Last updated: July 27, 2025

Introduction

Methylprednisolone acetate is a corticosteroid widely employed to reduce inflammation and suppress immune responses across various medical disciplines. Therapeutic applications span orthopedics, rheumatology, dermatology, and ophthalmology, positioning the drug as a cornerstone in both acute and chronic inflammatory management. Its drug profile—characterized by rapid onset of action and extended duration compared to methylprednisolone sodium succinate—drives steady demand within established markets.

This analysis explores the intricate market dynamics influencing methylprednisolone acetate's financial trajectory. It examines competitive positioning, regulatory influences, pricing trends, manufacturing considerations, and emerging opportunities shaped by technological innovations and healthcare trends.

Market Overview and Size

Global demand for methylprednisolone acetate remains robust, projected to sustain a compound annual growth rate (CAGR) of approximately 4% over the next five years (2023–2028). North America and Europe dominate the market, accounting for over 60% of sales, driven by high healthcare expenditure, advanced medical infrastructure, and extensive use in orthopedic and rheumatologic indications.

Emerging markets within Asia-Pacific, Latin America, and the Middle East exhibit accelerated growth potential due to increasing healthcare access and rising prevalence of chronic inflammatory diseases. The expanding pipeline of biosimilar products and compounded formulations further augments market size, indicating a positive financial trajectory.

Market Dynamics Influencing Revenue Streams

1. Increasing Prevalence of Indications

The rising incidence of autoimmune, inflammatory, and degenerative musculoskeletal conditions sustains demand for methylprednisolone acetate. Conditions such as rheumatoid arthritis, osteoarthritis, asthma, and dermatological inflammatory disorders have high prevalence rates globally, reinforcing long-term market stability.

2. Healthcare Infrastructure and Policy

Enhanced healthcare infrastructure, particularly in developed economies, enhances access to corticosteroid therapies. Reimbursement policies favor minimally invasive procedures involving intra-articular injections of methylprednisolone acetate, buoying sales in outpatient settings. Conversely, pricing pressures stemming from policy changes—especially within national health systems—pose challenges to profit margins.

3. Competitive Landscape and Patent Status

Methylprednisolone acetate has been off-patent for several years, fostering intense competition among generic manufacturers. This commoditization results in price erosion but increases accessibility. The entry of biosimilars remains limited due to the corticosteroid’s chemical nature, yet biosimilar development in related formulations could impact market share.

4. Regulatory Environment

Strict regulatory oversight influences market expansion, particularly concerning manufacturing standards and injection safety protocols. Recent guidelines in the U.S., EU, and emerging markets impose stringent quality controls, affecting manufacturing costs and supply chain stability.

5. Technological Innovations and New Formulations

Advancements in drug delivery, such as sustained-release formulations and nanoparticle-based delivery systems, seek to enhance therapeutic efficacy and reduce dosing frequency. These innovations can command premium pricing, temporarily boosting revenue streams, though clinical and regulatory hurdles may delay adoption.

Financial Trajectory and Revenue Drivers

Pricing Trends and Cost Forces

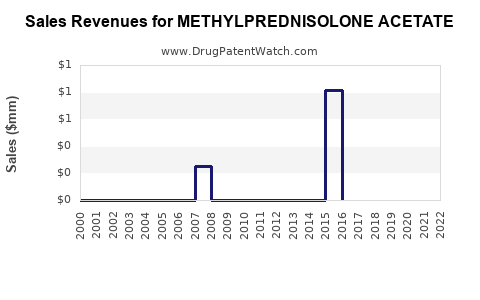

The widespread availability of generics has driven prices downward. Price reductions of 20–30% over the past decade have been documented, impacting revenue margins. However, niche formulations and targeted intra-articular injections sustain higher price points in specialized clinical settings.

Manufacturing Costs and Supply Chain Dynamics

Manufacturing methylprednisolone acetate involves complex sterile processing, quality assurance, and supply chain logistics, which currently face inflationary pressures. Raw material procurement, especially for active pharmaceutical ingredients (APIs), is susceptible to global supply disruptions, influencing overall production costs.

Market Penetration and Adoption

The drug's established efficacy ensures steady adoption in hospital formularies and outpatient clinics. Nonetheless, competition from newer anti-inflammatory biologics and small-molecule agents that target specific inflammatory pathways could gradually encroach on corticosteroid indications.

Emerging Opportunities

The development of proprietary sustained-release formulations and combination therapies presents new revenue avenues. Clinical trials exploring methylprednisolone acetate’s efficacy in novel indications, such as autoimmune neuroinflammatory diseases, may expand its market scope.

Impact of Regulatory and Policy Changes

Recent moves to curb corticosteroid overuse and potential side effects—including osteoporosis and adrenal suppression—necessitate stricter prescribing guidelines. These can influence prescribing behaviors and, consequently, revenue inflows. Additionally, regional regulatory differences necessitate tailored compliance strategies, impacting global market expansion plans.

Future Outlook and Investment Considerations

The long-term outlook signals moderate growth, reflective of the drug’s mature market status. Companies focusing on manufacturing efficiencies, innovative delivery systems, and expanding into underserved markets can capitalize on existing demand. Strategic investments in quality assurance, clinical research on novel indications, and partnerships for biosimilar development would further shape methylprednisolone acetate’s financial evolution.

Key Challenges and Risks

- Price suppression due to generics

- Regulatory scrutiny over safety and efficacy

- Competition from biologics and advanced therapies

- Supply chain disruptions impacting production costs

Conclusion

Methylprednisolone acetate maintains a resilient position within the corticosteroid segment, primarily driven by its widespread clinical utility and established market presence. While commoditization limits revenue upside in core indications, innovation and strategic market expansion could mitigate risks. The drug’s financial trajectory remains cautiously optimistic, contingent upon technological advancements, regulatory landscapes, and global healthcare dynamics.

Key Takeaways

- Steady Demand: The persistent need for anti-inflammatory treatments sustains methylprednisolone acetate’s market.

- Price Erosion: Competition from generics exerts downward pressure on prices but is balanced by niche high-value formulations.

- Innovation Drive: Sustained-release and combination drug formulations are critical for future revenue growth.

- Regulatory Impact: Stricter safety guidelines could influence prescribing patterns and market access strategies.

- Emerging Markets: Expanding healthcare access in emerging economies offers significant growth potential.

FAQs

1. How does the patent status of methylprednisolone acetate influence its market?

Being off-patent for years, methylprednisolone acetate faces robust generic competition, leading to significant price erosion but ensuring broad accessibility and stable demand.

2. What are the main clinical applications driving revenue for methylprednisolone acetate?

Intra-articular injections for orthopedic conditions, management of autoimmune and inflammatory disorders, and dermatologic applications constitute primary revenue sources.

3. How might new formulations impact the drug’s financial performance?

Innovative sustained-release formulations can command higher prices, potentially increasing revenue margins despite stringent regulatory requirements.

4. What challenges do manufacturers face in maintaining supply continuity?

Global raw material shortages, manufacturing complexities, and stringent quality standards can disrupt supply chains, increasing production costs and affecting market supply.

5. Are biosimilars relevant to methylprednisolone acetate?

Currently, biosimilars are less relevant due to the chemical nature of corticosteroids. However, the development of biosimilar-like formulations or advanced delivery systems could influence future competition.

References

[1] Global Market Insights. "Corticosteroids Market size and forecast." 2022.

[2] IMARC Group. "Methylprednisolone Market Analysis," 2022.

[3] U.S. Food and Drug Administration. "Guidelines for corticosteroid formulations," 2021.

[4] Pharma Intelligence. "Impact of biosimilars on corticosteroid markets," 2022.

[5] World Health Organization. "Prevalence and Management of Autoimmune Diseases," 2021.