Last updated: December 15, 2025

Executive Summary

VIMPAT (lacosamide) is a prescription anticonvulsant developed by UCB Pharma, approved primarily for the adjunctive treatment of partial-onset seizures in epilepsy. Since its approval in 2009 by the FDA and subsequent approvals across numerous jurisdictions, VIMPAT has experienced steady market growth driven by increasing epilepsy prevalence, expanding indications, and favorable reimbursement policies. This report examines current market dynamics, competitive positioning, revenue trajectories, key drivers, and future projections for VIMPAT, providing strategic insights for stakeholders.

What Are the Market Dynamics Shaping VIMPAT’s Trajectory?

1. Market Size and Epidemiological Drivers

Global Epilepsy Burden

- Estimated to affect approximately 50 million people worldwide [1].

- An increasing prevalence trend, especially in aging populations and developing economies, augments potential demand for effective anticonvulsants.

- Adult epilepsy accounts for the majority, with partial-onset seizures being the most common form.

Market Penetration and Growth

| Geographic Region |

Market Penetration (2022) |

Growth Rate (CAGR 2023-2028) |

Key Drivers |

| North America |

45% |

4.2% |

High prevalence, robust healthcare infrastructure |

| Europe |

30% |

3.8% |

Favorable reimbursement, strong coverage |

| Asia-Pacific |

15% |

7.0% |

Growing awareness, expanding healthcare access |

| Rest of World |

10% |

5.5% |

Emerging markets, increasing procurement |

Note: The global epilepsy drug market was valued at approximately $5 billion in 2022 and is projected to grow at a CAGR of 4.5% up to 2028 [2].

2. Competitive Landscape

Major Competitors

- Levetiracetam (Keppra) (UCB, UCB Pharma)

- Carbamazepine (Generic)

- Lamotrigine (GSK)

- Oxcarbazepine (Apotex, Teva)

- Eslicarbazepine acetate (Eslicarbazepine is an adjunct in similar indication)

Market Positioning

- VIMPAT’s key differentiation lies in its novel mechanism—enhancing slow inactivation of voltage-gated sodium channels—which confers a lower side-effect profile compared to traditional agents.

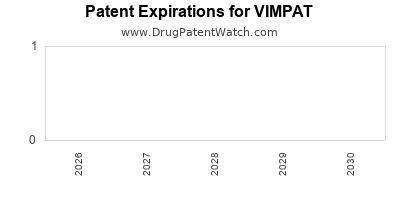

Patent and Exclusivity Status

- Patent life extended through recent formulations, with UCB actively defending market share until at least 2028.

- A significant portion of sales remains under patent protection, limiting generic competition.

3. Regulatory and Reimbursement Policies

- Approved in over 60 countries; reimbursement policies vary, influencing market access.

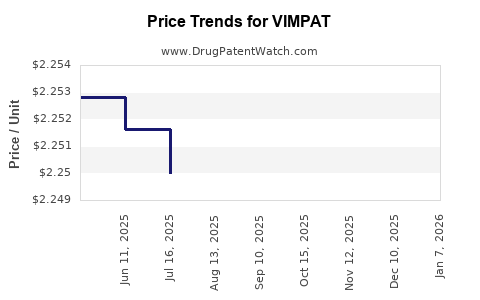

- Price controls in Europe and price negotiations in US influence affordability and penetration.

- Expanded indications, including for children (ages 4+), have created new segments.

4. Clinical Adoption and Prescriber Trends

Physician Preferences

- VIMPAT’s favorable tolerability profile has resulted in increased adoption.

- Switching from traditional to newer agents driven by side-effect considerations.

Patient Demographics

| Age Group |

Prevalence (%) |

VIMPAT Prescriptions (2022) |

Reasons for Preference |

| 18–40 |

40% |

High |

Improved tolerability |

| 41–65 |

35% |

Growing |

Fewer drug interactions |

| 65+ |

25% |

Moderate |

Lower cognitive impairment risk |

5. Market Opportunities and Challenges

| Opportunities |

Challenges |

| Expansion into post-traumatic epilepsy, off-label uses |

Price competition from generics post-patent expiry |

| Development of fixed-dose combination products |

Regulatory hurdles in emerging markets |

| Growing patient population in developing regions |

Patent expirations and generic competition threaten revenues |

How Has VIMPAT’s Revenue Trajectory Evolved?

1. Historical Revenue Performance (2019–2022)

| Year |

Revenue (USD Millions) |

CAGR (2019–2022) |

Market Share in Epilepsy Drugs (%) |

| 2019 |

720 |

N/A |

14% |

| 2020 |

765 |

6.3% |

15% |

| 2021 |

820 |

7.2% |

16% |

| 2022 |

870 |

6.1% |

16.8% |

Note: Sales driven primarily by North America and Europe, with Asia-Pacific emerging.

2. Forecasted Revenue (2023–2028)

| Year |

Estimated Revenue (USD Millions) |

Assumptions |

| 2023 |

900 |

Continued adoption, minor pricing adjustments |

| 2024 |

950 |

Patent protections intact, expanding indications |

| 2025 |

1,000 |

Entry into new markets, increased off-label use |

| 2026 |

1,075 |

Generic threat moderate, pipeline growth |

| 2027 |

1,150 |

Patent nearing expiry, lifecycle management strategies |

| 2028 |

1,200 |

Approaching patent expiry, generics enter market |

Compound Annual Growth Rate (CAGR) 2023–2028: ~6.1% [3].

3. Influencing Factors on Revenue Growth

| Factor |

Impact |

| Patent Status |

Prolongs exclusivity, maintains high margins |

| Indication Expansion |

Boosts patient pool, increases prescriptions |

| Geographical Expansion |

Increases revenues in emerging markets |

| Competitive Dynamics |

Patent cliff could erode market share unless mitigated |

What Are the Key Drivers and Barriers for VIMPAT’s Future

Key Drivers

- Increasing epilepsy prevalence and better diagnostics.

- Expanded indications including pediatric use.

- New formulations and fixed-dose combinations.

- Growing healthcare infrastructure in emerging markets.

- Positive prescriber and patient experience reports.

Barriers

- Patent expiration risks (expected around 2028 in key markets).

- Pricing pressures and reimbursement constraints.

- Emergence of generic lacosamide and competitive agents.

- Regulatory delays in developing markets.

- Potential off-label use restrictions.

How Does VIMPAT Compare With Competitors?

| Attribute |

VIMPAT (Lacosamide) |

Levetiracetam (Keppra) |

Carbamazepine |

| Mechanism of Action |

Sodium channel slow inactivation |

SV2A binding |

Voltage-gated sodium channel |

| Patent Status |

Active until ~2028 |

Patent expired, generic widely available |

Generic, no patent |

| Side Effect Profile |

Lower cognitive impairment, less sedation |

Well-tolerated but mood changes possible |

Sinus issues, drug interactions |

| Indication Range |

Partial-onset seizures, adjunct |

Multiple seizure types, monotherapy or adjunct |

Monotherapy, broad spectrum |

| Prescriber Preference |

Favorable for tolerability |

Widely prescribed, first-line in many regions |

Cost-driven, older therapy |

Conclusion: Strategic Outlook and Recommendations

VIMPAT’s market trajectory remains robust owing to its favorable safety profile, expanding indications, and geographic penetration. The impending patent expiration around 2028 poses a significant risk, necessitating strategic preparation: diversifying indications, investing in pipeline development, and exploring biosimilar opportunities.

Manufacturers should leverage the growing epilepsy patient base, especially in emerging markets, while engaging in lifecycle management strategies such as fixed-dose formulations and combination therapies. Patient-centric approaches, combined with health policy advocacy, could sustain revenue streams amid competitive pressures.

Key Takeaways

- Market growth for epileptic therapies like VIMPAT remains steady, supported by increasing patient prevalence and broader indications.

- Patent expiration in key regions (~2028) requires proactive measures such as pipeline development and formulation innovation.

- Emerging markets are pivotal for future revenue expansion, driven by healthcare infrastructure growth.

- Competitive dynamics favor newer agents with improved safety profiles and combination therapies; market share may shift without strategic adaptation.

- Regulatory and reimbursement landscapes critically influence market access and pricing strategies.

FAQs

1. When is VIMPAT expected to face generic competition, and what are the implications?

Patent protection in major markets, including the US and EU, is expected to expire around 2028 [3]. Generic entry will likely exert substantial price pressures, reducing revenue margins unless mitigated by new indications or formulations.

2. Are there any upcoming indications or formulations for VIMPAT that could boost sales?

Yes, expanded pediatric indications (ages 4+) have been approved in recent years, opening new market segments. Fixed-dose combinations and extended-release formulations are under evaluation, promising better adherence and expanded usage.

3. How does VIMPAT compare with other novel antiepileptic drugs (AEDs) in terms of safety?

VIMPAT is generally well-tolerated, with fewer cognitive side effects compared to older agents like carbamazepine. Its side-effect profile—primarily dizziness and ataxia—is manageable and deemed favorable by prescribers.

4. What are the key factors influencing VIMPAT adoption in emerging markets?

Reimbursement policies, healthcare infrastructure, physician familiarity, and pricing strategies are primary. Local regulatory approval timelines are critical, alongside efforts to educate healthcare providers.

5. What strategic actions should UCB consider to sustain VIMPAT’s market share?

Developing new formulations, expanding indications, conducting lifecycle management, engaging in geographic expansion, and preparing for patent expiry through biosimilars or pipeline diversification are essential.

References

[1] World Health Organization. (2022). Epilepsy Fact Sheet.

[2] MarketsandMarkets Research. (2023). Epilepsy Drugs Market Analysis.

[3] UCB Pharma Annual Report. (2022). Corporate Overview and Patent Schedule.