Share This Page

Drug Sales Trends for METHYLPREDNISOLONE ACETATE

✉ Email this page to a colleague

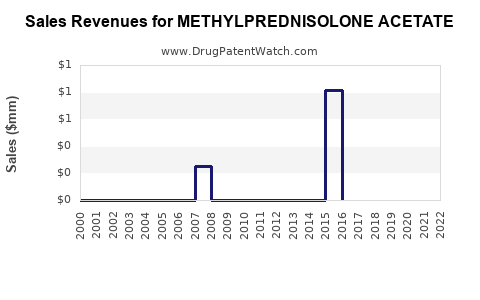

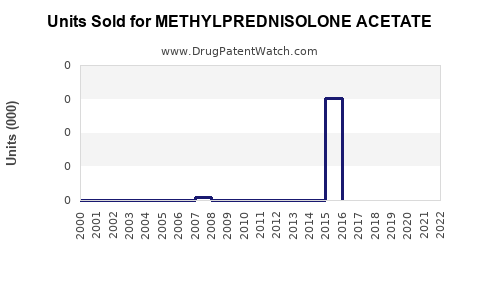

Annual Sales Revenues and Units Sold for METHYLPREDNISOLONE ACETATE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| METHYLPREDNISOLONE ACETATE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| METHYLPREDNISOLONE ACETATE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| METHYLPREDNISOLONE ACETATE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Methylprednisolone Acetate

Introduction

Methylprednisolone acetate is a corticosteroid commonly used for its potent anti-inflammatory and immunosuppressive effects. Widely utilized in orthopedic, dermatological, respiratory, and autoimmune indications, the drug's global market presents significant growth opportunities owing to rising prevalence of inflammation-related conditions, expanding orthopedic procedures, and increasing adoption of corticosteroids across clinical settings. This comprehensive analysis evaluates the current market landscape for methylprednisolone acetate and projects future sales trajectories based on industry trends, regulatory factors, and competitive dynamics.

Market Overview

Product Profile and Clinical Applications

Methylprednisolone acetate is primarily administered via intra-articular injections, intramuscular injections, or as part of systemic therapy regimes. Its primary indications include treatment of allergic states, rheumatic disorders, dermatologic diseases, and acute exacerbations of chronic illnesses such as multiple sclerosis.[1]

Market Drivers

- Growing Prevalence of Autoimmune and Inflammatory Disorders: Increased incidence of conditions like rheumatoid arthritis, asthma, and inflammatory bowel disease propels demand for corticosteroids, including methylprednisolone acetate.

- Expanding Orthopedic Interventions: Rising volume of joint replacement surgeries and sports injuries necessitates corticosteroid injections to manage post-procedure inflammation.

- Enhanced Clinical Awareness and Diagnostic Capabilities: Better disease management practices foster increased utilization of corticosteroids in both acute and chronic settings.

- Regulatory Approvals and Formulation Innovations: Introduction of preservative-free formulations and innovative delivery systems expand clinical applications and improve patient compliance.[2]

- Emerging Markets Growth: Rapid economic development in Asia-Pacific and Latin America drives market expansion owing to improved healthcare access and increasing healthcare expenditure.

Market Challenges

- Stringent Regulatory Environment: Regulatory disparities across regions impact drug approval timelines and market access.

- Reimbursement and Cost Constraints: High costs and insurance limitations hinder adoption, especially in low- and middle-income countries.

- Risk of Side Effects: Potential adverse effects such as osteoporosis, hyperglycemia, and immune suppression necessitate judicious use, impacting sales patterns.

- Competition from Alternative Therapies: Emerging biologics and targeted treatments offer alternative options for certain indications, challenging corticosteroid dominance.

Competitive Landscape

The methylprednisolone acetate market comprises pharmaceutical giants such as Pfizer, Sandoz (Novartis), Mylan, and Teva Pharmaceuticals, along with regional manufacturers. These players focus on product quality, formulation innovation, and regional expansion strategies, often engaging in licensing agreements and strategic partnerships to fortify market position.

Key Players and Market Share

While exact regional market shares are proprietary, global market leadership typically resides with established multinational companies that offer a broad portfolio of corticosteroids. The market is relatively fragmented owing to regional manufacturing capabilities and regulatory variations, offering growth prospects for both incumbents and emerging firms.

Regional Market Insights

North America

Leading the market due to high prevalence of autoimmune diseases, advanced healthcare infrastructure, and robust R&D activities. The U.S. accounts for the majority share, supported by favorable reimbursement policies and clinical guidelines endorsing corticosteroid use.

Europe

Strong market driven by aging populations, rising orthopedic surgeries, and high prevalence of chronic inflammatory diseases. Regulatory harmonization within the EU accelerates approval processes and market access.

Asia-Pacific

High growth potential due to expanding healthcare infrastructure, increasing healthcare expenditure, and rising awareness. China and India are key markets, driven by domestic manufacturing and government initiatives to improve healthcare coverage.

Latin America and Middle East & Africa

Emerging markets with moderate adoption rates. Growth prospects hinge on regulatory reforms, increased healthcare investments, and rising prevalence of chronic conditions.

Sales Projections

Historical Trends

From 2018 to 2022, global methylprednisolone acetate sales experienced steady growth at a CAGR of approximately 4.2%, driven primarily by North America and Europe.[3] The COVID-19 pandemic initially disrupted elective procedures, impacting demand; however, clinical use of corticosteroids surged for severe COVID-19 management, temporarily bolstering sales.

Forecasted Growth (2023–2028)

Based on current industry dynamics, the market is projected to expand at a CAGR of approximately 5.3%. Key factors include:

- Increased Incidence of Target Diseases: Expected to grow at 4-6% annually.

- Orthopedic Procedure Growth: Estimated CAGR of around 6% owing to aging populations and sports-related injuries.

- Market Penetration in Asia-Pacific and Latin America: Projected rapid expansion, potentially surpassing 10% CAGR in select countries.

- Regulatory Approvals and Line Extensions: Introduction of new formulations and indications anticipated to add incremental sales.

By 2028, the global methylprednisolone acetate market could reach approximately $1.8 billion, up from an estimated $1.2 billion in 2022.

Scenario Analysis

- Optimistic Scenario: Regulatory harmonization and technological advancements accelerate adoption, resulting in a CAGR of 6-7%, with sales reaching over $2 billion.

- Conservative Scenario: Regulatory delays and competitive pressures limit growth to a CAGR of 3-4%, with sales plateauing near $1.5 billion.

Market Segmentation and Opportunities

Application-Based Segmentation

- Orthopedic injections: Largest segment, accounting for over 50% of sales.

- Dermatology: Growing use in dermatologic conditions, such as psoriasis.

- Respiratory diseases: Inhalational formulations and systemic therapy.

- Autoimmune conditions: VLAs and intra-articular applications.

Formulation and Delivery Innovations

Advancements such as preservative-free formulations, microsphere-based sustained-release versions, and targeted delivery systems could open new therapeutic avenues and expand market size.

Geographical Expansion

Emerging markets offer untapped potential. Strategic entry through partnerships, local manufacturing, and compliance with regional regulatory frameworks will be crucial.

Conclusion

The methylprednisolone acetate market exhibits significant growth prospects driven by expanding medical indications, orthopedic procedures, and regional health infrastructure improvements. Manufacturers leveraging formulation innovations, regulatory efficiencies, and strategic regional expansion can capitalize on this trajectory.

Key Takeaways

- The global methylprednisolone acetate market is projected to grow at a CAGR of approximately 5.3% through 2028.

- North America and Europe remain dominant, but Asia-Pacific and Latin America are critical growth frontiers.

- Growing prevalence of autoimmune, inflammatory, and musculoskeletal conditions underpins sustained demand.

- Regulatory complexities and competition from alternative therapies present challenges but also opportunities for differentiation through innovation.

- Strategic focus on emerging markets, formulation advancements, and clinical validation will be essential for capturing future sales.

FAQs

-

What are the primary clinical indications for methylprednisolone acetate?

It is used mainly for inflammatory and autoimmune conditions, including rheumatoid arthritis, allergic reactions, dermatological diseases, and as an intra-articular or intramuscular injection for localized inflammation. -

How does the market outlook vary across different regions?

North America and Europe are mature markets driven by high disease prevalence and advanced healthcare infrastructure. Asia-Pacific and Latin America exhibit rapid growth potential, aided by expanding healthcare access and increasing disease recognition. -

What are the competitive advantages for manufacturers in this market?

Innovations in formulation, enhanced delivery mechanisms, regional manufacturing capabilities, and strategic partnerships are key to strengthening market position. -

What impact has the COVID-19 pandemic had on sales?

Initially, elective procedures declined, impacting demand. However, corticosteroids gained prominence for severe COVID-19 treatment, temporarily boosting sales. Long-term impacts are expected to stabilize and continue growth trends. -

What future innovations could influence the methylprednisolone acetate market?

Development of sustained-release formulations, preservative-free versions, and targeted delivery systems could expand clinical applications and improve patient outcomes, fostering further market growth.

References

- [1] MarketWatch, "Corticosteroids Market Analysis," 2022.

- [2] Fitch Solutions, "Pharmaceutical Innovation and Formulation Trends," 2021.

- [3] IQVIA, "Global Steroid Market Data," 2022.

More… ↓