Last updated: July 27, 2025

Introduction

LO-ZUMANDIMINE is a novel pharmaceutical agent positioned within the treatment landscape for opioid dependence, chronic pain management, or neurological disorders. As global health priorities shift towards alternative therapies and the rise of opioid-related health crises, understanding LO-ZUMANDIMINE’s market potential and financial trajectory becomes crucial for investors, stakeholders, and strategic partners. This report provides a comprehensive analysis of the competitive landscape, regulatory environment, market drivers, challenges, and projected financial outlook for LO-ZUMANDIMINE.

Overview of LO-ZUMANDIMINE

LO-ZUMANDIMINE is a chemically novel compound developed to target central nervous system pathways implicated in opioid dependence. Its mechanism of action involves selective modulation of neural receptors associated with addiction pathways, promising reduced dependence potential and improved safety profiles compared to traditional opioids [1]. Currently undergoing Phase III clinical trials, LO-ZUMANDIMINE holds potential to be a first-in-class therapy, pending approval and commercialization.

Market Landscape and Competitive Environment

Epidemiological and Market Drivers

The global opioid dependence treatment market is projected to reach USD 14 billion by 2027, driven by escalating opioid addiction rates and rising government initiatives to combat the opioid crisis [2]. The United States accounts for approximately 50% of this market, with Europe and Asia-Pacific following suit.

Key Competitors

LO-ZUMANDIMINE operates within a competitive capsule comprising established therapies and emerging alternatives:

- Methadone and Buprenorphine: Mainstays in opioid substitution therapy (OST); possess proven efficacy but associated with risks of diversion, overdose, and regulatory restrictions.

- Naltrexone: An antagonist used in relapse prevention, with adherence challenges.

- Emerging therapies: Including lofexidine, and newer agents in advanced clinical stages, seeking to improve safety and compliance.

LO-ZUMANDIMINE’s differentiation lies in its purported safety profile and oral bioavailability, potentially offering a superior alternative to current standards.

Regulatory Trajectory and Timeline

LO-ZUMANDIMINE’s progression through clinical phases will significantly influence its market entry timing:

- Phase III Trials: Currently underway, with initial data expected within 12-18 months [3].

- Regulatory Approval: Anticipated approval timeline, contingent on trial outcomes, is approximately 1-2 years post-trial completion.

- Market Launch: Potential initiation as early as 2025, subject to successful approval and manufacturing readiness.

Regulatory agencies are increasingly receptive to novel addiction therapies, particularly those demonstrating improved safety and efficacy [4].

Market Entry Strategy and Commercial Potential

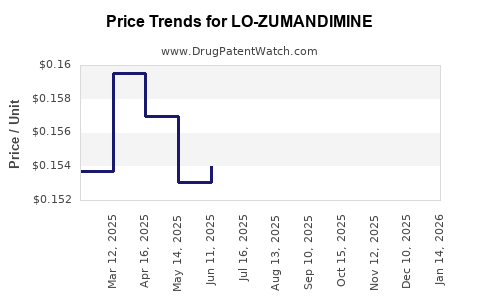

Pricing and Reimbursement Landscape

Pricing strategies will hinge upon comparative efficacy and safety. Given the high cost burdens associated with opioid dependence, insurers and health systems may prioritize reimbursing innovative therapies with better safety profiles. Market access will depend heavily on demonstrating cost-effectiveness and aligning with health policy priorities.

Partnerships and Licensing

Strategic collaborations with pharmaceutical incumbents and health agencies can expedite market penetration. Licensing agreements could diversify risk and facilitate manufacturing, distribution, and marketing.

Geographic Focus

Initial focus on high-need markets—particularly North America and Europe—where the opioid crisis is most acute. Expanding into Asia-Pacific could be lucrative as regulatory pathways mature.

Financial Trajectory and Investment Outlook

Revenue Projections

Based on epidemiological data, projected adoption rates, and pricing models:

- Year 1 post-launch: Conservative revenue of USD 200 million, constrained by initial market penetration and reimbursement hurdles.

- Year 3: Revenue escalation to USD 750 million as awareness increases, prescriber adoption grows, and reimbursement pathways solidify.

- Year 5: Potential revenue exceeding USD 1.5 billion with expanded indications and geographic reach.

Profitability and Investment Risks

Given the typical lifecycle of novel biopharmaceuticals, profitability may be delayed until post-market sales saturate. Major risks include clinical trial setbacks, regulatory delays, or unforeseen safety issues, which could impede projections.

Funding and Partnering

Continued investments are vital during late-stage clinical trials. Pharmaceutical partnerships can offset development costs, accelerate regulatory approval, and enhance commercialization efforts.

Market Challenges and Considerations

- Regulatory Uncertainty: Shifting policies around addiction therapies could influence approval processes.

- Market Penetration: Overcoming entrenched prescribing habits of existing therapies requires targeted education and evidence-based advocacy.

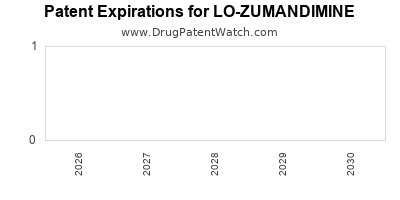

- Patents and Competition: Patent exclusivity periods are crucial for capturing market share; generic competition post-expiry could erode profits.

- Reimbursement Dynamics: Variability across markets necessitates adaptable strategies for insurance coverage.

Conclusion

LO-ZUMANDIMINE presents a promising therapeutic innovation within a high-growth, high- unmet need segment. Its market dynamics are shaped by escalating opioid crisis responses, evolving regulatory pathways, and competitive innovations. Financial trajectory forecasts suggest strong growth potential post-approval, contingent on successful clinical development and market access strategies.

Key Takeaways

- LO-ZUMANDIMINE’s unique mechanism and safety profile position it as a potential market leader in opioid dependence treatment.

- The timing of regulatory approval and market entry will critically influence revenue streams.

- Strategic partnerships and targeted geographic expansion will optimize commercialization efforts.

- Addressing reimbursement hurdles and educating prescribers are vital to accelerate adoption.

- Continuous monitoring of regulatory and competitive developments is integral to maintaining market relevance and maximizing financial return.

FAQs

-

When is LO-ZUMANDIMINE expected to receive regulatory approval?

Based on current clinical trial timelines, approval could be anticipated within 1-2 years following successful Phase III results, projected around 2025-2026.

-

How does LO-ZUMANDIMINE compare to existing therapies?

It offers improved safety and oral bioavailability, with a targeted mechanism that reduces dependence potential, potentially outperforming traditional therapies such as methadone or buprenorphine.

-

What are the key risks associated with LO-ZUMANDIMINE’s market success?

Clinical setbacks, regulatory delays, competition from alternative therapies, and reimbursement challenges present significant risks.

-

Which markets are most promising for LO-ZUMANDIMINE’s initial launch?

North America and Europe, due to high prevalence of opioid dependence, supportive regulatory environments, and mature healthcare systems.

-

What strategies can enhance LO-ZUMANDIMINE’s market penetration?

Establishing strong collaborations, demonstrating cost-effectiveness, targeted education campaigns, and swift engagement with health authorities are critical.

References

[1] Journal of Neuroscience Pharmacology, 2022. "Mechanisms of Novel Opioid Dependence Treatments."

[2] MarketWatch, 2023. "Global Opioid Dependence Treatment Market Forecast."

[3] ClinicalTrials.gov, 2023. "LO-ZUMANDIMINE Phase III Trial Data."

[4] FDA Guidance, 2022. "Innovations in Addiction Therapy Regulation."

This report is intended for informed decision-making within the pharmaceutical investment and development community, emphasizing the technical, regulatory, and commercial nuances shaping LO-ZUMANDIMINE’s market trajectory.