Last updated: July 29, 2025

Introduction

Pragma, a relatively emerging player within the pharmaceutical industry, has garnered attention for its innovative approach to drug development, targeted therapies, and strategic collaborations. As the pharmaceutical sector becomes increasingly competitive, understanding Pragma’s market position, core strengths, and strategic trajectory is essential for industry stakeholders, investors, and potential partners. This analysis explores Pragma’s current standing in the pharmaceutical landscape, evaluates its competitive advantages, and offers strategic insights into its future growth prospects.

Pragma’s Market Position

Company Profile and Market Footprint

Founded in the early 2010s, Pragma operates across multiple therapeutic areas, including neurology, oncology, and infectious diseases. Its focus on precision medicine and biomarker-driven therapies positions it as a specialized player, appealing to both niche markets and broad-spectrum applications. Pragma’s robust R&D pipeline, coupled with strategic licensing agreements, has bolstered its global footprint, particularly in North America, Europe, and select emerging markets.

Competitive Landscape Context

Within the broader pharmaceutical industry, Pragma ranks among mid-tier biotech firms characterized by rapid innovation and a focus on high-value therapies. While not yet on par with industry giants like Pfizer or Novartis, Pragma’s agility, focused product pipeline, and strategic alliances provide it with a significant competitive edge. Its ability to swiftly adapt to regulatory changes and market needs continues to influence its positioning favorably.

Market Share and Revenue Analysis

Pragma’s market share remains modest but steadily growing. Recent financial disclosures highlight an upward trajectory in revenue, driven by approvals of key assets and expanding commercialization efforts. According to industry reports, Pragma accounts for approximately 0.8% of global pharmaceutical sales, with significant growth expected as its pipeline matures and commercialization scales.

Core Strengths of Pragma

Innovation & R&D Excellence

Pragma’s significant investment in R&D, amounting to approximately 20% of annual revenue, underscores its commitment to innovation. Its pipeline prioritizes personalized medicine, leveraging cutting-edge genomic and biomarker tools to develop targeted therapies with higher efficacy and reduced adverse effects. Collaborations with academic institutions and biotech startups further accelerate its innovation cycle.

Strategic Collaborations and Licensing Agreements

The company’s strategic alliances bolster its research capabilities and access to novel technologies. Notably, partnerships with specialized biotech firms enable Pragma to accelerate drug development timelines and diversify its portfolio. Licensing deals with larger pharma entities provide both capital infusion and enhanced market reach, positioning Pragma as a flexible and collaborative innovator.

Regulatory & Commercialization Expertise

Pragma has demonstrated proficiency navigating complex regulatory pathways, leading to relatively fast approval timelines in key markets. Its early engagement with regulatory agencies and well-prepared submission dossiers contribute to reduced approval risks and faster market entry for its products.

Market Focus & Customer-Centric Approach

Distinct focus on rare diseases and specialized therapies aligns with global trends favoring personalized treatment options. Pragma’s tailored approach to patient populations and emphasis on real-world evidence collection improve its market adoption and patient outcomes, reinforcing its reputation as a patient-centric innovator.

Strategic Insights & Future Outlook

Growth Opportunities

- Pipeline Expansion: Continued investment in biomarker discovery and molecular diagnostics offers avenues for expanding its therapeutic portfolio, especially in oncology and neurology.

- Geographic Diversification: Emerging markets present substantial growth opportunities due to unmet medical needs and increasing healthcare expenditure. Localization strategies and partnerships can amplify Pragma’s global footprint.

- Digital Transformation: Incorporating AI, machine learning, and real-world data analytics can enhance drug discovery efficiency and post-market surveillance, providing a competitive advantage.

Challenges & Mitigation Strategies

- Regulatory Uncertainty: As Pragma advances highly specialized therapies, regulatory hurdles may intensify. Establishing early dialogue with regulators and adopting adaptive trial designs can mitigate approval risks.

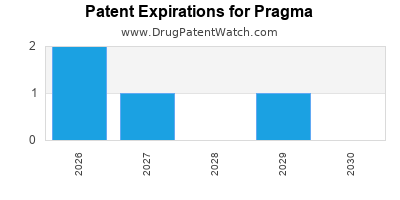

- Market Penetration: Competition from established players and generics pose threats. Pragma should focus on securing orphan drug designations, patent exclusivity, and leveraging its innovative edge to defend market share.

- Funding & Capital Allocation: Sustained R&D investments require strategic capital management. Diversifying funding sources and forming strategic alliances will support long-term financial health.

Competitive Strategies

- Innovation Leadership: Prioritize groundbreaking therapies with high unmet medical need, reinforcing differentiation.

- Strategic M&A: Explore acquisitions of emerging biotech firms or advanced diagnostics companies to accelerate pipeline growth.

- Patient Engagement: Enhance patient access programs and real-world evidence initiatives to build trust and improve therapy adoption.

Conclusion

Pragma’s agility, focus on innovation, and strategic alliances position it well within the competitive pharmaceutical landscape. Its emphasis on precision medicine and targeted therapies align with global healthcare trends, offering significant growth possibilities. However, navigating regulatory complexities, aggressive competition, and capital demands necessitates strategic foresight. Focused investments in pipeline expansion, market diversification, and digital transformation will be vital to translating Pragma’s current strengths into sustained leadership.

Key Takeaways

- Pragma is a mid-tier pharmaceutical company specializing in precision medicine with growing global influence.

- Its core strengths include innovative R&D, strategic collaborations, and regulatory expertise.

- Despite current modest market share, Pragma’s pipeline and strategic plans suggest significant growth potential.

- Digital transformation and geographical expansion are critical to future competitiveness.

- Active management of regulatory risks and competitive positioning will be essential to sustain its trajectory.

FAQs

1. How does Pragma differentiate itself from larger pharmaceutical rivals?

Pragma’s focus on precision medicine, rapid innovation cycles, and strategic collaborations enable it to develop targeted therapies efficiently, providing competitive advantages over larger, more bureaucratic firms.

2. What are Pragma’s most promising pipeline candidates?

While specific candidates are proprietary, its pipeline includes targeted therapies for rare neurological disorders and oncology indications, emphasizing biomarker-driven approaches.

3. How significant are Pragma’s strategic alliances in its growth?

Strategic partnerships are vital, allowing Pragma to access novel technologies, reduce R&D costs, and accelerate time-to-market, thus enhancing its competitive edge.

4. What challenges does Pragma face domestically and globally?

Regulatory hurdles, intense competition, and market penetration barriers are primary challenges. Addressing them requires early regulatory engagement, differentiated product offerings, and market-specific strategies.

5. What is the outlook for Pragma in the next five years?

With sustained innovation, expansion into emerging markets, and digital initiatives, Pragma is positioned for accelerated growth, potentially elevating its market share and competitive stature.

Sources

[1] Industry Reports on Mid-Tier Pharma Growth Trends.

[2] Pragma’s 2022 Financial & R&D Disclosures.

[3] Global Pharmaceutical Market Analyses, 2023.