DROSPIRENONE - Generic Drug Details

✉ Email this page to a colleague

What are the generic drug sources for drospirenone and what is the scope of freedom to operate?

Drospirenone

is the generic ingredient in twenty-one branded drugs marketed by Exeltis Usa Inc, Mayne Pharma, Bayer Hlthcare, Novast Labs, Barr, Glenmark Pharms Ltd, Hetero Labs, Jubilant Cadista, Pharmobedient, Watson Labs, Xiromed, Sun Pharm, Aurobindo Pharma Ltd, Lupin Ltd, Apotex, Dr Reddys Labs Sa, Naari Pte, and Watson Labs Inc, and is included in thirty-eight NDAs. There are twenty-six patents protecting this compound. Additional information is available in the individual branded drug profile pages.Drospirenone has sixty-nine patent family members in thirty-one countries.

There are eleven drug master file entries for drospirenone. One supplier is listed for this compound. There are two tentative approvals for this compound.

Summary for DROSPIRENONE

| International Patents: | 69 |

| US Patents: | 26 |

| Tradenames: | 21 |

| Applicants: | 18 |

| NDAs: | 38 |

| Drug Master File Entries: | 11 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 79 |

| Clinical Trials: | 116 |

| Patent Applications: | 4,093 |

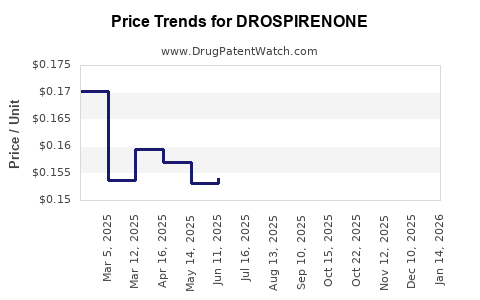

| Drug Prices: | Drug price trends for DROSPIRENONE |

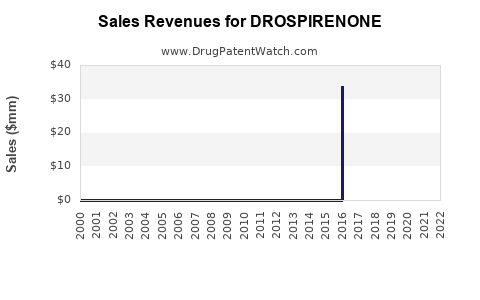

| Drug Sales Revenues: | Drug sales revenues for DROSPIRENONE |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for DROSPIRENONE |

| What excipients (inactive ingredients) are in DROSPIRENONE? | DROSPIRENONE excipients list |

| DailyMed Link: | DROSPIRENONE at DailyMed |

Recent Clinical Trials for DROSPIRENONE

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Vertex Pharmaceuticals Incorporated | PHASE1 |

| Hansoh BioMedical R&D Company | PHASE1 |

| Cairo University | PHASE3 |

Generic filers with tentative approvals for DROSPIRENONE

| Applicant | Application No. | Strength | Dosage Form |

| ⤷ Get Started Free | ⤷ Get Started Free | 4MG | TABLET;ORAL |

| ⤷ Get Started Free | ⤷ Get Started Free | 0.5MG;1MG | TABLET;ORAL |

The 'tentative' approval signifies that the product meets all FDA standards for marketing, and, but for the patents / regulatory protections, it would approved.

Anatomical Therapeutic Chemical (ATC) Classes for DROSPIRENONE

Paragraph IV (Patent) Challenges for DROSPIRENONE

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| SLYND | Tablets | drospirenone | 4 mg | 211367 | 1 | 2022-01-07 |

US Patents and Regulatory Information for DROSPIRENONE

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Aurobindo Pharma Ltd | LO-ZUMANDIMINE | drospirenone; ethinyl estradiol | TABLET;ORAL | 209632-001 | Feb 27, 2018 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Bayer Hlthcare | YAZ | drospirenone; ethinyl estradiol | TABLET;ORAL | 021676-001 | Mar 16, 2006 | AB | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Watson Labs | DROSPIRENONE AND ETHINYL ESTRADIOL | drospirenone; ethinyl estradiol | TABLET;ORAL | 078833-001 | Nov 28, 2011 | AB | RX | No | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Mayne Pharma | NEXTSTELLIS | drospirenone; estetrol | TABLET;ORAL | 214154-001 | Apr 15, 2021 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

International Patents for DROSPIRENONE

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Hungary | S2000016 | ⤷ Get Started Free | |

| South Korea | 20170085604 | 드로스피레논을 포함하는 약학적 조성물 및 피임용 키트 (Pharmaceutical composition comprising drospirenone and contraceptive kit) | ⤷ Get Started Free |

| Lithuania | 3632448 | ⤷ Get Started Free | |

| Hungary | E058176 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for DROSPIRENONE

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 3632448 | 29/2022 | Austria | ⤷ Get Started Free | PRODUCT NAME: DROSPIRENON; NAT. REGISTRATION NO/DATE: 139227 20191206; FIRST REGISTRATION: DK 31332 (MITTEILUNG) 20191022 |

| 3632448 | 22C1031 | France | ⤷ Get Started Free | PRODUCT NAME: DROSPIRENONE; NAT. REGISTRATION NO/DATE: NL49691 20191121; FIRST REGISTRATION: DK - 61678 20191016 |

| 2588114 | 301123 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: SLINDA; NATIONAL REGISTRATION NO/DATE: RGV 127386 20210317; FIRST REGISTRATION: DK 31332 20191016 |

| 2588114 | LUC00227 | Luxembourg | ⤷ Get Started Free | PRODUCT NAME: DROSPIRENONE; AUTHORISATION NUMBER AND DATE: 31332 20191022 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for Drosperinone

More… ↓