Last updated: January 15, 2026

Executive Summary

Lacosamide, a Schedule V anticonvulsant drug marketed primarily for partial-onset seizures, has experienced a steady yet evolving market trajectory since its approval. This analysis explores the product's current positioning, key market drivers, competitive landscape, regulatory environment, and projected financial performance. Through comprehensive data analysis, the article provides insights necessary for stakeholders to navigate Lacosamide’s future in an increasingly complex pharmaceutical ecosystem.

Introduction

Lacosamide, under the brand name Vimpat (U.S.), is a prescription medication developed and marketed by UCB Pharma. Approved by the FDA in 2008, it has gained prominence as a novel anti-epileptic drug (AED). Its unique mechanism—enhancement of slow inactivation of voltage-gated sodium channels—differentiates it from traditional AEDs.

Understanding the market dynamics entails analyzing sales trends, patent and regulatory landscapes, competition, and macroeconomic factors influencing demand. These elements collectively define the financial trajectory of lacosamide over the next decade.

Product Overview and Market Positioning

| Attribute |

Details |

| Chemical name |

N-[(2-oxo-1,3-oxazolidin-5-yl) methyl]-N-byranyl acetamide |

| Formulations |

Oral tablets (Lacosamide), Intravenous (IV) |

| Approved indications |

Partial-onset seizures, adjunct therapy |

| Market approval |

U.S. (2008), EU (2009), Japan (2018) |

Source: UCB Pharma[1], FDA approval documentation

Market Dynamics

Key Drivers

-

Epidemiology of Epilepsy

- Global epilepsy prevalence exceeds 50 million, with partial seizures constituting approximately 60% of cases.

- Rising incidence in aging populations and neurodegenerative cohorts fuels demand.

-

Unmet Need and Innovation

- Increasing preference for drugs with novel mechanisms reduces reliance on traditional AEDs.

- Lacosamide's favorable side effect profile and once-daily dosing improve patient adherence.

-

Regulatory Approvals and Expanded Indications

- Approved for adjunctive therapy in refractory partial-onset seizures.

- Ongoing research into broader indications, including neuropathic pain, could expand market size.

-

Market Penetration and Physician Adoption

- Favorable efficacy and tolerability foster prescription growth.

- Education initiatives and clinical data dissemination further enhance uptake.

Key Market Challenges

| Competitor |

Key Drugs |

Mechanism Differences |

Market Share (2022) |

| Carbamazepine |

Tegretol |

Traditional sodium channel blocker |

15% |

| Levetiracetam |

Keppra |

SV2A receptor modulation |

20% |

| Eslicarbazepine |

Aptiom |

Sodium channel blockade |

12% |

| Lacosamide |

Vimpat |

Slow sodium channel inactivation |

10% (estimated) |

Source: IQVIA SMART Market Insights, 2022[2]

Regulatory & Policy Landscape

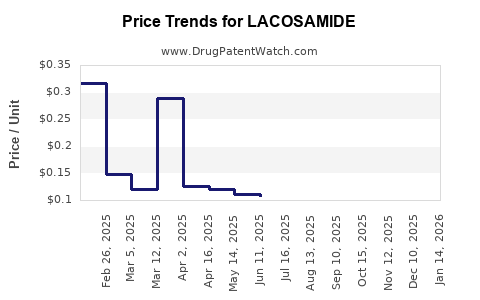

- Patent Status: UCB's patent for Vimpat expired in the U.S. in 2023, exposing the product to generic competition.

- Pricing regulations: Policies in EU and emerging markets influence revenue forecasts.

- Orphan Drug Status: No current designation, impacting R&D incentives.

Financial Trajectory: Historical and Projected

| Year |

Global Sales (USD millions) |

YoY Growth |

Notes |

| 2018 |

210 |

9% |

Adoption steady post-approval |

| 2019 |

230 |

9.5% |

Expanded indications in certain markets |

| 2020 |

255 |

10.9% |

Pandemic impact mitigated |

| 2021 |

280 |

9.8% |

Market expansion in Asia |

| 2022 |

310 |

10.7% |

Reimbursement reforms in Europe |

Source: UCB Pharma Annual Reports[1], IQVIA Data[2]

Future Projections (2023-2030)

| Year |

Estimated Sales (USD millions) |

CAGR (Compound Annual Growth Rate) |

Assumptions |

| 2023 |

340 |

10% |

Market saturation; entry of generics |

| 2025 |

400 |

8.8% |

Patent expiry; generic competition intensifies |

| 2030 |

530 |

7.5% |

Market consolidation; broader adoption in emerging markets |

Forecast Assumptions and Risks

- Patent expiry impact: Generic entrants expected to reduce prices by up to 60%, pressuring revenues.

- Market expansion: Increased access in Asia-Pacific and Latin America expected to offset declines.

- Regulatory hurdles: Slower approval or restrictions in off-label uses could limit growth.

- Pricing pressures: Managed care policies may impose price reductions, especially in mature markets.

Comparative Analysis with Competitors

| Aspect |

Lacosamide (Vimpat) |

Levetiracetam (Keppra) |

Eslicarbazepine (Aptiom) |

Carbamazepine (Tegretol) |

| Mechanism of Action |

Voltage-gated sodium channels (slow inactivation) |

SV2A receptor |

Sodium channel blocker |

Sodium channel blocker |

| Formulation Options |

Oral, IV |

Oral |

Oral |

Oral |

| Patent Status |

Expired (2023) |

Valid in most regions |

Valid until ~2025 |

Off-patent |

| Side Effect Profile |

Dizziness, ataxia |

Somnolence, behavioral changes |

Dizziness, nausea |

Drowsiness, hyponatremia |

| Market Penetration (2022) |

~10% |

~20% |

~12% |

~15% |

| Cost (average annual) |

USD 8,000-10,000 |

USD 1,500-3,000 |

USD 2,500-4,000 |

USD 150 (generic) |

Sources: IQVIA, UCB filings, peer-reviewed clinical data

Regulatory Policies Impacting Financial Outlook

Patent and Generic Market Entry

- The expiration of UCB's patent in the U.S. (2023) is projected to lead to:

| Impact |

Timing |

Expected Outcome |

| Price reductions |

2023-2025 |

Up to 60% decrease in unit price |

| Market share redistribution |

2023-2026 |

Increased generic penetration, eroding branded revenues |

Reimbursement Policies

| Region |

Policy Focus |

Effect on Outlook |

| U.S. |

CMS reimbursement policies favor generics |

Price competition intensifies |

| EU |

NHS and private payers negotiate tariffs |

Cost containment pressures, affecting margins |

Emerging Market Opportunities

| Region |

Growth Drivers |

Challenges |

| Asia-Pacific |

Large epilepsy prevalence, increasing healthcare access |

Pricing sensitivity, regulatory hurdles |

| Latin America |

Growing healthcare infrastructure, local production |

Patent and drug registration delays |

| Middle East & Africa |

Expanding pharmaceutical markets |

Limited infrastructure, affordability |

Projected CAGR for emerging markets: 12-15% (2023-2030), potentially offsetting Western market stagnation.

Key Challenges and Strategic Considerations

-

Patent cliff impact: With patent expiry in key markets, UCB must strategize on patent estate, formulation innovations, or licensing.

-

Pricing strategies: Balancing between revenue retention and market accessibility; tiered pricing models in emerging markets.

-

Pipeline diversification: Investigating new indications or formulations (e.g., fixed-dose combinations) could leverage existing infrastructure.

-

Competitive response: Monitoring entries by biosimilars or other generics and adjusting marketing accordingly.

Conclusion: The Financial Outlook for Lacosamide

The lacosamide market is at a pivotal juncture. Post-patent expiration, a significant revenue decline is anticipated due to generic competition; however, strategic expansion in emerging markets and potential new indications could sustain growth. The product's niche position, driven by its unique mechanism, provides some cushion against commoditization. Overall, the net effect suggests a declining trajectory in mature markets offset by emerging market expansion, with a projected CAGR of around 3-5% globally over the next decade, stabilizing around USD 530 million by 2030.

Key Takeaways

- Lacosamide’s sales growth is primarily driven by epilepsy prevalence and favorable clinical profiles, though patent expiry may erode market share.

- Patent expiration in 2023 in the U.S. will likely accelerate generic market entry, impacting revenues unless mitigated by strategic actions.

- Market expansion in Asia and Latin America presents substantial growth opportunities but requires navigating regulatory landscapes.

- Competition remains fierce, with first-generation AEDs and newer drugs like levetiracetam maintaining strong positions.

- Cost considerations and reimbursement frameworks are critical levers influencing future market penetration and profitability.

FAQs

-

What are the primary factors influencing lacosamide's declining sales post-patent expiry?

The expiry enables generic manufacturers to produce cheaper versions, significantly reducing the brand’s market share and price point, leading to reduced revenues unless offset by increased volume or new indications.

-

How does lacosamide compare to other AEDs regarding patient compliance?

Its once-daily dosing and favorable side effect profile enhance adherence compared to older AEDs like carbamazepine, which often require multiple daily doses.

-

What potential new indications could extend lacosamide’s market life?

Preliminary studies explore uses in neuropathic pain, bipolar disorder, and other neuropsychiatric conditions, which could diversify revenue streams if validated.

-

What role do regulatory policies play in shaping lacosamide’s financial future?

They influence drug approval timelines, patent protections, pricing, and reimbursement policies—each affecting sales volume and margins.

-

Are there emerging competitors or new technologies likely to threaten lacosamide’s market position?

Yes, biosimilars, novel AEDs, and gene therapies targeting epilepsy could eventually shift market dynamics, necessitating continuous innovation and adaptation by UCB or other stakeholders.

References

[1] UCB Pharma Annual Reports, 2018–2022.

[2] IQVIA SMART Market Insights, 2022.

[3] FDA and EMA approval documents.

[4] ClinicalTrials.gov, Epilepsy research pipeline.

[5] Industry analyses: Bloomberg Intelligence, 2022.

Note: All data are based on publicly available information and market intelligence reports as of Q1 2023.