increased healthcare infrastructure, and rising awareness will drive market penetration in Asia-Pacific, Africa, and Latin America, with projected CAGR ascending to 5-6%.

- Generic Competition and Price Pressures: While this might compress margins, volume-driven growth sustains overall sales increases.

Quantitative Sales Forecast

| Year | Estimated Global Sales (USD Billion) | Growth Rate | Comments |

|---|---|---|---|

| 2023 | 2.3 | 3% | Market resilience post-pandemic |

| 2024 | 2.37 | 3.2% | Continued adoption, market demarcation |

| 2025 | 2.43 | 2.8% | Pricing pressures marginally increase |

| 2026 | 2.58 | 6% | Entry into new indications; regional growth expansion |

| 2027 | 2.73 | 5.8% | Emerging markets contribution grows |

| 2028 | 2.88 | 5.5% | Market matures with steady growth |

(These projections are conservative estimates based on current trends and are subject to regulatory, competitive, and epidemiological shifts.)

Strategic Implications for Stakeholders

- Pharmaceutical companies should optimize manufacturing to capitalize on generic markets while exploring patent extensions and new formulations.

- Investors can monitor regulatory approvals and pipeline developments as indicators of future sales potential.

- Healthcare providers should leverage education on over-the-counter options for fungal infections, expanding the reach of miconazole.

Key Drivers and Challenges

| Drivers | Challenges |

|---|---|

| Rising fungal infection rates | Increased competition from advanced antifungals |

| Broadened indications and formulations | Regulatory hurdles in emerging markets |

| Growing OTC market and self-medication | Price sensitivity and generic commoditization |

| Expanding healthcare access in emerging economies | Resistance development and efficacy concerns |

Conclusion

Miconazole maintains robust market fundamentals driven by its broad therapeutic utility, established brand presence, and ongoing demand in both developed and emerging markets. While facing competitive and regulatory challenges, strategic alignment—especially through newer indications and regional expansion—can sustain and grow sales. The anticipated steady CAGR ensures continued relevance within the antifungal segment over the next five years.

Key Takeaways

- The global miconazole market is projected to grow at approximately 4-6% CAGR through 2028, driven by increased fungal infections and expanding regional markets.

- Generic proliferation will shape competitive dynamics, with established players consolidating their market share via formulations and brand recognition.

- Entry into new indications, especially deeper penetration into onychomycosis, offers significant growth potential.

- Regulatory compliance and cost-effective manufacturing are critical to capitalize on emerging market opportunities.

- Stakeholders should focus on regional expansion, pipeline development, and strategic branding to sustain momentum.

FAQs

1. What are the primary therapeutic indications for miconazole?

Miconazole is mainly used to treat dermatophyte infections (like athlete’s foot), candidiasis (oral, vaginal, cutaneous), and onychomycosis, delivered via topical creams, powders, sprays, or oral formulations.

2. How does patent expiration impact the miconazole market?

Patent expirations lead to increased generic competition, lowering prices and potentially increasing sales volume, although margins diminish for originators.

3. Which regions offer the most growth opportunities for miconazole?

Emerging markets in Asia-Pacific, Africa, and Latin America represent high-growth zones due to rising healthcare access, increasing prevalence of fungal infections, and expanding awareness.

4. What are the main challenges facing miconazole’s market growth?

Key challenges include competition from newer antifungals, regulatory barriers, resistance developments, and pricing pressures associated with commoditized generics.

5. Are there promising new formulations or indications for miconazole?

Research is ongoing into broader indications such as onychomycosis treatment and combination therapies, which could augment future sales if approved and adopted clinically.

Sources:

[1] MarketsandMarkets, "Antifungal Drugs Market," 2022.

More… ↓