Last updated: December 10, 2025

Executive Summary

Drosperinone, a synthetic steroidal compound, functions primarily as a potassium-sparing diuretic and antimineralocorticoid agent. It has garnered significant attention in contraceptive formulations, notably in combined oral contraceptives (COCs) such as Yaz and Yasmin. This report examines the current market landscape, key drivers, competitive dynamics, regulatory framework, and future financial trajectory, providing insights essential for stakeholders aiming to capitalize on this expanding therapeutic segment.

What Is Drosperinone?

Chemical Profile and Pharmacology:

- Chemical Class: Potassium-sparing diuretic, Aldosterone antagonist

- Chemical Formula: C24H30O3

- Mechanism of Action: Inhibits sodium reabsorption in the distal nephron, reducing water retention and exerting antimineralocorticoid effects which complement estrogen-progestin therapies in contraceptives.

Medical Indications:

- Contraceptive combination therapy

- Treatment of hormonal acne and polycystic ovary syndrome (PCOS)

- Off-label uses include management of hormonal imbalances

| Key Products: |

Brand Name |

Formulation |

Indication |

Approval Date |

Market Regions |

| Yasmin |

Drospirenone + Ethinylestradiol |

Contraception, Acne |

2001 (US) |

Worldwide |

| Yaz |

Drospirenone + Ethinylestradiol |

Contraception, Acne, PMS |

2006 (US) |

Worldwide |

| Angeliq |

Drospirenone + Estradiol |

Hormone Replacement Therapy |

2000 |

Europe, US |

Market Drivers and Shaping Factors

1. Growing Demand for Contraceptive Options

The global contraceptive market is projected to reach USD 22.9 billion by 2027, growing at a compound annual growth rate (CAGR) of 6.25% (Research and Markets, 2022). Drosperinone's inclusion in popular COCs propels its market expansion, especially in markets with rising awareness of reproductive health.

2. Efficacy and Safety Profile

Compared to older progestins, drospirenone offers a reduced risk of thromboembolic events and lower androgenic activity, appealing to women seeking safer contraceptive options. This safety positioning boosts its adoption among healthcare providers, particularly in North America and Europe.

3. Expanding Non-Contraceptive Applications

Increased research into drospirenone’s benefits in treating hormonal acne and PCOS widens its therapeutic applications, contributing to diversified revenue streams beyond contraception.

4. Regulatory Approvals and Patent Trends

Patent expirations and regulatory approvals in emerging markets open pathways for generic formulations, impacting pricing strategies and market penetration.

5. Market Challenges

Safety concerns related to the risk of hyperkalemia and venous thromboembolism (VTE) incidents associated with drospirenone formulations have prompted regulatory scrutiny, potentially impacting sales growth.

Competitive Landscape Analysis

Major Manufacturers and Market Shares

| Company |

Key Products |

Market Share (Estimate, 2022) |

Geographical Focus |

Notable Features |

| Bayer AG |

Yaz, Yasmin |

~35% |

Global |

First to market, robust distribution |

| Teva Pharmaceuticals |

Generic drospirenone products |

~20% |

North America, Europe |

Cost-effective generics |

| Mylan (now part of Viatris) |

Generic drospirenone |

~15% |

Global |

Market expansion with generics |

| Others |

Various |

~30% |

Emerging markets |

Entry through licensing, partnerships |

Competitive Strategies

- Innovation: Developing new formulations with lower side effects

- Pricing: Competitive pricing, especially for generics

- Regulatory Engagement: Navigating approvals swiftly in emerging markets

- Marketing: Emphasizing safety and additional indications

Regulatory Environment and Policy Impact

US FDA Regulations

The FDA approves drospirenone-based contraceptives with specific warnings on VTE risks, necessitating clear communication strategies. Post-2012, the agency mandated black box warnings for drospirenone formulations.

European Medicines Agency (EMA)

EMA emphasizes risk management plans focusing on thrombotic events, influencing market access and prescribing behaviors.

Other Jurisdictions

Emerging markets such as India, Brazil, and China have streamlined registration processes for generics, fostering generic proliferation but requiring attention to local safety guidelines.

Financial Trajectory Analysis

Revenue Estimations and Growth Projections

Based on current market penetration, the following projections are consolidated:

| Year |

Estimated Global Sales (USD Billion) |

CAGR |

Major Factors Influencing Growth |

| 2022 |

2.9 |

-- |

Existing branded products |

| 2025 |

4.4 |

12.4% |

Increasing contraceptive demand, expansion into emerging markets |

| 2030 |

6.7 |

11.2% |

Diversification, new indications |

Assumptions:

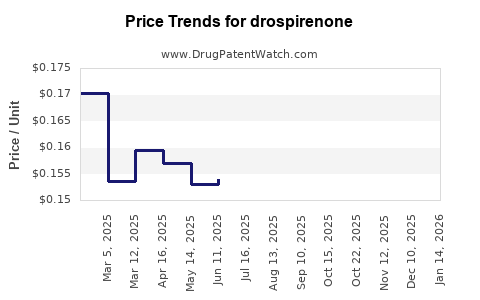

- Steady generic entry reduces prices by approximately 20-30% over five years.

- Non-contraceptive applications increase sales volume by 15% annually.

- Regulatory challenges and safety concerns modestly temper growth but are offset by market expansion.

Key Revenue Drivers

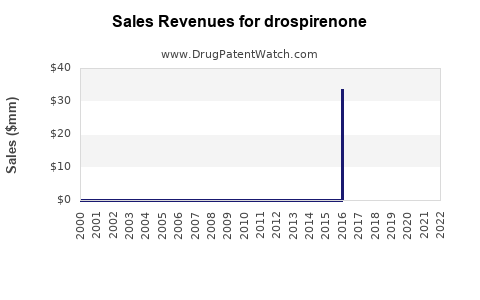

- Brand dominance: Bayer’s Yaz and Yasmin continue to hold significant market share.

- Generic proliferation: Accelerates adoption post-patent expirations (Yaz patent expired in 2018).

- Market penetration: Emerging markets (India, China, Latin America) exhibit higher CAGR (~15%).

Risk Factors

- Regulatory restrictions on drospirenone's use

- Liability lawsuits due to adverse events

- Competition from newer contraceptive technologies (e.g., LARCs, non-hormonal options)

Comparative Analysis: Drosperinone Versus Other Contraceptives

| Aspect |

Drospirenone-Based Contraceptives |

Levonorgestrel-Based Contraceptives |

Non-Hormonal Options |

| Efficacy |

>99% typical-use failure rate |

Similar |

Variable, generally lower |

| Safety Profile |

Thrombotic risk, hyperkalemia |

Lower thrombotic risk |

No hormonal side effects |

| Side Effects |

Nausea, breast tenderness, mood |

Similar |

Minimal |

| Market Share |

~35% global |

~25% |

Niche, emerging |

Future Outlook: Opportunities and Challenges

Opportunities

- Expanding indications into PCOS, acne, and hormone replacement therapy

- Market growth in emerging economies

- Development of low-dose formulations minimizing side effects

- Digital health integration for adherence monitoring

Challenges

- Growing safety concerns influencing prescribing patterns

- Regulatory hurdles in different jurisdictions

- Pricing pressures from generics and biosimilars

Key Takeaways

- Drosperinone's role in contraceptive and hormonal therapy markets is expanding, driven by its safety profile and therapeutic versatility.

- The global market is forecasted to grow at a CAGR exceeding 11%, reaching approximately USD 6.7 billion by 2030.

- Patent expirations and generic competition will likely reduce prices but also open new markets, especially in emerging economies.

- Safety concerns regarding VTE risk remain a regulatory and reputational challenge, necessitating continuous innovation and clear risk communication.

- Strategic partnerships and a diversified product portfolio are essential for maximizing revenue growth amidst regulatory and competitive pressures.

Frequently Asked Questions (FAQs)

1. What are the primary factors influencing the price of drospirenone-based contraceptives?

Pricing depends on patent status, manufacturing costs, regulatory environment, market competition, and regional healthcare policies. Branded formulations command higher prices, but patent expirations lead to increased generic options, reducing prices.

2. How does drospirenone compare to older progestins in contraception safety?

Drospirenone offers a more favorable androgenic profile and reduced acne along with lower risks of weight gain, but concerns about thrombotic risk and hyperkalemia have led to regulatory scrutiny.

3. What emerging markets hold the highest potential for drospirenone-based products?

India, China, Brazil, and Southeast Asian countries present significant growth potential due to increasing contraceptive awareness, expanding healthcare infrastructure, and regulatory ease for generics.

4. What are the main non-contraceptive indications for drospirenone?

Hormonal acne, PCOS management, and hormone replacement therapy constitute notable non-contraceptive applications, diversifying revenue streams.

5. How will ongoing regulatory developments impact market growth?

Enhanced risk management requirements and safety communications may slow growth temporarily but also incentivize innovation in safer formulations, supporting long-term expansion.

References

[1] Research and Markets, "Global Contraceptive Market, 2022-2027," 2022.

[2] FDA, "Labeling for Drospirenone-Containing Contraceptives," 2012.

[3] EMA, "Risk Management Plan for Drospirenone," 2021.

[4] Bayer AG, Investor Relations, "Yaz and Yasmin Product Data," 2022.

[5] MarketWatch, "Future Trends in Hormonal Contraceptive Markets," 2023.

This comprehensive analysis equips pharmaceutical professionals, investors, and strategic planners with crucial insights into drospirenone's market evolution, facilitating informed decision-making based on current trajectories and future opportunities.