Last updated: July 27, 2025

Introduction

Folic acid, a synthetic form of folate (vitamin B9), plays an essential role in DNA synthesis and cellular growth. Its primary application in healthcare encompasses prenatal vitamins, deficiency prevention, and supplementation, positioning it as a staple in both OTC and prescription markets. The global folic acid market is expanding driven by increasing awareness of maternal health, rising prevalence of neural tube defects, and widespread utilization in dietary supplements and fortification programs.

This comprehensive analysis evaluates current market dynamics, competitive landscape, regulatory influences, and projected pricing trends for folic acid over the next five years.

Market Overview

Global Market Size and Growth Trends

In 2022, the global folic acid market was valued approximately at USD 870 million, with projections of a compound annual growth rate (CAGR) of around 5%, reaching USD 1.3 billion by 2027 [1]. The growth trajectory is underpinned by:

- Increasing awareness of prenatal health: Governments and health agencies advocate folic acid supplementation to prevent neural tube defects (NTDs), especially in developing regions.

- Expansion in dietary fortification programs: Mandatory folic acid fortification in foods, notably in North America and parts of Europe, boosts market demand.

- Growing supplement consumption: Rising health consciousness, preventive healthcare trends, and aging populations contribute to increased OTC sales.

Regional Market Dynamics

- North America: The largest segment driven by well-established fortification regulations and high supplement adoption. The U.S. mandates folic acid fortification since 1998, significantly impacting demand.

- Europe: Increasing government initiatives and awareness programs foster growth, albeit with some regulatory divergence.

- Asia-Pacific: The fastest-growing region, propelled by large populations, rising healthcare infrastructure, and increased supplementation awareness.

- Latin America and Africa: Emerging markets with growth opportunities due to increasing maternal health programs.

Market Drivers

- Regulatory mandates: Governments push for mandatory folic acid fortification, influencing both supply and demand. For instance, the U.S. mandates fortification of enriched cereal grains.

- Clinical research: Evidence supporting folic acid's role in reducing birth defects sustains demand.

- Product diversification: Folic acid integration into multiple formulations enhances accessibility.

- Healthcare expenditure: Increased spending on maternal and child health correlates with higher folic acid consumption.

Competitive Landscape

Key manufacturers include:

- FMC Corporation: Major player supplying pharmaceutical and fortification-grade folic acid.

- Croda International: Supplies high-purity folic acid for pharmaceutical applications.

- Nature’s Bounty and GNC: Leading supplement brands heavily utilizing folic acid.

- Merck KGaA: Supplies raw materials and finished formulations.

Market entry barriers include regulatory approvals, high purity standards, and supply chain stability, which favor established players.

Regulatory Environment

Stringent regulatory standards govern manufacturing, labeling, and health claims. The Food and Drug Administration (FDA) in the U.S. and the European Food Safety Authority (EFSA) in Europe require compliance with Good Manufacturing Practices (GMP). Recently, increased scrutiny on supplement quality control has intensified, influencing raw material sourcing and pricing.

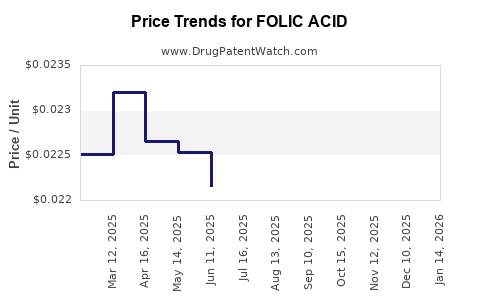

Pricing Trends and Projections

Current Price Landscape

As of 2023, the average price of pharmaceutical-grade folic acid (per gram) ranges from USD 15 to USD 25, largely depending on purity, form (powder vs. tablet), and supplier. Fortification-grade folic acid, sold in bulk quantities, typically commands lower per-unit prices for large-volume purchasers.

Factors Influencing Future Prices

- Raw material costs: Prices of pteroic acid, para-aminobenzoic acid, and other raw inputs are pivotal, with recent volatility due to supply chain disruptions.

- Manufacturing advancements: Improved synthesis and purification reduce costs, pressuring market prices downward.

- Regulatory costs: Stricter standards elevate compliance costs, potentially raising prices.

- Market demand: Growth in supplement consumption sustains economies of scale, stabilizing or reducing prices.

- Competitive pressures: Entry of new manufacturers and increased competition tend to lower prices over time.

Price Projections (2023–2028)

Forecasts indicate a gradual decline in unit prices, with a compound annual decrease of approximately 2-3%. By 2028, wholesale folic acid prices are projected to range between USD 12 to USD 20 per gram. The relative stabilization benefits manufacturers and reduces consumer costs, supporting broader market penetration.

Challenges and Opportunities

Challenges

- Supply chain disruptions: Dependence on raw material imports makes market vulnerable to geopolitical and logistical disturbances.

- Regulatory harmonization: Variability in standards across regions complicates global manufacturing and pricing strategies.

- Market saturation in developed regions: Growth potential in mature markets is moderate, emphasizing the importance of emerging markets.

Opportunities

- Innovation in formulations: Combining folic acid with other micronutrients can stimulate market growth.

- Emerging markets: Expansion into regions lacking fortification programs presents growth avenues.

- Bioavailability enhancements: Development of stabilized or more bioavailable forms can command premium pricing.

Conclusion

The global folic acid market exhibits steady growth, driven primarily by maternal health initiatives, regulatory mandates, and supplement consumption trends. Price projections reflect an overall declining trend as manufacturing efficiency improves and competition intensifies. Stakeholders should prioritize supply chain resilience, regulatory compliance, and product innovation to capitalize on emerging opportunities while managing pricing pressures.

Key Takeaways

- The folic acid market is projected to grow at a CAGR of approximately 5% through 2027, reaching USD 1.3 billion.

- Regulatory mandates, particularly in North America and Europe, underpin consistent demand growth.

- Prices are expected to decline modestly by 2028, with wholesale costs between USD 12 and USD 20 per gram.

- Supply chain stability and regulatory compliance remain critical for sustainable pricing and profitability.

- Opportunities exist in emerging markets and product innovation, especially in bioavailability and combination supplements.

FAQs

1. How do government fortification programs influence folic acid prices?

Mandatory fortification increases bulk demand, often leading to economies of scale that lower per-unit prices. These programs also create consistent, predictable demand, stabilizing market prices.

2. What are the main factors that could cause folic acid prices to rise in the next five years?

Potential factors include raw material shortages, regulatory tightening increasing manufacturing costs, and supply chain disruptions from geopolitical or logistical issues.

3. Are there any emerging markets poised to drive future folic acid demand?

Yes. Countries in Asia-Pacific, Latin America, and Africa are expanding maternal health initiatives, representing significant growth opportunities due to increasing supplementation awareness and evolving food fortification policies.

4. How does patenting or intellectual property affect the folic acid market?

Since folic acid is a generic vitamin, patents are limited. However, proprietary formulations or delivery systems could influence pricing and market share, especially if they improve bioavailability or stability.

5. What role does consumer perception play in the pricing of folic acid supplements?

Positive perceptions of supplementation benefits, safety, and brand reputation can command premium prices, particularly in developed markets where consumers are willing to pay more for perceived quality and efficacy.

Sources

[1] Market Research Future. (2022). "Folic Acid Market Analysis, Size, Share & Growth Projections."

[2] GlobalData. (2023). "Vitamin and Supplement Market Outlook."

[3] U.S. Food and Drug Administration. (2020). "Food Fortification Policy."]