Last updated: July 28, 2025

Introduction

Folic acid, a synthetic form of the B-vitamin folate, is a critical nutrient in prenatal health, anemia prevention, and cellular health. Recognized for its role in reducing neural tube defects during pregnancy, folic acid has become a staple supplement in global health initiatives. The evolving landscape of healthcare, regulatory policies, and consumer awareness significantly influences its market dynamics. This report presents a comprehensive analysis of the folic acid market, including current market size, growth drivers, barriers, and sales projections through 2030.

Market Overview and Definition

Folic acid is primarily marketed as a dietary supplement and food fortification ingredient. Its applications extend to prescription drugs for specific deficiencies and prenatal formulations. The global market encompasses branded and generic products, over-the-counter (OTC) supplements, and fortified foods.

According to industry reports, the global edible vitamin and supplement market was valued at approximately USD 150 billion in 2022, with folic acid constituting a substantial segment, driven by its mandatory fortification policies and increasing health consciousness.

Current Market Size and Segmentation

Geographical Distribution

- North America: The largest market share, driven by widespread supplement use, stringent regulatory standards, and high prenatal supplement awareness.

- Europe: Significant growth attributed to regulatory mandates and proactive health policies.

- Asia-Pacific: Fastest-growing segment, fueled by emerging economies, increased health awareness, and governmental fortification programs.

- Rest of the World: Increasing demand from Latin America, Middle East, and Africa, although market penetration remains moderate.

Product Types

- Prescription-based Folic Acid: Primarily used for treating deficiencies and during pregnancy.

- OTC Supplements: Widely available, including standalone folic acid tablets and multivitamins.

- Food Fortification: Enriched cereals, flour, and other staple foods.

End-User Segments

- Pregnant Women: The largest consumer group, vital for neural tube defect prevention.

- General Population: For anemia prevention and overall health.

- Healthcare Providers & Food Manufacturers: Key stakeholders in distribution and formulation.

Market Drivers

-

Prenatal Nutritional Guidelines: Globally, health organizations like WHO and CDC recommend folic acid supplementation for women planning pregnancy, driving demand.

-

Fortification Policies: Mandatory folic acid fortification in countries like the US, Canada, and some European markets has significantly increased access.

-

Rising Awareness of Neural Tube Defects: Increased educational campaigns have bolstered consumer acceptance.

-

Aging Population: Older adults increasingly seek supplements to maintain health, indirectly supporting folic acid sales.

-

Expanding Dietary Supplement Industry: Growing consumer preference for preventive healthcare supports market growth.

Market Barriers

- Regulatory Challenges: Variations in fortification policies and supplement regulations hinder uniform market development.

- Price Sensitivity: Cost considerations impact consumer purchasing decisions, especially in emerging markets.

- Health Concerns & Folic Acid Supplements: Debates on optimal dosing and long-term safety may temper impulsive demand.

- Market Saturation: Mature markets in North America and Europe approach saturation, limiting near-term growth.

Competitive Landscape

Key players include Pfizer, BASF, Zentiva, Amway, and local supplement manufacturers. The competitive environment is characterized by:

- Product Innovation: Enhanced formulations with added micronutrients.

- Regulatory Compliance: Ensuring adherence to country-specific guidelines.

- Strategic Collaborations: Partnerships with food manufacturers and healthcare providers.

Sales Projections Through 2030

Based on historical growth rates, market trends, and demographic projections, the folic acid segment is expected to grow substantially.

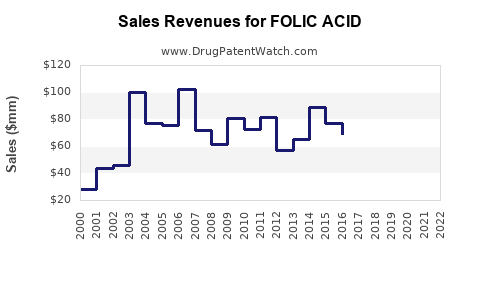

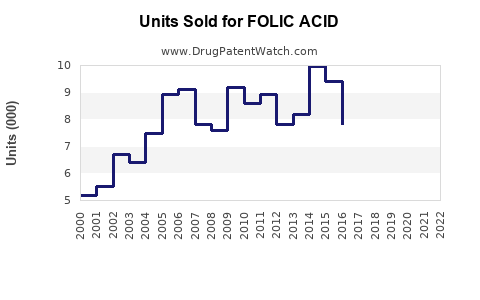

Quantitative Analysis

- Historical CAGR (2018-2022): Approximately 4.5%-5% globally.

- Projected CAGR (2023-2030): Estimated at 6% driven by emerging markets, fortification mandates, and increased prenatal health initiatives.

Forecasted Market Size

| Year |

Estimated Market Size (USD Billion) |

| 2022 |

5.0 |

| 2023 |

5.3 |

| 2025 |

6.2 |

| 2027 |

7.5 |

| 2030 |

9.4 |

Notes: These projections factor in supply chain dynamics, regulatory changes, and consumer behavior. The Asia-Pacific region is anticipated to contribute over 40% of total sales by 2030, reflecting high growth potential.

Emerging Trends and Opportunities

- Personalized Nutrition: Custom formulations targeting specific health needs.

- Plant-based & Organic Supplements: Rising consumer demand for natural and organic folic acid sources.

- Digital Marketing & E-commerce: Expansion of online retail channels broadens reach, especially in developing countries.

- Policy Advocacy: Continuous government initiatives mandating fortification create stable demand.

Regulatory and Policy Impact

Ongoing regulatory updates, such as the US FDA’s fortification guidelines and European Food Safety Authority (EFSA) standards, will influence market growth and innovation. Moreover, potential revisions of safe dosage levels could impact manufacturing strategies.

Risks and Uncertainties

- Regulatory Changes: Stringent regulations could restrict certain formulations or labeling.

- Market Saturation: Mature markets in North America and Europe might limit growth.

- Public Health Debates: Conflicting research regarding optimal folic acid intake may influence consumer behavior.

- Supply Chain Disruptions: Raw material shortages or geopolitical issues could impact production.

Key Takeaways

- The global folic acid market is poised for continued growth, driven by mandatory fortification policies, increasing prenatal supplement awareness, and expanding healthcare infrastructure.

- Asia-Pacific represents the most promising region, with projected double-digit growth rates due to emerging markets and governmental health initiatives.

- Ongoing innovation and strategic partnerships will be essential for market participants to capitalize on increasing demand.

- Regulatory landscape variability presents both opportunities and barriers; proactive compliance is vital.

- The market’s stability hinges on public health policies, scientific consensus on optimal dosing, and consumer perceptions.

FAQs

1. What are the primary factors driving the global demand for folic acid?

The main drivers include mandatory food fortification policies, increased awareness of neural tube defects prevention, growing prenatal supplement consumption, and expanding dietary supplement markets globally.

2. How do regulatory differences across regions affect the folic acid market?

Diverse regulations regarding fortification levels, labeling, and health claims create challenges for manufacturers. Countries with strict policies may limit available formulations, while regions with supportive regulations promote market expansion.

3. Which regions are expected to see the highest sales growth for folic acid?

The Asia-Pacific region is projected to experience the fastest growth due to rising health awareness, government initiatives, and large populations of women of childbearing age.

4. How might emerging scientific research influence the market demand?

Evolving research on optimal folic acid intake and safety profiles could modify recommended dosages, affecting product formulations and consumer usage patterns.

5. What opportunities exist for new entrants in the folic acid market?

Opportunities include developing plant-based, organic formulations, leveraging digital marketing, forming strategic alliances with food manufacturers, and expanding into underserved markets with emerging health awareness campaigns.

References

[1] MarketWatch, "Global Dietary Supplements Market," 2022.

[2] Fortune Business Insights, "Folic Acid Market Size, Share & Industry Analysis," 2022.

[3] WHO, "Guidelines for fortification of food-grade wheat flour with folic acid," 2015.

[4] US FDA, "Food fortification standards and guidelines," 2021.

[5] Grand View Research, "Nutritional Supplements Market Analysis," 2022.