Last updated: July 27, 2025

Introduction

Folic acid, a synthetic form of naturally occurring folate (vitamin B9), has been a cornerstone in nutritional supplementation and pharmaceutical applications for decades. Its vital role in DNA synthesis, cell proliferation, and fetal development has cemented its importance in preventive healthcare. As global markets evolve amid shifting regulatory landscapes, demographic changes, and innovative pharmaceutical developments, understanding the market dynamics and financial trajectory of folic acid becomes imperative for stakeholders. This analysis provides a detailed exploration of these factors, shaping strategic decision-making in a competitive landscape.

1. Market Overview

Global Demand and Consumption

The global folic acid market exhibits steady growth, driven primarily by heightened awareness of prenatal health, folic acid fortification policies, and expanding use in dietary supplements. According to industry reports, the market valuation was approximately USD 900 million in 2021, with projections to reach over USD 1.2 billion by 2027 [1].

Key consumption regions include North America, Europe, and Asia-Pacific. North America leads in market share, attributable to strict regulatory mandates for folic acid fortification and high consumer health consciousness. Asia-Pacific emerges as a rapidly expanding segment, benefitting from burgeoning healthcare infrastructure and increasing adoption of dietary supplements.

Segmental Breakdown

- Pharmaceutical Grade Folic Acid: Primarily used in prescription formulations and fortification.

- Food Fortification: Mandatory folic acid fortification programs, particularly in the US and Europe, bolster demand.

- Dietary Supplements: Growing popularity among women of childbearing age and health-conscious consumers.

2. Market Drivers

Regulatory Mandates and Public Health Policies

Mandatory folic acid fortification policies in countries like the US (since 1998) [2] and Canada have significantly amplified demand. These policies aim to curb neural tube defects (NTDs), impacting supply chains and manufacturing scales positively.

Rising Awareness and Preventive Healthcare

Enhanced understanding of folate's role in pregnancy, neural health, and cardiovascular disease prevention continues to propel demand. Prenatal vitamins containing folic acid are recommended globally, especially among high-risk populations.

Demographic Shifts

Increasing birth rates in developing regions and aging populations in developed countries contribute to sustained market growth. Additionally, the rise in lifestyle-related deficiencies positions folic acid as an essential supplement.

Product Innovation and Formulation Advancements

Market players invest in developing novel delivery systems (e.g., sustained-release formulations), improving bioavailability and compliance, reinforcing market appeal.

3. Market Challenges

Regulatory and Quality Assurance Hurdles

Stringent quality standards impose barriers to entry and operational costs. Substandard products risk market reputation, especially in regions with rigorous regulatory oversight.

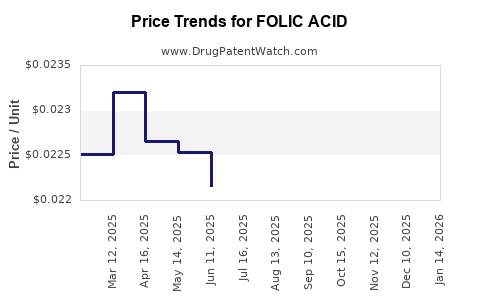

Price Volatility and Raw Material Costs

Dependence on raw material trends and geopolitical stability impacts pricing. Fluctuations in supply chains, especially across China and India—major producers—can influence costs.

Competition and Market Saturation

The mature market faces intense competition, with key players including BASF and Zhejiang Huaheng Pharmaceuticals. The commoditized nature limits pricing power, requiring differentiation strategies.

4. Market Players and Competitive Landscape

Major industry participants leverage economies of scale, strategic partnerships, and R&D investments. The trend toward vertical integration—controlling raw material sourcing up to finished product manufacturing—enhances resilience.

Emerging players focus on bioequivalent formulations and niche markets, such as specialty pharmaceuticals and fortified food sectors.

5. Financial Trajectory and Investment Outlook

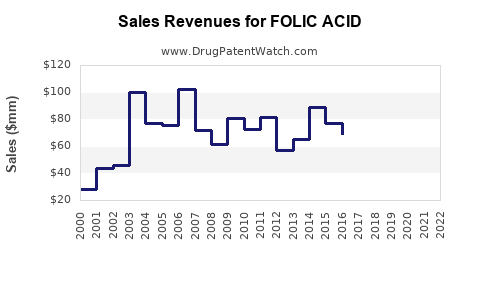

Revenue Trends

The market's compound annual growth rate (CAGR) is projected at approximately 5-6% through 2027 [1]. Growth accelerates in developing countries adopting fortification policies and in segments like dietary supplements.

Profit Margins Analysis

Margins are influenced by raw material costs, regulatory expenses, and market competition. Premium formulations and customized delivery systems command higher margins, whereas commoditized folic acid faces suppressed profitability.

Investment Opportunities

- Manufacturing Expansion: Capital investments in high-capacity, compliant production facilities offer scale benefits.

- Product Diversification: Developing specialty formulations, such as stabilized or encapsulated forms, can create differentiation and higher margins.

- Regional Market Penetration: Targeting emerging markets with underdeveloped infrastructure presents upside potential.

Risks and Mitigation

- Regulatory change risks necessitate proactive compliance strategies.

- Raw material supply chain volatility mandates diversified sourcing.

- Competitive pressures require innovative, value-added product development.

6. Future Outlook

The trajectory of the folic acid market hinges on the confluence of regulatory initiatives, technological innovation, demographic trends, and consumer awareness. The push toward personalized medicine and functional foods may unlock novel applications, further expanding the market. Sustainable manufacturing practices and quality assurance will be pivotal in maintaining competitiveness.

Emerging technological advances, such as bio-fermentation methods for natural folate production, may reshape supply chains and cost structures, indicating a potential shift in the financial landscape of folic acid manufacturing.

7. Regulatory and Ethical Considerations

Global regulatory frameworks—such as the US FDA’s enforcement of fortification standards and the European Food Safety Authority’s (EFSA) health claims regulation—directly influence market growth. Ensuring compliance preserves market access and protects brand reputation.

Ethical considerations include equitable access in developing regions and transparent labeling, aligning with global health equity goals.

Key Takeaways

- Growing Market Demand: Driven by public health policies and rising awareness of folic acid’s health benefits, especially in prenatal care.

- Strategic Market Expansion: Opportunities abound in Asia-Pacific and emerging markets with increasing fortification mandates.

- Innovation Focus Needed: To counter price competition, firms must invest in product differentiation and delivery system enhancements.

- Regulatory Compliance Essential: Navigating global standards is critical for sustained growth and international trade.

- Investment Focus: Expansion in manufacturing capacity, R&D, and regional market penetration can capitalize on projected growth.

FAQs

1. What are the primary drivers influencing the demand for folic acid globally?

Public health policies mandating fortification, rising awareness of its role in preventing neural tube defects, demographic shifts, and growth in dietary supplement consumption are key demand drivers.

2. How do regulatory frameworks impact the folic acid market?

Regulatory standards influence manufacturing practices, product formulation, and market access, directly affecting both supply and pricing strategies.

3. What technological innovations are shaping the future of folic acid production?

Bio-fermentation processes and improved encapsulation techniques enhance bioavailability and stability, offering competitive advantages.

4. Which regions present the highest growth opportunities?

Asia-Pacific and Latin America are poised for significant expansion due to increasing fortification policies and rising health awareness.

5. What are the main challenges faced by players in the folic acid market?

Price volatility, raw material supply chain disruptions, stringent regulations, and market saturation pose ongoing challenges.

References

[1] Market Research Future. "Folic Acid Market Research Report – Forecast to 2027."

[2] U.S. Food & Drug Administration. "Folic Acid – Fortification and Supplementation Policies."